Unregulated Crypto Exchange: Risks, Red Flags, and Real Examples

When you hear unregulated crypto exchange, a cryptocurrency trading platform that operates without oversight from financial authorities. Also known as unlicensed crypto platform, it doesn't follow KYC, AML, or consumer protection rules—meaning there’s no government watchdog watching your money. That sounds appealing if you hate paperwork, but it’s like renting a car with no brakes and no insurance.

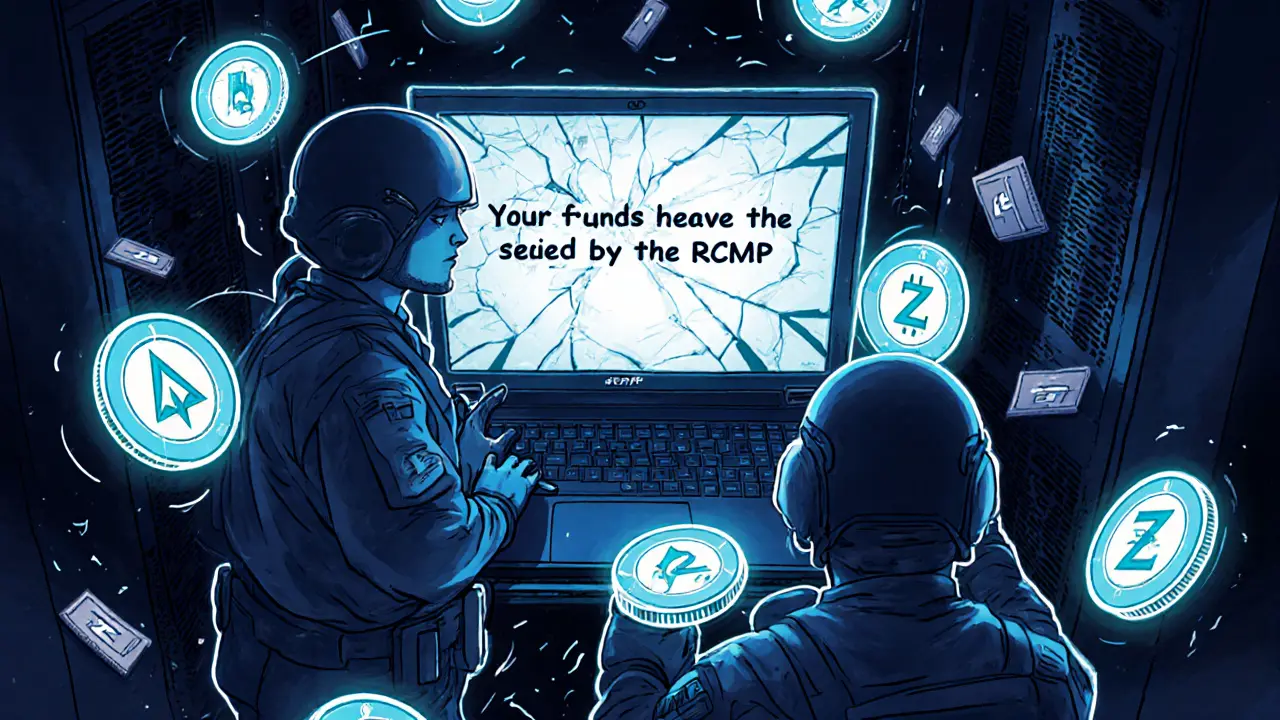

These platforms often promise anonymity, low fees, or fast withdrawals. But behind those perks? High risk. AlphaX, a once-popular DEX that vanished overnight in 2025 with no warning didn’t just shut down—it erased user funds. Same with Wavelength, a fake exchange that never existed but tricked hundreds into depositing crypto. These aren’t rare cases. They’re the rule. Unregulated doesn’t mean innovative—it means unaccountable. And when things go wrong, there’s no customer service, no refund policy, and no legal recourse.

Why do people still use them? Sometimes, it’s because they live in countries where banks block crypto, like Pakistan or Cambodia. Other times, it’s because they think they’re too smart to get scammed. But scams don’t target the stupid—they target the trusting. The crypto exchange safety, the set of practices and features that protect users from theft, fraud, and platform failure you get from a regulated platform like VirgoCX or COEXSTAR—two-factor authentication, cold storage, audits, insurance—isn’t a luxury. It’s the bare minimum.

What you’ll find below isn’t a list of "best" unregulated exchanges. It’s a catalog of what happens when you skip the safety net. You’ll see how platforms disappear, how fake airdrops lure victims, and how even "decentralized" tools can turn into traps. These aren’t hypotheticals. These are real stories from real users who lost everything. If you’re thinking about using an unregulated exchange, read these first. Because your next trade could be your last.