Crypto Exchange Compliance Calculator

Assess Your Exchange's Compliance Impact

Based on the TradeOgre shutdown case study, estimate how compliance requirements would affect your business operations and revenue.

Estimated Impact

Low RiskBased on current market conditions

TradeOgre Case Study: When the RCMP shut down TradeOgre, they seized $40 million in assets. This tool models how compliance requirements could prevent similar seizures while estimating revenue impact.

On September 18, 2025, Canada pulled the plug on TradeOgre-one of the most privacy-focused cryptocurrency exchanges in the world-and seized over $40 million in digital assets. It wasn’t just a raid. It was the first time Canadian authorities shut down an entire crypto exchange, not just froze wallets or arrested individuals. The Royal Canadian Mounted Police (RCMP) walked away with CAD$56 million ($40 million USD), the largest cryptocurrency seizure in Canadian history. And they didn’t do it by guessing. They tracked every coin, every transaction, every hidden server.

TradeOgre wasn’t some shady back-alley operation. It was a fully functional exchange, launched in 2018, registered in the U.S., and built to operate outside the system. No KYC. No ID checks. No reporting to regulators. If you wanted to trade Monero, Zcash, or obscure altcoins without leaving a paper trail, TradeOgre was your go-to. It ran on Tor, the same network used by whistleblowers and journalists to stay anonymous. But for criminals, it was a goldmine.

The RCMP didn’t stumble on this by accident. The investigation started in June 2024 after Europol flagged suspicious transaction patterns linked to TradeOgre. Blockchain analytics firm Arkham Intelligence was brought in to trace the money. What they found was chilling: over 18 months, TradeOgre processed more than $200 million in transactions-almost none of them traceable to real identities. And the money wasn’t just sitting there. It was moving through dozens of wallets, layered with mixers, split into tiny amounts, and disguised as legitimate trades.

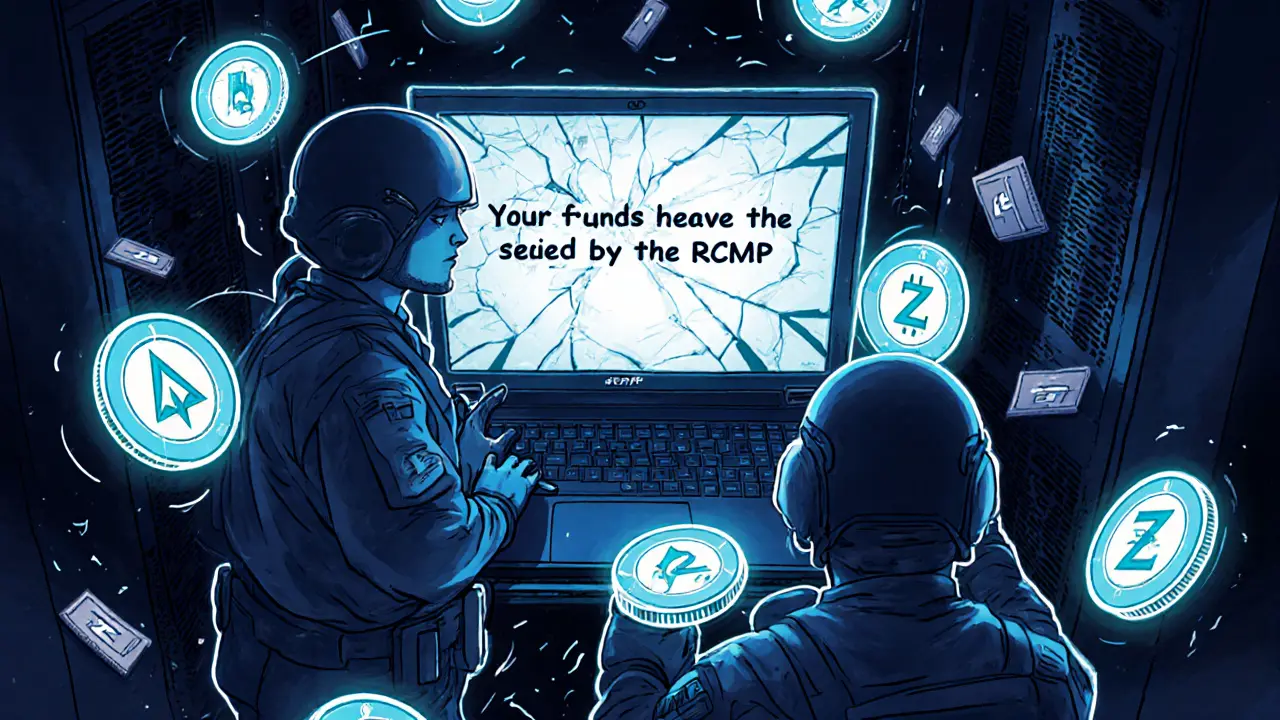

What made this case different from others was how the RCMP handled the takedown. Instead of just freezing funds, they took control of the exchange’s infrastructure. On September 18, users logging in found a message on the site: “Your funds have been seized by the RCMP. All assets are under government control.” The message wasn’t a phishing scam. It was embedded directly into the blockchain, signed by law enforcement. That’s how sure they were.

TradeOgre’s entire business model was built on ignoring Canadian law. Under FINTRAC rules, any business handling money-digital or not-must register, verify users, and report suspicious activity. TradeOgre did none of it. Even though it was registered in the U.S., it actively marketed itself to Canadian users. That made it a target. Canada doesn’t care where your company is based. If you’re serving Canadians, you play by Canadian rules. Or you get shut down.

This wasn’t just about money laundering. It was about sending a message. For years, crypto exchanges argued they were “decentralized” and couldn’t be regulated. TradeOgre proved that wasn’t true. Even if you hide behind Tor, even if you only accept Monero, even if you never ask for a name or address-law enforcement can still find you. The tools exist. The data is there. The collaboration between Europol, Arkham, and the RCMP showed how global, coordinated efforts are now the norm.

Before TradeOgre, most crypto seizures targeted individual wallets or mixing services. This was the first time an entire exchange was dismantled. That changes everything. Other privacy-focused platforms like Bisq, LocalMonero, and Haveno are now watching closely. They can’t assume they’re safe just because they’re open-source or decentralized. If they’re handling Canadian user funds without KYC, they’re already on the radar.

The seized assets? Most of it is believed to be proceeds from ransomware, darknet market sales, and fraudulent ICOs. But the RCMP hasn’t released specific cases. That’s intentional. They’re still tracing the money backward. Some of it might be linked to high-profile cyberattacks from 2023 and 2024. Others could be from smaller, ongoing scams targeting Canadian retirees or small businesses.

What’s striking is how quiet TradeOgre has been since the seizure. No press release. No lawyer’s statement. No Twitter thread defending their rights. That silence speaks volumes. Either the operators were caught off guard, or they knew the evidence was too strong to fight. In past cases, exchange founders have tried to claim they were just “tech providers” or that users were responsible for illegal activity. TradeOgre didn’t even try. They vanished.

For users, the fallout was immediate. Thousands lost access to their funds. Some had small amounts-$50, $200. Others held tens of thousands in Monero. The RCMP says those funds may be returned if they can prove they were clean. But proving innocence in crypto is hard. Without KYC, there’s no record of who owned what. Most users will never get their money back.

But here’s the real lesson: this isn’t the end of privacy-focused crypto. It’s the beginning of a new era. Exchanges that want to survive will have to choose: privacy or compliance. You can’t have both anymore-not if you’re targeting Western markets. The days of “no KYC, no problem” are over. Canada didn’t ban privacy coins. They banned unregulated platforms that used them as shields.

Other countries are watching. The U.S. SEC has already signaled it’s ready to follow suit. The EU is tightening its MiCA regulations. Australia, the UK, and New Zealand are all upgrading their crypto enforcement teams. This case is a blueprint. And it’s being copied.

For everyday traders, the message is simple: if you’re using an exchange that doesn’t ask for your ID, you’re not anonymous-you’re exposed. Your transactions are being watched. Your wallet addresses are being mapped. Your coins can be seized. And if you’re trading on platforms that ignore the law, you’re not a freedom fighter-you’re collateral damage.

TradeOgre’s shutdown didn’t kill crypto. It forced it to grow up. The industry can’t hide behind anonymity forever. The regulators have the tools. The data is public. The international networks are connected. The only question left is: who’s next?

This is huge. For years people said privacy coins were untouchable. Turns out, all it took was good analytics and international cooperation. The writing was on the wall.

lol imagine logging in one day and seeing the government just... took your coins 🤡 no warning no notice just a cold message on the site. that's next level.

People keep acting like this is about banning privacy, but it's not. It's about operating without any legal accountability. If you're serving Canadian users and ignoring their laws, you're not a tech pioneer-you're a liability. TradeOgre knew the risks. They just thought they'd never get caught. Guess what? They did.

The fact that they embedded the seizure notice directly into the blockchain? That's next-gen law enforcement. Not just freezing wallets-taking over the platform's identity. It's like hacking the hacker. I didn't think we'd see this kind of precision in crypto enforcement. Honestly? Kinda impressive.

You think this is about money laundering but its really about sovereignty. The RCMP didn't just seize coins they seized the myth that decentralization equals immunity. The blockchain isn't a lawless frontier anymore its a jurisdictional battleground and canada just declared war on the illusion of anonymity

This is the beginning of the end for crypto. Once they start seizing entire exchanges, there's no going back. The whole point of Bitcoin was to escape control. Now the control is coming for you even if you use Monero. You think you're hidden? You're not.

I feel bad for the regular users who just wanted to trade without handing over their ID. But they chose a platform that knowingly broke the law. There's no moral high ground there. Still, the system needs to figure out how to return clean funds-otherwise we're punishing the innocent because the guilty hid behind them.

This was all planned. The RCMP didn't just stumble on this. This was a setup. They've been tracking every wallet for years. They let TradeOgre grow so they could take it down with maximum impact. This isn't justice-it's a message to anyone thinking about using crypto to escape the system. You're already in their database.

So now the government can just take your crypto whenever they want? No warrant? No trial? Just a message on a website? This is fascism with a blockchain logo. Next they'll freeze your bank account because you bought a pizza with BTC and the IRS thinks you're 'suspicious'.

I think people are missing the point. This isn't about taking money. It's about showing that you can't hide forever. Even if you use Tor. Even if you use Monero. Even if you never give your name. They still found it. That's the real lesson here.

You call this enforcement? This is tyranny. They didn't just seize assets-they erased people's financial autonomy. If you don't have KYC, you're a criminal? Then why does every bank in the world have millions in dirty money and no one touches them? Double standard. This is about control, not crime.

Funny how the same people who scream 'freedom from the state' when it comes to crypto suddenly get quiet when their coins get taken. The truth? They didn't want privacy. They wanted to be untraceable so they could do whatever they wanted without consequences. Now the consequences are here. And honestly? It's about time. The romanticization of anonymous crypto was always just a cover for criminal convenience.

Let's be real. If you're using an exchange that doesn't ask for your ID, you're not some underground freedom fighter-you're just someone who doesn't want to pay taxes or report income. This isn't about privacy. It's about accountability. And honestly? Good. We need more of this.

The legal and ethical implications of this case extend far beyond cryptocurrency. The precedent set by the RCMP's ability to take operational control of a decentralized platform-via blockchain-embedded notice, no judicial warrant publicly disclosed-raises profound questions about the limits of extraterritorial enforcement, the nature of digital sovereignty, and the erosion of due process in algorithmic governance. If a state can unilaterally seize infrastructure operated outside its borders by leveraging blockchain metadata and international intelligence partnerships, then no digital asset, no matter how pseudonymous or distributed, is truly beyond reach. This is not merely a regulatory milestone; it is the crystallization of a new paradigm in which anonymity is no longer a technical condition but a legal vulnerability.

The silence from TradeOgre’s operators speaks louder than any press release. When you’ve built a business on the premise that you’re untouchable, and then you vanish without a word, it suggests either a complete lack of legal defense-or a realization that the evidence was too overwhelming to contest. That’s not just a shutdown. That’s a confession by absence.