POP Token Price: Current Value, Trends, and Where to Track It

When you search for POP token price, a digital asset tied to a specific blockchain project, often used for governance, rewards, or in-app utility. Also known as POP cryptocurrency, it’s the kind of token that moves based on community activity, exchange listings, and market sentiment—not just hype. Unlike big-name coins, POP doesn’t always show up on mainstream dashboards. That’s why tracking its price isn’t as simple as checking CoinMarketCap. You need to know where it’s traded, how liquid it is, and whether the data you’re seeing is real or outdated.

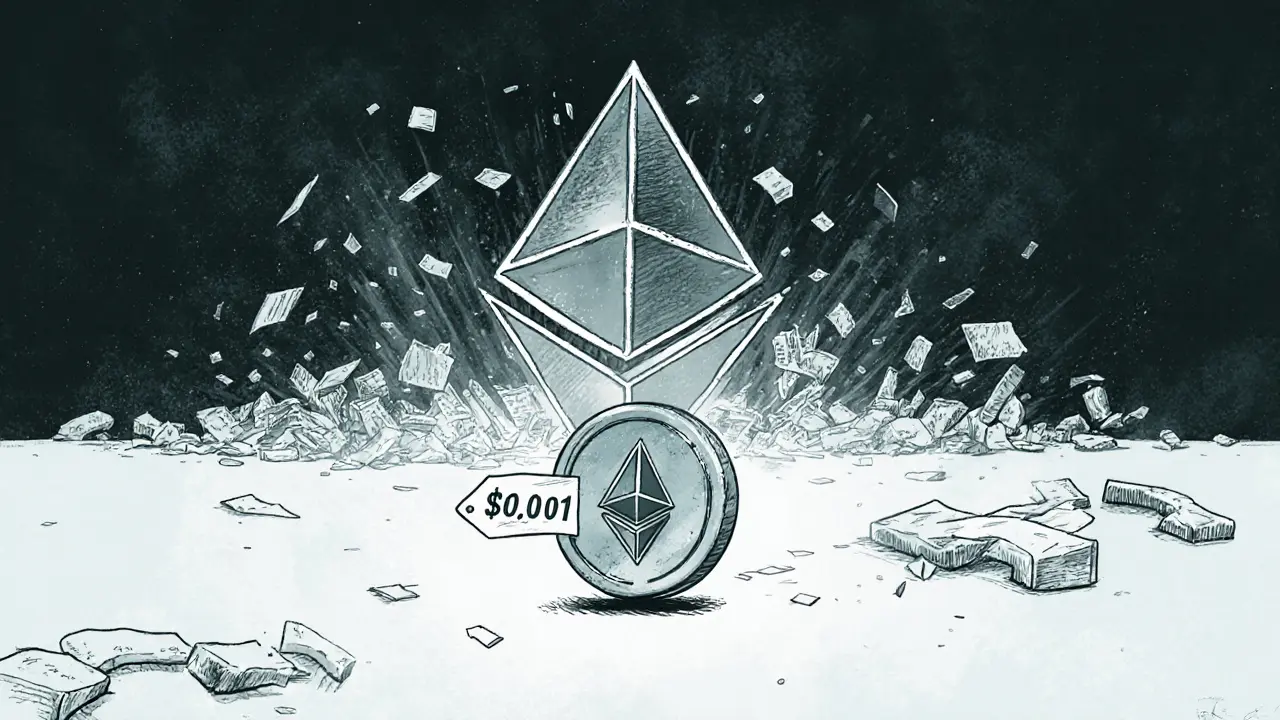

The value of POP token, a utility or governance token often linked to niche DeFi platforms or gaming ecosystems depends heavily on its underlying project. If the team behind it stopped updating the app, dropped social media, or never delivered on promises, the price will sink—even if someone’s still listing it on a small exchange. That’s why you’ll find conflicting numbers: one site says $0.002, another says $0.0008. One might be showing last year’s data. Another could be a fake listing with no real trades. Always check the trading volume. If it’s under $10,000 a day, the price is basically a guess.

Crypto token price, the market value of a digital asset determined by supply, demand, and real trading activity on exchanges for POP follows the same rules as every other token: no demand, no price. If nobody’s buying or selling it, the number you see is meaningless. Some platforms inflate prices by creating fake trades. Others list it without verification. That’s why users who bought POP based on a tweet or a YouTube video often end up stuck with tokens they can’t cash out. Real value comes from active markets, not promises.

What you’ll find in the posts below are real examples of how tokens like POP behave—sometimes rising fast, sometimes vanishing quietly. You’ll see how one project’s token got listed on a tiny exchange and vanished within weeks. You’ll see how another token’s price dropped 95% after the team went silent. And you’ll see exactly where to look for accurate data, what red flags to watch for, and how to avoid paying for a token that’s already dead. This isn’t about guessing. It’s about knowing what to check before you buy.