POP Token Value Calculator

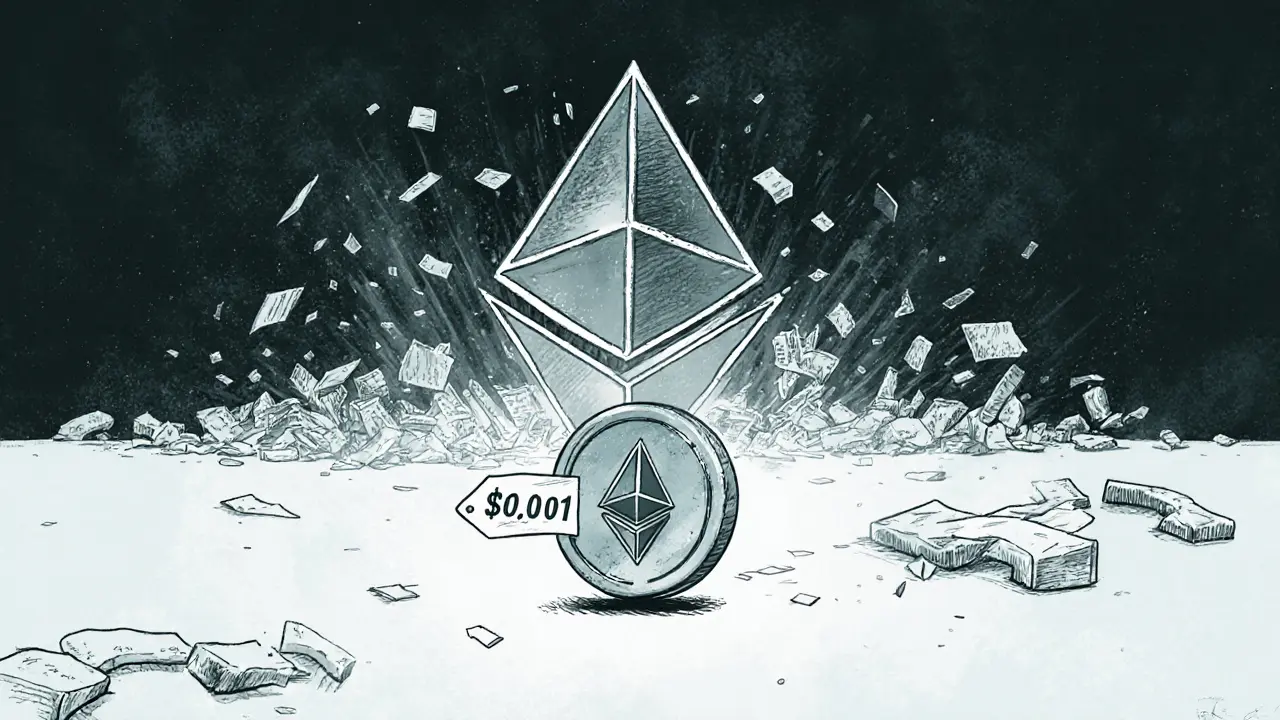

POP Network Token (POP) is a nearly dead ERC-20 token with a market cap of $18,936 as of late October 2023. Each token is worth approximately $0.00001. Calculate how many tokens you would need to make meaningful amounts of money.

POP Network Token (POP) isn’t a crypto coin you hear about on mainstream news. You won’t find it on Binance, Coinbase, or Kraken. If you stumbled across it while scrolling through obscure crypto lists, you’re not alone-most people who look into POP end up confused, skeptical, or both. So what exactly is POP? And more importantly, should you care?

POP Network Token is a nearly dead ERC-20 token built on Ethereum

POP is an ERC-20 token, meaning it runs on the Ethereum blockchain. Its contract address is 0x5d858bcd53e085920620549214a8b27ce2f04670, and you can check its activity on Etherscan. But here’s the catch: there’s almost no activity. As of October 2023, the 24-hour trading volume was under $100 on most platforms. That’s not just low-it’s practically invisible in a market where even the smallest coins trade millions daily.

The total supply of POP is fixed at 1.6 billion tokens. That sounds like a lot, but when you divide the tiny market cap ($18,936 as of late October 2023) by that number, each POP token is worth about $0.00001. For comparison, you’d need over 100,000 POP tokens to make one dollar. And even that’s misleading-because most of those tokens aren’t even in circulation. Bitget says the circulating supply is zero. Etherscan says it’s the full 1.6 billion. No one agrees. That kind of contradiction is a red flag.

It claims to revolutionize streaming-but there’s no product

POP Network’s pitch sounds ambitious: a decentralized media platform that turns streaming activity into economic value using blockchain and AI. Creators, they say, can earn directly from viewers without YouTube or TikTok taking a cut. Sounds great, right? Except there’s no app. No website where you can stream. No wallet integration. No browser extension. No public GitHub repo. No developer documentation. Just a static website (thepopnetwork.org) with marketing fluff and no technical details.

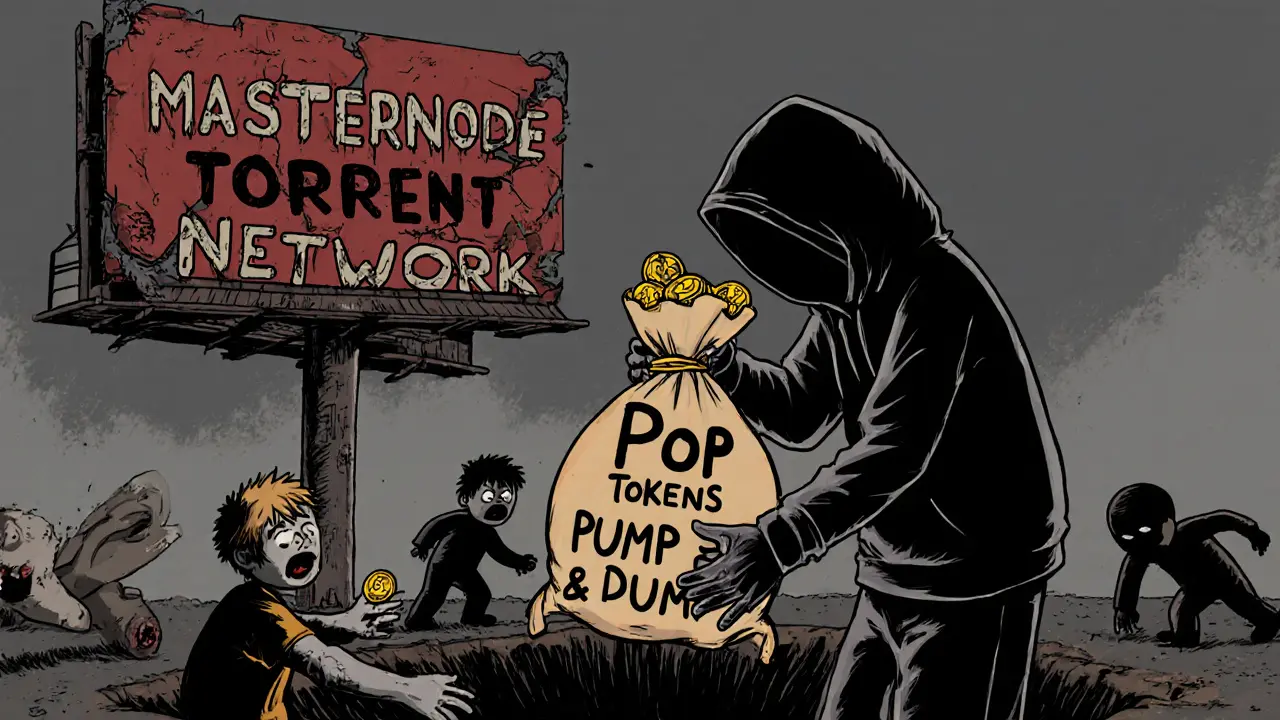

The project claims to use a “Masternode Torrent Network” to distribute content and a “Superdelegated Proof-of-Stake” blockchain to process transactions. But no one has ever seen this system work. Independent blockchain analysts on Reddit called it “vaporware.” Even the most generous reviewers admit: no working product exists. If you’re looking for a platform to earn from streaming, you’re better off exploring Theta Network or Audius-both have real users, real apps, and real revenue sharing.

Value dropped 99.53%-and it’s been falling for years

POP didn’t start at $0.00001. It was once worth far more. According to Etherscan’s own data, the token has lost 99.53% of its value since launch. That’s not a market dip. That’s a collapse. And it’s been happening for years. There’s no news about a comeback, no team update, no new features. The official Twitter account, @_popnetwork, posted only 12 times in the 12 months leading up to October 2023. The last meaningful update was in July. That’s not a startup in stealth mode-that’s a project abandoned.

Compare that to Theta Token (THETA), which has over 4 million monthly active users and a market cap of $422 million. Or Audius (AUDIO), with a $108 million valuation and a functional music streaming app. POP doesn’t even register on the same scale. Its market cap is less than 0.005% of Theta’s. It’s not just behind-it’s off the map.

It’s listed on one exchange-and even there, nobody trades it

Bitget is the only major exchange that lists POP. And even there, trading is almost nonexistent. The 24-hour volume on Bitget ranges between $56 and $7,440 depending on the source-meaning the data is either inaccurate or manipulated. There are no user reviews. No ratings. No comments. No community chatter. If you bought POP on Bitget today, you’d struggle to sell it tomorrow. Liquidity is near zero. You’d be stuck with tokens no one wants.

Binance, Kraken, KuCoin, Coinbase-all of them explicitly list POP as “Not listed.” That’s not an oversight. It’s a decision. These exchanges vet projects for liquidity, transparency, and activity. POP fails on all three.

No community. No support. No future

Look for a Telegram group? Nothing. Discord server? Not found. GitHub? Empty. Reddit threads? Three mentions in a year, all skeptical. The official Twitter has 1,247 followers-and engagement rates below 0.05%. That’s worse than a bot account. Real projects with real teams have active communities. POP has silence.

And here’s the kicker: there’s no team you can contact. Valerian Bennett and Ming “Jack” Li are named as founders, but no LinkedIn profiles, no interviews, no public appearances. No one answers questions. No one responds to emails. If you invested in POP, you’d have no one to ask when things go wrong-because there’s no one left to ask.

Why does POP still exist?

Some might say, “If it’s worthless, why is it still listed?” The answer is simple: low-cap tokens like POP are often used for pump-and-dump schemes. A small group buys the token early, hyped it with vague promises, then sells to new buyers who don’t know any better. The price spikes briefly, then crashes. Rinse and repeat. The fact that POP’s value has dropped 99.53% over time and shows no signs of recovery suggests this is exactly what happened.

There’s also the “zombie token” effect. Some exchanges keep listing tokens long after they’re dead because delisting requires effort-and there’s no penalty for keeping them up. POP is a ghost. It’s still on the blockchain, still on Bitget, still listed on some crypto trackers-but it’s not alive.

Should you buy POP Network Token?

No.

Not because it’s “risky.” Because it’s meaningless. There’s no product. No users. No team. No liquidity. No future. Even if you believe in blockchain-based streaming, POP isn’t the way to get there. It’s a dead end.

If you’re curious about decentralized media, look at Theta Network, Audius, or Livepeer. They have apps you can use today. They have active communities. They have transparent development. They’re not perfect-but at least they’re trying.

POP? It’s a footnote in crypto history. A cautionary tale. A token that promised to change streaming but never even got off the ground.

Man, I saw POP mentioned in some obscure crypto newsletter and thought it was a new DeFi thing. Turned out it’s basically a digital ghost town. I checked Etherscan out of curiosity-zero transactions for weeks. If you’re trying to build something real, you don’t leave your project looking like a abandoned MySpace page.

It’s wild how some tokens just linger like bad WiFi signals-still there, but nobody connects anymore.

POP is a textbook example of a token that conflates whitepaper aesthetics with actual utility. The so-called ‘Masternode Torrent Network’ is a syntactic oxymoron-torrents are peer-to-peer, masternodes are centralized validators. The ‘Superdelegated PoS’ is just buzzword salad. No working codebase, no audit, no team verifiable on LinkedIn. It’s not a failure-it’s a non-event.

And the circulating supply discrepancy? That’s not ambiguity, that’s fraud by omission.

POP is dead

Move on

There are better projects

Stop wasting time

Really

Just stop

I know it’s tempting to chase anything that sounds like ‘decentralized streaming,’ but please, take a breath. If a project has no GitHub, no Discord, and no recent updates since 2022, it’s not ‘in stealth mode’-it’s dead. I’ve seen too many people lose money chasing ghosts like this. Stick to Theta, Audius, or even Livepeer-they’ve got real code, real users, and real support. You don’t need to gamble on vaporware to believe in Web3.

Did you know Bitget lists POP because they’re in cahoots with the devs? This isn’t just a dead token-it’s a coordinated pump-and-dump with shell companies. The ‘founders’ don’t exist. Their names are fabricated from LinkedIn profiles scraped from random engineers. The whole thing is a front for laundering crypto from darknet markets. I’ve seen the transaction patterns-tiny micro-trades every 3 days, always from the same 3 wallets. That’s not trading, that’s washing. And the 1.6B supply? That’s just to make the math look plausible to newbies. They want you to think it’s ‘undervalued.’ It’s not. It’s a trap.

I used to think all crypto projects were just risky, but POP takes it to another level. No app, no team, no community-it’s like buying a car with no engine and being told it’ll start when you believe hard enough.

I’m not saying don’t explore new tech, but if you can’t even find a GitHub repo, you’re not investing-you’re donating to a mystery box. Stick to projects with open code and real people behind them. Trust me, your future self will thank you.

Who even writes this stuff? ‘Superdelegated Proof-of-Stake’? That’s not a consensus mechanism, that’s a PowerPoint slide from a 2017 startup pitch. And you call this ‘research’? This isn’t a token-it’s a scam dressed up in blockchain jargon. Why are people still looking at this? Are we still in 2018? The fact that Bitget hasn’t delisted it says more about them than POP. This is why crypto gets a bad name.

It’s funny how we treat crypto like it’s some kind of spiritual quest-‘Is this the next big thing?’ ‘Could this change the world?’-when in reality, most tokens are just digital graffiti on the blockchain wall. POP is the equivalent of a scribble that says ‘I believe in unicorns’ in neon pink. It’s not malicious, necessarily. It’s just… pointless. The tragedy isn’t that people lost money. The tragedy is that someone, somewhere, believed that ‘Masternode Torrent Network’ was a legitimate technical architecture. We don’t need more innovation. We need more honesty.

And if you’re looking for decentralized streaming? The future isn’t in tokens. It’s in communities that actually show up, build things, and fix bugs together. POP didn’t fail because of the market. It failed because no one cared enough to make it real.

Upon reviewing the on-chain activity and market data associated with POP Network Token, it is evident that the asset exhibits negligible liquidity, zero developer engagement, and a complete absence of community infrastructure. The contract address provided corresponds to a token with no discernible transactional velocity beyond micro-scale wash trading. Furthermore, the nominal market capitalization, when normalized against total supply, yields a per-token valuation that is functionally irrelevant within any meaningful economic context. The project’s lack of transparency, absence of verifiable personnel, and nonexistence of functional deliverables collectively constitute a paradigmatic case of non-utility in the context of blockchain-based asset issuance. One might reasonably conclude that POP represents a vestigial artifact of speculative excess rather than a viable technological initiative.

Wow, this breakdown is spot-on 🙌 I literally just checked POP on CoinGecko yesterday and thought I was going crazy-$0.00001?! And zero volume?!

My cousin bought some last year thinking it was ‘the next big thing’-he’s still holding it like it’s gold. I told him it’s like owning a piece of a deserted island with no map. He laughed. Then he asked if I could help him ‘re-list’ it on Binance 😅

Definitely sending this to him. Theta and Audius are the real deals. Pop? More like ‘P.O.P.’-Pile of Paper.

POP is the crypto equivalent of a broken vending machine that still dispenses air. The devs didn’t fail-they never started. That ‘Masternode Torrent Network’? That’s not a tech stack, that’s a punchline. And the fact that Bitget still lists it? That’s not negligence, that’s complicity. This isn’t a risky investment. It’s a moral hazard wrapped in a whitepaper. The only thing POP stands for is ‘Proof of Profit’-for the early insiders who dumped their bags before the rug was even laid.

Don’t be the last sucker. Delete the bookmark. Block the Twitter. Walk away.

I get why people get excited about new crypto stuff but come on. If you can’t even find a team page or a real website with contact info, you’re not investing-you’re gambling with your wallet. I’ve seen this movie before. The guy who made POP probably moved on to his next ‘revolutionary’ idea. And the people who bought in? They’re just waiting for a miracle that’s never coming.

Just stick with the ones that have apps you can use. That’s how you know it’s real.

im so mad i bought pop last year like a dumbass i thought it was gonna be big like theta but now i feel so stupid like why did i even look at it i shouldve just bought catcoin or something at least that had memes

Okay, I’ll admit-I was one of those people who scrolled past POP and thought, ‘Hmm, interesting concept.’ I didn’t buy, but I did spend way too long reading their website. The idea of creators getting paid directly from viewers? I love that. I still believe in it. But POP? It’s like someone took a beautiful dream and turned it into a PowerPoint slide with clipart.

It’s not that the vision is wrong-it’s that execution matters. If you want to change streaming, you don’t just write a whitepaper and disappear. You build. You launch. You listen. You fix bugs. You answer questions. POP didn’t do any of that. And honestly? That’s sadder than the price drop. Because the dream was good. It just had the wrong custodian.

So yeah, don’t buy POP. But don’t give up on the idea. Go support Theta. Try Audius. Help the real builders. That’s how we make Web3 actually work.