Government Surveillance and Crypto: How Privacy Is Being Challenged

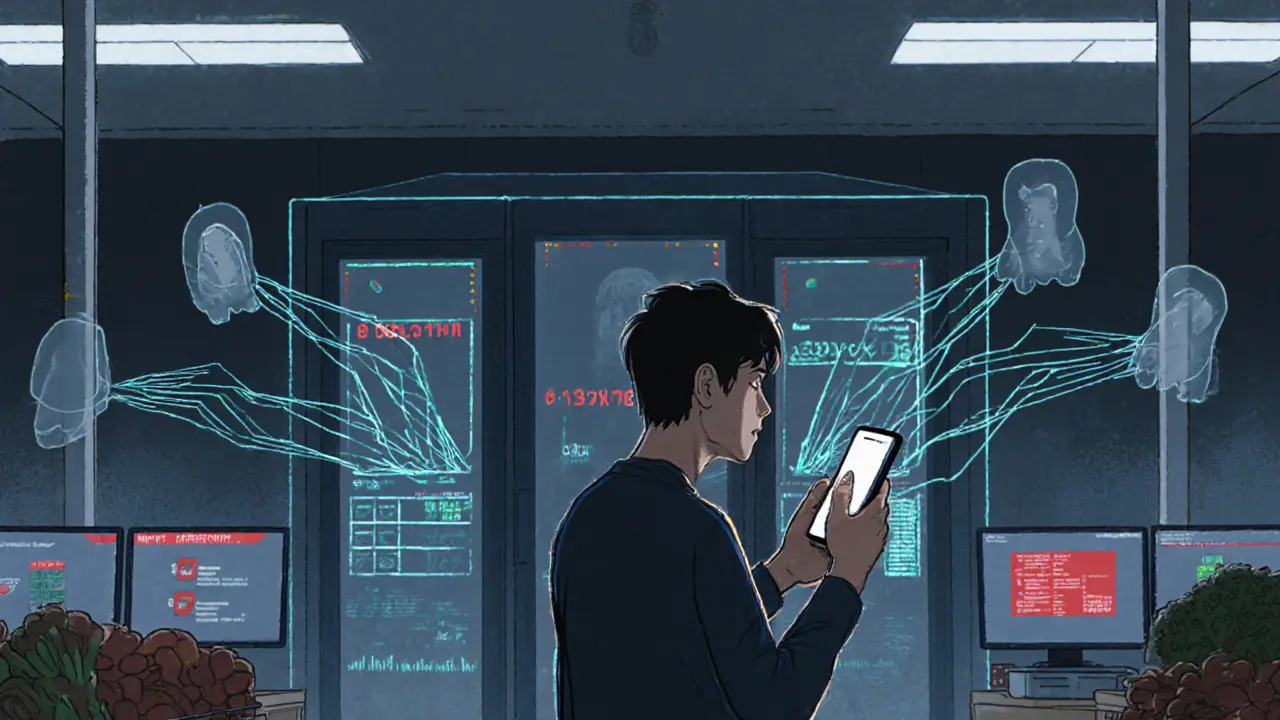

When you use cryptocurrency, you’re not just trading coins—you’re stepping into a world where government surveillance, the monitoring of financial activity by state authorities to enforce laws or control behavior. Also known as financial oversight, it’s becoming harder to avoid. Unlike cash, every crypto transaction leaves a digital trail. Even if you think you’re anonymous, agencies can trace wallets, link addresses to identities, and freeze funds without a warrant in many countries. This isn’t science fiction—it’s happening right now in Nigeria, China, Russia, and beyond.

That’s why decentralized identity, a system where users own and control their personal data without relying on central authorities. Also known as self-sovereign identity, it’s not just a tech buzzword—it’s a survival tool. If you’re using crypto to avoid inflation, bypass banking limits, or protect your savings from seizure, you need more than a wallet. You need ways to prove who you are without giving away everything. Projects like DID and verifiable credentials let you share proof of age or residency without exposing your full transaction history. But most people still don’t know these exist—or how to use them.

And then there’s the other side: blockchain anonymity, the ability to obscure transaction origins and destinations using tools like mixers or privacy-focused chains. Also known as crypto obfuscation, it’s a double-edged sword. On one hand, it protects dissidents in authoritarian regimes. On the other, it’s exploited by groups like North Korea’s Lazarus Team to launder stolen crypto. Regulators are pushing back hard—banning mixers, forcing exchanges to collect KYC data, and even tracking users through IP addresses. The result? A growing gap between what crypto promises (freedom) and what governments allow (control).

You can’t ignore this tension. Whether you’re trading on a niche DEX like ShadowSwap, claiming an airdrop like FARA, or holding stablecoins in Argentina to beat inflation, your actions are being watched. Even if you’re not doing anything illegal, your behavior is being mapped. The same tools that let you trade without a bank—like state channels and wrapped tokens—are also the ones that make it easier for authorities to trace you.

This collection doesn’t just list crypto projects. It shows you how real people are fighting back—not with protests, but with smart choices. You’ll find guides on how to store your seed phrase safely, why mixing services are both dangerous and necessary, how countries like Mexico and the UK tax your crypto, and why China’s ban on crypto hasn’t stopped 59 million people from trading anyway. These aren’t theoretical debates. They’re daily realities for millions.

What you’re about to read isn’t about getting rich. It’s about staying free. Whether you’re a casual holder or a hardcore DeFi user, understanding how government surveillance works—and how to protect yourself—is no longer optional. It’s the difference between keeping your money… and losing it to a frozen account, a seized wallet, or a silent ban you never saw coming.