When you swipe a card or tap your phone to pay, you don’t expect the government to see exactly what you bought, when, and from whom. But with Central Bank Digital Currencies (CBDCs), that could change - and it already has in some countries.

Over 130 nations are exploring CBDCs, digital versions of their national money issued directly by central banks. China launched its digital yuan in 2020. The Bahamas rolled out the Sand Dollar the same year. The European Central Bank is testing the digital euro. But behind the hype about faster payments and financial inclusion lies a far more unsettling question: Who controls your money, and who sees your transactions?

CBDCs Aren’t Like Bitcoin - and That’s the Problem

Many assume CBDCs run on blockchain, like Bitcoin or Ethereum. They don’t. Most are built on centralized databases controlled by the central bank. That means every transaction flows through a single system owned by the government. There’s no public ledger. No anonymity. No decentralization.

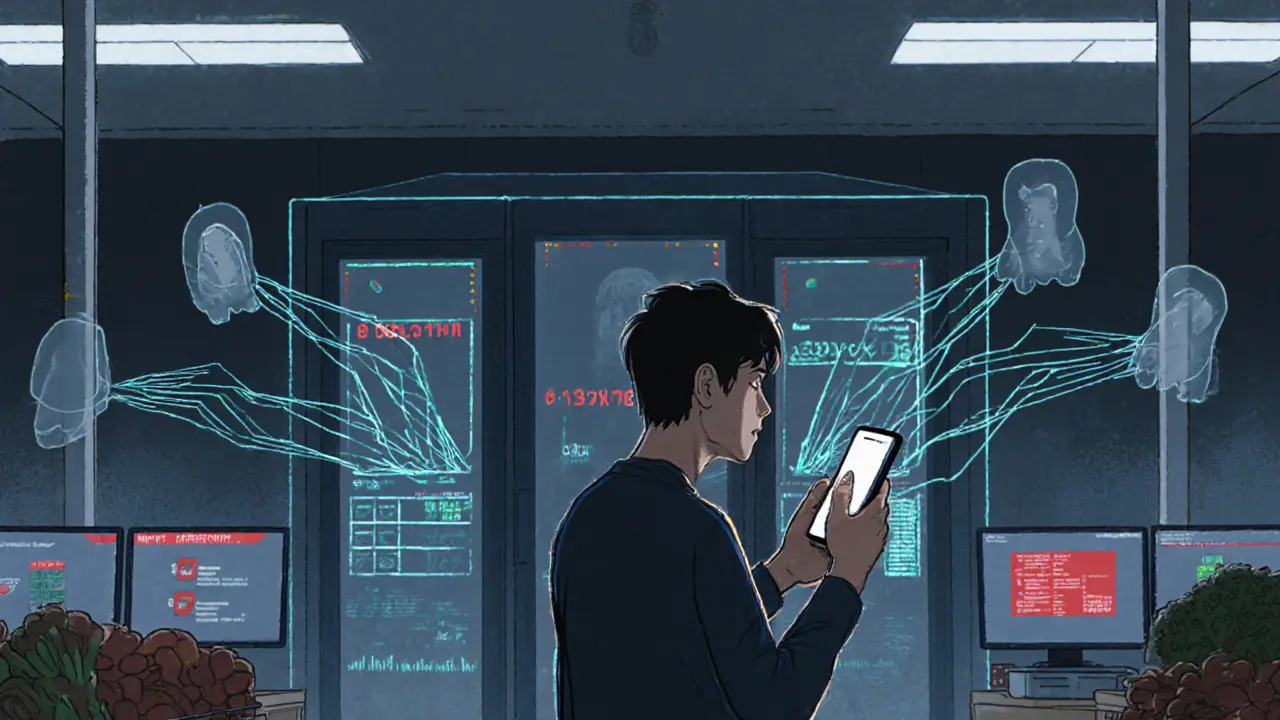

China’s digital yuan, for example, lets users open "anonymous" wallets - but only up to 50,000 yuan (about $7,000) and with daily spending limits of 2,000 yuan. Beyond that, you need full identity verification. The central bank can track every transaction. If you buy groceries, pay rent, or donate to a political group, they know. And they can freeze accounts, block payments, or even program restrictions - like preventing purchases of certain goods.

The European Central Bank claims its digital euro will protect privacy with offline payments up to €100 and minimal identity checks for small transactions. But even that has limits. Online purchases? Your identity is linked. Large transfers? Full KYC. And if you’re flagged as "suspicious," your access can be revoked.

Why Privacy Matters More Than You Think

It’s not just about hiding what you buy. It’s about freedom.

In 2023, a Pew Research survey found 68% of Americans had "major concerns" about government surveillance through a digital dollar. Reddit threads on r/CBDC and r/Privacy are flooded with posts like: "A programmable digital currency is the ultimate tool for social control." That post got over 8,700 upvotes.

Think about it: If your government can see every transaction, they can also control them. What if you’re a journalist reporting on corruption? A protest organizer? Someone who donates to a controversial cause? A person who uses cash to avoid being tracked by employers or insurers? In a cashless society with CBDCs, those actions could be monitored, restricted, or punished.

The European Data Protection Supervisor warned in 2022 that concentrating financial data in central banks creates "unprecedented privacy risks." Even if the bank says it won’t misuse data, the infrastructure is built to allow it. And history shows power tends to expand, not shrink.

What Countries Are Doing Right - and Wrong

Not all CBDCs are the same. Some are designed to be more private than others.

China’s digital yuan started strict but loosened limits after public backlash. By late 2023, they raised the anonymous wallet cap from 10,000 to 50,000 yuan. That’s a response to pressure - not a design choice.

The Bahamas’ Sand Dollar, the first fully launched CBDC, has no anonymity. Every transaction is visible to the Central Bank. Adoption? Only 15% of adults use it two years later. People don’t trust it.

Compare that to the Eastern Caribbean’s DCash. It uses privacy-preserving tech and allows limited anonymous transactions. Two years after launch, adoption hit 22%. People trusted it because they felt some control.

The U.S. isn’t even trying. In 2025, President Trump signed an executive order halting all retail CBDC development. Why? Pressure from privacy advocates, tech experts, and lawmakers who saw the risks. The U.S. still has the most private payment system in the world - cash and private apps like Venmo and Apple Pay. But those aren’t perfect. They’re owned by corporations, not the government. And corporations sell data.

The Privacy vs. Regulation Dilemma

Central banks say they need to know who’s paying whom to stop money laundering, terrorism, and fraud. That’s valid. But current anti-money laundering rules require tracking every transaction over $1,000 - the "travel rule." That directly clashes with privacy.

Here’s the catch: You can’t have both total privacy and total compliance. If you want to prevent crime, you need visibility. If you want to protect rights, you need limits.

Experts like Jiaying Jiang argue that CBDCs could actually be more private than today’s systems. Why? Because private payment apps like PayPal and Stripe already collect your name, email, phone, location, purchase history, and device ID. CBDCs could be designed to collect less - if lawmakers force them to.

But that’s the problem. Right now, no law in the U.S. or EU requires CBDCs to protect privacy by default. The EU’s GDPR and Digital Services Act apply, but they weren’t made for digital currency. The U.S. has no federal privacy law at all. That’s why progress is stalled.

Can Technology Save Privacy?

Yes - but only if we demand it.

There are real technical solutions:

- Zero-knowledge proofs let the system verify a transaction without seeing who sent it or what it was for.

- Homomorphic encryption lets the bank check for fraud without decrypting the transaction details.

- Decentralized identity lets you prove you’re an adult or citizen without handing over your full ID.

The Hong Kong Monetary Authority tested homomorphic encryption in 2022. The European Investment Bank piloted decentralized identity in 2021. These aren’t sci-fi ideas - they’re working.

But they’re expensive. Adding privacy features increases system complexity by 35% and slows transactions by 15-25%. That’s why most central banks skip them. Speed and cost matter more than rights.

The Bank for International Settlements released new privacy standards in February 2024: no unnecessary data collection, transaction unlinkability, user-controlled sharing. But only 28 out of 67 countries that passed new CBDC laws include these rules.

What Happens If We Don’t Act

The U.S. stepped back from CBDCs. That’s a win for privacy - but a loss for influence.

China is leading. By 2025, the digital yuan will be used in over 100 countries through Belt and Road partnerships. If you buy oil from Saudi Arabia or electronics from Vietnam using digital yuan, China sees the transaction. They control the rules. And their rules prioritize state oversight over individual rights.

Meanwhile, the European Central Bank is still debating. Their digital euro won’t launch before 2027. And even then, it won’t be fully anonymous.

Private stablecoins like USDT and USDC still dominate the digital currency market - processing $58.7 billion daily. Why? Because they’re decentralized. Because they’re harder to track. Because they don’t require your name.

But they’re unregulated. They can collapse. They can be hacked. They can be seized. CBDCs are safe - but at a cost.

What You Can Do

Don’t wait for lawmakers to protect you. Demand it.

- Support legislation that requires CBDCs to use privacy-by-design principles.

- Push for laws that limit data collection to only what’s legally necessary.

- Ask your representatives: Will a digital dollar let me pay for a protest sign without the government knowing?

Privacy isn’t about hiding illegal activity. It’s about protecting democracy.

If your money is tracked, controlled, and programmable - you don’t own it. The state does.

And that’s not progress. That’s power.

Are CBDCs based on blockchain technology?

Most CBDCs are not built on blockchain. Instead, they use centralized databases controlled by the central bank. This allows faster processing and offline functionality, but removes the anonymity and decentralization that make Bitcoin and Ethereum private. A few pilot programs have tested blockchain-based models, but none have been adopted at scale.

Can the government track my spending with a CBDC?

Yes - unless strict privacy safeguards are built in. In China’s digital yuan, the central bank can see all transactions. In the European digital euro, small offline payments may be anonymous, but online purchases and large transfers require identity verification. Without legal limits, the government could track every purchase, donation, or payment you make.

Why is the U.S. not developing a digital dollar?

In 2025, President Trump signed an executive order halting all retail CBDC development in the U.S. The decision was driven by widespread public concern over government surveillance, lack of federal privacy laws, and pressure from privacy advocates and tech experts. The U.S. still relies on cash and private payment apps, which, while imperfect, offer more privacy than most CBDC designs.

Do CBDCs offer better privacy than PayPal or Apple Pay?

Not inherently - but they could. Private apps like PayPal and Apple Pay collect massive amounts of personal data and sell it to advertisers. CBDCs, if designed with privacy-by-design principles, could collect less. For example, they might only verify your identity once, not track every purchase. But right now, most CBDCs are designed for control, not privacy.

What’s the biggest risk of CBDCs for ordinary people?

The biggest risk is loss of financial autonomy. With CBDCs, governments can freeze accounts, block payments to certain merchants, or even program expiration dates on money. Imagine being unable to pay for a protest, a book, or a medical treatment because your digital wallet was restricted. That’s not theoretical - it’s already happened in countries with strict financial controls.

Is there any country with a truly private CBDC?

No country has a fully private CBDC yet. The closest is the Eastern Caribbean’s DCash, which allows limited anonymous transactions and achieved 22% adoption. The European digital euro will allow small offline payments without ID, but larger transactions require verification. True privacy - where the central bank cannot link your identity to your spending - remains unimplemented at scale.

How do privacy features affect CBDC performance?

Adding privacy tech like zero-knowledge proofs or homomorphic encryption increases system complexity by about 35% and slows transactions by 15-25%. That’s why most central banks avoid them - they want speed and low cost. But without these features, CBDCs become surveillance tools, not payment systems.

What’s the future of CBDC privacy?

The future depends on public pressure. Fourteen central banks are now testing user-controlled privacy dashboards that let citizens choose how much data to share per transaction. If citizens demand privacy by default, CBDCs may evolve. If not, they’ll become the most powerful surveillance tool in modern finance.

Money should be private. Period.

It's not about hiding anything. It's about freedom.

The notion that a central bank can monitor every transaction without consequence is not merely concerning-it is an affront to the foundational principles of liberty. We are not living in a dystopian novel; we are actively constructing one.

This isn't just about surveillance. It's about control. When the state owns your money, it owns your choices. And that's not progress-it's regression wrapped in tech jargon.

They're already testing behavioral scoring in China. If you buy too many books on democracy, your wallet gets flagged. If you donate to a protest, it gets frozen. This isn't speculation. It's documented. They're building a financial panopticon. And we're cheering.

The architectural design of CBDCs fundamentally contradicts the principles of decentralized trust. By centralizing transactional metadata under sovereign control, we are engineering systemic vulnerability-both in terms of privacy erosion and attack surface expansion. The cryptographic primitives necessary for privacy-preserving settlement exist, yet are deliberately omitted due to operational expediency over civil liberty preservation.

I get why people are scared. But let's be real-right now, your bank and apps like Venmo already know everything you buy. At least with a CBDC, we could actually demand rules. Right now? No one's even trying to protect us.

They’re putting chips in your money. 🤖💸

They’ll know when you buy condoms. When you buy a Bible. When you buy a gun. When you buy a book about how to overthrow the government. And then? They’ll decide if you’re "responsible" enough to spend. This isn’t finance. It’s brainwashing with a ledger.

You people act like the government is the villain. Meanwhile, you’re using apps that sell your data to advertisers every time you tap your phone. At least the government can’t charge you $3.99 for a coffee because your "spending profile" says you’re a "premium user." We’re not the enemy. Corporations are.

Let’s not lose sight of the bigger picture. Financial inclusion is real. Millions lack access to banking. CBDCs can fix that-if we design them right. Privacy and security aren’t opposites. They’re both possible. We just need the will to build them that way.

Oh please. You think people in the U.S. care about privacy? They’re posting their breakfast on Instagram and calling it "authentic." The idea that we’re somehow "saving democracy" by resisting CBDCs is laughable. Most people would trade their privacy for faster refunds.

Wait-so you’re saying we should trust a government that can’t even fix the postal service… but we shouldn’t trust a digital currency that’s *designed* to prevent fraud? And yet, you’re fine with PayPal tracking your every move? Contradiction much?

We have a chance here to build something better. Not just a digital dollar-but a fair one. We can demand zero-knowledge proofs. We can demand limits on data retention. We can demand that no one’s wallet be frozen because they bought a protest sign. This isn’t about being anti-tech. It’s about being pro-human.

CBDCs are inevitable and you are all overreacting like peasants with torches

China has 1.4 billion people using digital yuan and no one is rioting

your fear is emotional not logical

stop watching youtube conspiracy videos

I hear the fear. I really do. But maybe we’re focusing too much on the worst-case scenario. What if CBDCs could actually make financial abuse harder? Imagine if your grandma’s pension couldn’t be drained by scammers because the system flagged suspicious transfers. Privacy doesn’t mean secrecy-it means control. And control can be built in.

I just want to know one thing: If I pay for my daughter’s abortion with a CBDC, will the government know? And if they do… will they stop it? That’s not a theoretical question. It’s my life.

You think this is bad? Wait until the digital dollar is linked to your social credit score. Then your kid’s college loan gets denied because you donated to a protest in 2023. Then your insurance rates go up because you bought gluten-free bread too often. Then your job gets flagged because you searched "how to opt out of CBDC". This isn’t paranoia. It’s a timeline.

The European Central Bank’s proposal to permit offline transactions under €100 is a superficial concession. The architecture remains fundamentally non-privacy-preserving. Without transaction unlinkability, homomorphic encryption, and decentralized identity verification, any claim of "privacy" is rhetorical theater. The public must demand technical audits-not press releases.