Bitcoin: The Original Crypto That Changed Everything

When you hear Bitcoin, the first decentralized digital currency created in 2009 by someone using the name Satoshi Nakamoto. Also known as BTC, it’s the only crypto that’s been around long enough to survive crashes, bans, hype cycles, and copycats. It’s not just a coin—it’s the reason crypto exists. While thousands of new tokens pop up every year, Bitcoin still holds the biggest market share, the most network security, and the most trust from people who don’t trust banks.

Bitcoin runs on blockchain, a public, tamper-proof digital ledger that records every transaction across thousands of computers. That’s what makes it unstoppable and censorship-resistant. Unlike regular money, no government or company controls it. Every Bitcoin ever created is tracked on this chain, and you can verify any transaction yourself. This system uses cryptographic hashing, a math process that turns data into a unique code, ensuring no one can alter past transactions. SHA-256, the hashing algorithm Bitcoin uses, is the same one that keeps the network secure after more than a decade of attacks.

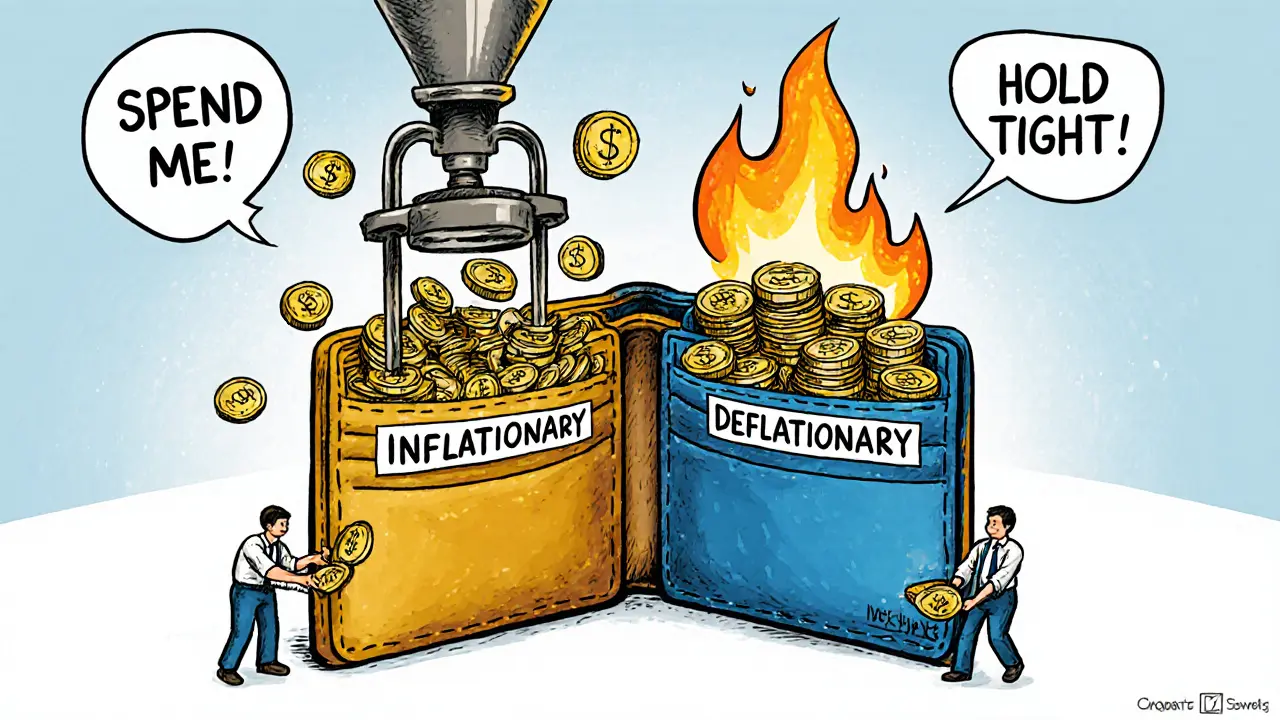

Bitcoin isn’t meant to be a fast payment tool—that’s why Bitcoin Cash was created. It’s not a smart contract platform—that’s Ethereum’s job. Bitcoin’s purpose is simple: be digital gold. Store value. Resist inflation. Survive collapse. That’s why people hold it through bear markets, why institutions buy it, and why scams like Bitcoin 2.0 or BTC2.0 keep trying to trick you into thinking they’re the real thing. They’re not. Only one Bitcoin exists, and it’s the original.

What you’ll find here aren’t just price charts or vague predictions. You’ll see real breakdowns of what works and what’s fake. From how to tell if a crypto exchange is pretending to support Bitcoin, to why some "Bitcoin" tokens are just Ethereum scams with no connection to the real network. You’ll learn how Bitcoin compares to other coins that claim to be its upgrade, and why most of them fail. No fluff. No hype. Just what you need to know before you buy, trade, or ignore it.