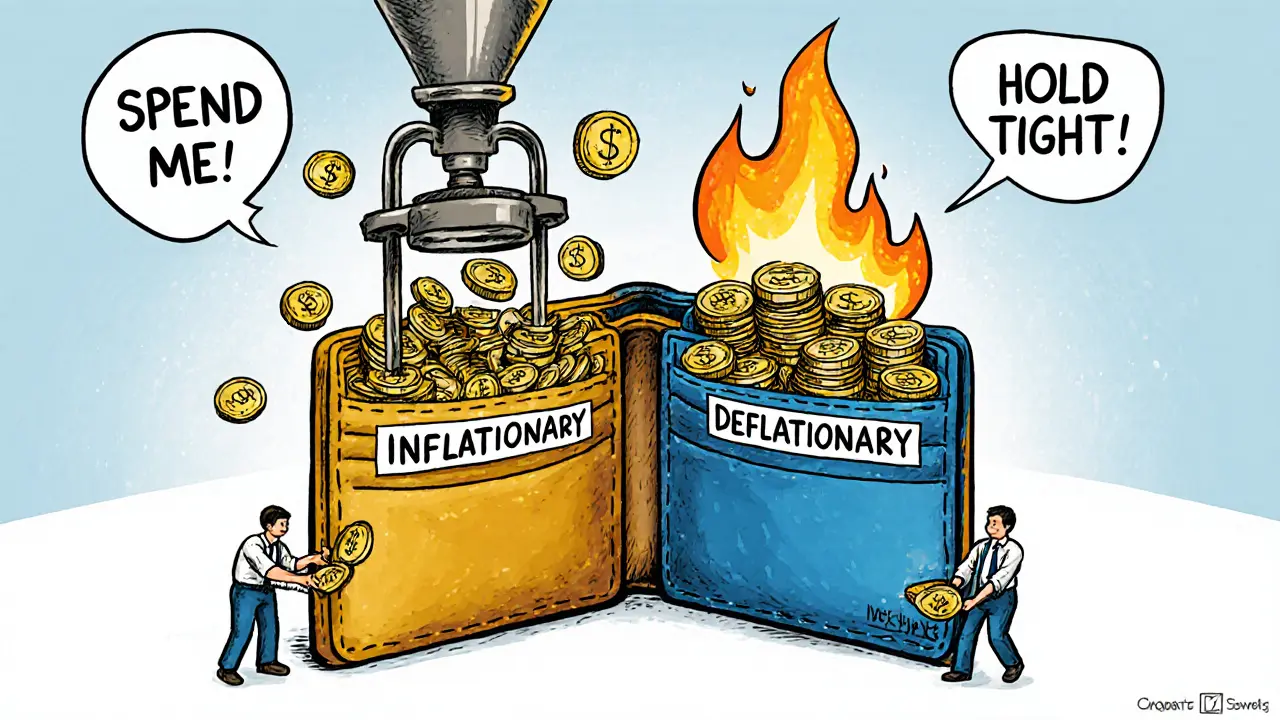

When you buy a cryptocurrency, you’re not just buying code-you’re buying a monetary system. Some tokens are designed to get more expensive over time. Others are built to lose value slowly. The difference comes down to one thing: supply. Whether a token is deflationary or inflationary shapes how it behaves, who holds it, and why it moves in price.

What Makes a Token Inflationary?

Inflationary tokens are like printing more money. Every year, new coins are created and added to circulation. This isn’t necessarily bad-it’s how many networks keep running. Miners and validators get paid in new tokens. Developers fund projects by issuing more coins. Users get rewarded for using the platform.Take Dogecoin. It started with a 100 billion cap, but in 2014, the creators removed it. Now, 5 billion new DOGE are added every year-forever. That’s inflation. It’s not designed to be a store of value. It’s meant to be spent, shared, used in tips and memes. The more people use it, the more gets made. Demand doesn’t need to outpace supply because the supply keeps growing.

Ethereum is another example. Even after EIP-1559 started burning transaction fees, it still issues new ETH to stakers. In 2024, Ethereum’s net supply grew by about 0.3% annually because staking rewards were higher than the amount burned. That’s inflation-even if it’s slow.

The goal? Keep the network alive. Pay people to secure it. Encourage spending. Inflationary tokens thrive in ecosystems where usage matters more than hoarding. If you’re building a DeFi protocol that needs liquidity, you’ll want inflationary tokens to reward users for locking up their assets. It’s a tool, not a flaw.

What Makes a Token Deflationary?

Deflationary tokens are the opposite. They either have a hard cap-or actively destroy coins. Bitcoin is the classic case. Only 21 million will ever exist. Every four years, the reward for mining new blocks cuts in half. The last Bitcoin will be mined around 2140. After that, no more. That’s scarcity built into the code.But it’s not just about caps. Some tokens burn coins on purpose. Every time you send a transaction, a portion of the fee gets destroyed. That’s what Ethereum does with EIP-1559. When the network is busy, more ETH gets burned than created. In 2023, Ethereum went deflationary for over 18 months straight. Supply shrank. Price reacted.

Other projects go further. Some burn 1% of every transaction. Others lock up tokens in smart contracts so they’re permanently removed from circulation. The idea is simple: make the asset rarer over time. That creates a psychological incentive to hold. Why spend something that’s getting scarcer? Why sell when everyone else is buying because supply is shrinking?

This model works best for assets meant to be held-digital gold, savings tools, long-term investments. Bitcoin’s price doesn’t move because people use it to buy coffee. It moves because people believe it’s a hedge against inflation in the real world.

How Supply Changes Behavior

Think about your own wallet. If you hold an inflationary token, you’re more likely to spend it. Why? Because you know more are coming. Your 100 tokens today might be worth less next year if supply grows faster than demand. So you trade it, use it, move it. That’s good for adoption. Bad for price stability.With a deflationary token, you think differently. You don’t want to spend it. You want to stack it. You wait. You watch the supply tick down. You hope the price goes up because fewer coins exist and more people want them. That’s why Bitcoin holders don’t trade daily. They’re not day traders-they’re savers.

This difference creates two types of crypto users: spenders and savers. Inflationary tokens attract merchants, gamers, DeFi users. Deflationary tokens attract investors, institutions, long-term believers.

There’s a reason Coinbase lists Bitcoin and Ethereum first. They’re not just popular-they represent two different financial behaviors. One is money you use. The other is money you keep.

Price Volatility: Why Deflationary Tokens Swing More

Inflationary tokens tend to be calmer. Why? Because supply keeps growing. If demand spikes, more coins are made to meet it. That smooths out price spikes. Dogecoin doesn’t go up 50% in a week because there’s always more coming. It’s designed to be stable in supply, even if volatile in hype.Deflationary tokens? They’re the opposite. When demand rises and supply is fixed-or shrinking-there’s nowhere to turn but up. If 10,000 people suddenly want Bitcoin and only 100 new coins are being mined, the price has to jump to balance the market. That’s why Bitcoin can surge 30% in a week and then drop 20% the next. It’s not broken. It’s working as designed.

But this volatility hurts real-world use. If you run a store and accept Bitcoin, you can’t afford to lose 15% of your revenue because the price dropped overnight. That’s why most merchants use stablecoins or convert crypto to fiat immediately. Deflationary tokens aren’t meant for daily transactions. They’re meant for wealth preservation.

Real-World Examples That Tell the Story

Let’s look at three coins that show the full spectrum.- Bitcoin: Deflationary. 21 million cap. Halvings every four years. No new coins after 2140. Used as digital gold. Holds value across crises. Low transaction volume compared to its market cap.

- Ethereum: Hybrid. Inflationary from staking rewards. Deflationary from fee burning. Net supply changed based on network usage. In 2023, it burned over 4 million ETH. In 2024, it added 0.3% annually. It’s neither one nor the other-it adapts.

- Dogecoin: Pure inflationary. 5 billion new coins per year. No cap. Designed for tipping, memes, and fast payments. Price stays low because supply is endless. No one expects it to become a store of value.

Notice how each one serves a different purpose. Bitcoin is savings. Ethereum is infrastructure. Dogecoin is community. You don’t pick one over the other-you pick based on what you need.

Which One Should You Hold?

There’s no right answer. But there’s a right fit.If you’re looking to protect your savings from inflation, deflationary tokens like Bitcoin make sense. They’re scarce. They’re battle-tested. They’re not meant to be traded every day. You buy and hold for years. Think of it like buying gold bars-not because you’ll use them, but because you trust they’ll keep their value.

If you’re building or using a decentralized app, inflationary tokens are often better. You need liquidity. You need to reward users. You need flexibility. Projects like Solana, Polygon, and Avalanche use inflationary models to grow their ecosystems fast. You might earn tokens by staking, providing liquidity, or referring friends. That’s not a bug-it’s the business model.

And then there’s Ethereum. It’s the middle ground. It’s not purely one or the other. That’s why it’s the most used blockchain. It balances growth with value preservation. It’s not perfect-but it’s adaptable.

Don’t chase the “best” token. Chase the one that matches your goal. Are you saving? Go deflationary. Are you participating? Go inflationary. Are you building? Look at hybrid models.

The Future Isn’t Either/Or

The old debate-deflationary vs inflationary-is fading. Smart projects don’t pick one. They design systems that shift based on demand.Imagine a token that burns coins when the price is high (to cool speculation) and issues new coins when the price is low (to support adoption). That’s not science fiction. It’s already being tested in DAO-governed tokens. Governance votes can adjust issuance rates. Some tokens even have “emergency inflation” triggers during network crises.

What’s clear now is that supply isn’t just a number. It’s a policy. It’s a signal. It tells you what the creators believe about money, value, and human behavior.

Deflationary tokens say: “Value comes from scarcity.” Inflationary tokens say: “Value comes from use.”

The best crypto portfolios include both. You don’t need to choose. You need to understand.

Man, I never thought about how Dogecoin’s infinite supply actually makes it perfect for tipping. It’s not meant to be gold-it’s digital confetti. You don’t hoard confetti, you throw it at parties. That’s why it’ll never hit $10 but always stays fun.

The real insight here isn’t about supply curves-it’s about behavioral economics disguised as crypto. Deflationary tokens create hoarders. Inflationary tokens create participants. The design isn’t technical-it’s psychological. And that’s why most people fail at crypto: they confuse the tool with the intention.

BTC is just digital gold because people say so. It’s not magic. It’s a meme with a cap.

OMG this is SO important!! 🙌 If you're new to crypto, just remember: Bitcoin = savings account, Dogecoin = digital soda machine, Ethereum = the engine that runs everything. Don't overthink it. Use the right tool for the job. 💡💰

Deflationary tokens are a cult. They’re not money-they’re religious artifacts. People worship scarcity like it’s divine. Meanwhile, inflationary tokens are the only real money-because real economies grow. You think gold is valuable? Try feeding your family with it.

You people act like Ethereum is some genius hybrid but it's just a mess. Burning fees doesn't make it deflationary-it just makes it confusing. If you can't decide if you want inflation or deflation, stop pretending you're smart. Just pick one.

Love this breakdown. It’s like comparing a savings bond to a gift card. One you keep, one you use. And honestly? Most people should have both. No need to be a purist. Crypto’s cool because it lets you mix and match.

YES! 🚀 Deflationary for long term, inflationary for DeFi. Simple. No drama. Just stack and spend. Crypto’s not rocket science-it’s just smart money moves. 👊

While the distinction between deflationary and inflationary tokens is conceptually sound, it is critically important to recognize that the underlying governance mechanisms, tokenomics transparency, and network effects must be rigorously evaluated before any investment decision is made. Misunderstanding supply dynamics can lead to catastrophic portfolio outcomes.

Ethereum isn’t hybrid. It’s inconsistent. And Dogecoin’s 5 billion/year? That’s not inflation-it’s a joke. Why are people still talking about this?

They’re lying. All of it. Deflationary tokens are a Fed trap. They want you to hoard so they can control the narrative. The real money is in inflationary chains-those are the ones the banks can’t touch. They don’t want you to know this. Watch the miners. They’re the ones who know.

Bro this is the best explainer i’ve ever seen. Like seriously. I was confused about eth but now i get it. Deflationary = save, inflationary = use. I’m buying more eth and solana. Thanks man!!

It is worth noting that the economic models described herein are predicated upon the assumption of a stable, non-adversarial network environment. In the event of a consensus failure or a significant protocol fork, the assumptions governing supply dynamics may collapse entirely. One must therefore consider not only tokenomics, but also network resilience.

so like… btc = gold, doge = meme, eth = whatever. got it. also why is everyone so serious? 😂

People who use Dogecoin are just dumb. You’re not saving anything. You’re just gambling.

This is so helpful! I’ve been holding Bitcoin but I’m starting to think about staking on Polygon too. I didn’t realize inflationary tokens could be good for participation. Maybe I can try both? Thanks for making it so clear!

They’re all controlled. Bitcoin? The NSA made it. Ethereum? Wall Street. Dogecoin? The Fed’s pet project to distract you. You think you’re choosing? You’re being led. The real crypto is off-chain. You think you’re safe? You’re not.

Wait, so you’re saying Ethereum’s inflation is just a subsidy for stakers? That’s actually kinda genius. It’s like paying rent to keep the lights on. Meanwhile, Bitcoin’s like a landlord who refuses to upgrade the plumbing. You pay more for less.