425x Leverage Crypto: What It Really Means and Why It's Dangerous

When you hear 425x leverage crypto, a trading method that multiplies your position size by 425 times using borrowed funds. It’s not magic—it’s math with massive risk. Imagine putting down $100 and controlling $42,500 worth of crypto. Sounds insane? It is. And that’s exactly why most people who try it lose everything.

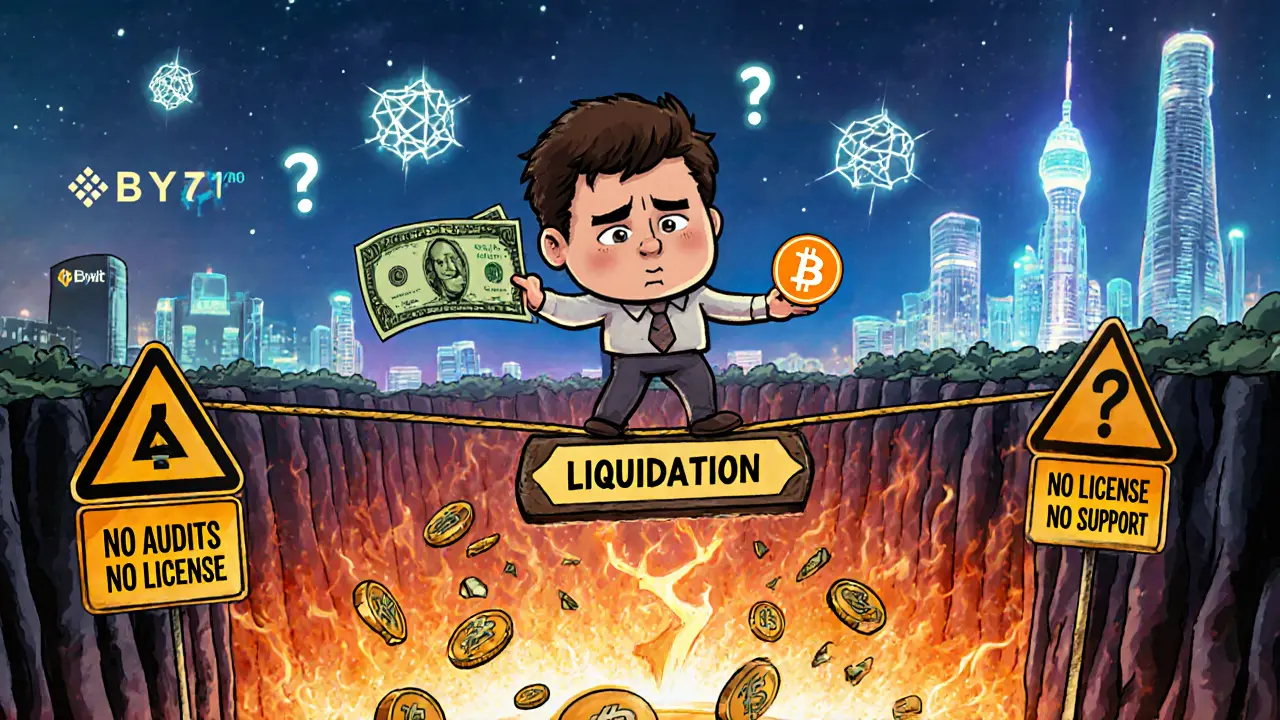

Margin trading, the system behind high-leverage crypto, lets you borrow money from an exchange to trade bigger than your account allows. But crypto leverage, especially at 425x, turns small price swings into total wipeouts. A 0.24% drop in Bitcoin can erase your entire balance. No broker warns you enough: this isn’t investing—it’s betting with your life savings.

People chase 425x leverage because they see videos of someone turning $500 into $20,000 in a day. They don’t see the 99 out of 100 who lost it all before lunch. Exchanges like Bybit, BitMEX, and OKX offer these insane multipliers, but they’re not helping you—they’re collecting fees from your losses. The real winners? The platform, not you.

There’s a reason only a tiny fraction of traders survive long-term with leverage. It doesn’t matter if you’re right 60% of the time—when one bad trade wipes you out, the game is over. Even professional traders avoid anything above 10x. If you’re thinking about 425x, ask yourself: do you want to trade crypto, or do you want to gamble on a slot machine with crypto as the coins?

The posts below don’t sugarcoat crypto risks. You’ll find real breakdowns of exchanges that offer high leverage, scams hiding behind leverage promises, and how people lose everything chasing quick wins. You’ll also see what actually works—like regulated platforms, low-risk staking, and smart token use cases. This isn’t about getting rich fast. It’s about not going broke trying.