Leverage Risk Calculator

Calculate Your Risk

Understand how leverage affects your trades. This calculator shows the potential gains and losses at different leverage levels, highlighting the extreme risks at 425x leverage like Aibit offers.

Key Insight: At 425x leverage, a 0.2% price movement against you wipes out your entire investment.

What if you could trade Bitcoin with 425x leverage? That’s the headline promise from Aibit, a crypto exchange that launched in July 2024 and quickly made waves with claims of AI-powered trading and insane leverage ratios. But behind the flashy numbers, there’s a lot left unexplained. Is Aibit a game-changer-or a ticking time bomb?

What Aibit Actually Offers

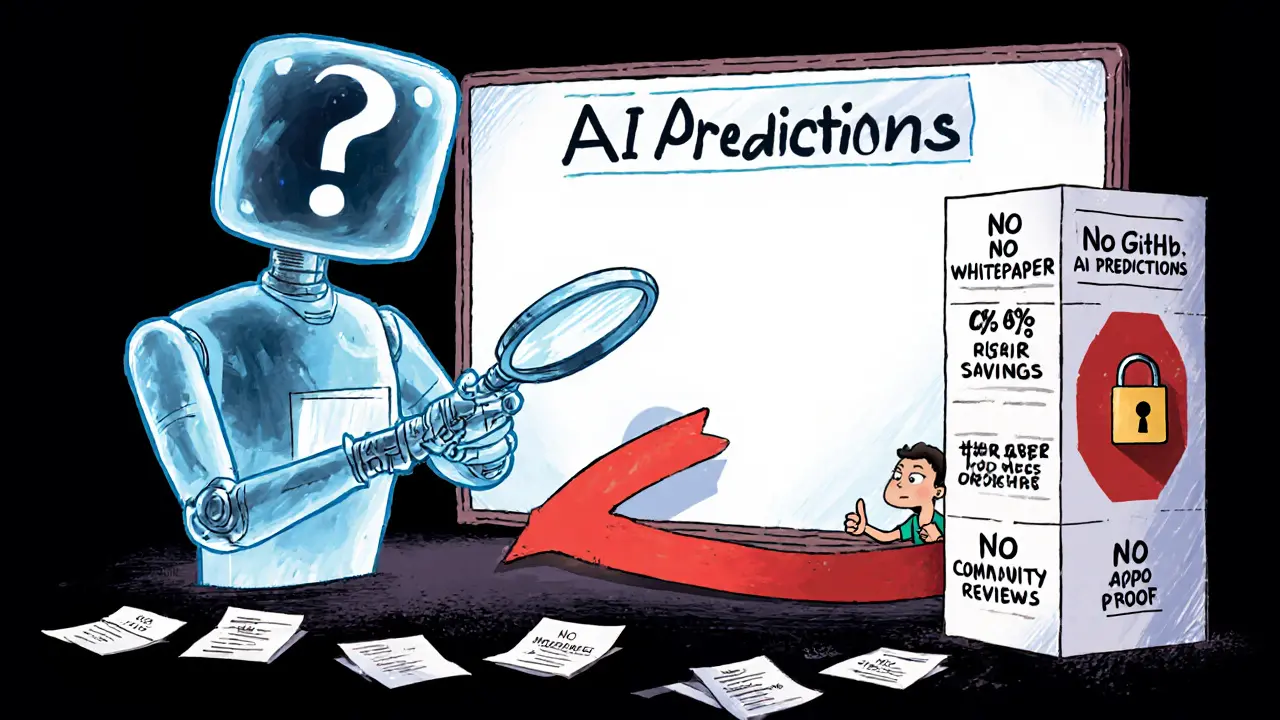

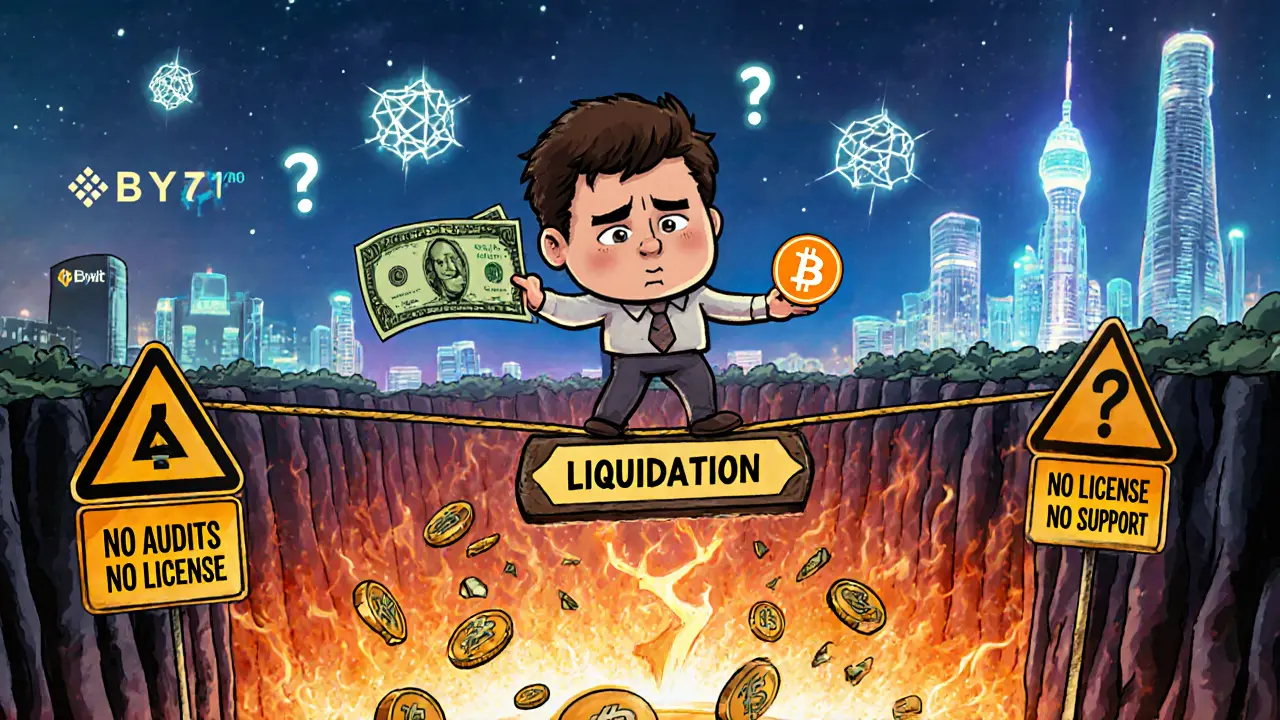

Aibit isn’t just another crypto exchange. It’s built around one core idea: make extreme leverage accessible. While most platforms cap leverage at 100x or 125x, Aibit lets you go all the way to 425x on select perpetual futures contracts. That means if you put down $100, you could control a $42,500 position. Sounds tempting, right? Especially if you’re trying to ride a quick price spike. But here’s the catch: that kind of leverage doesn’t just amplify gains. It multiplies losses too. A 0.2% move against you at 425x leverage wipes out your entire position. That’s not trading-it’s gambling with margin. Beyond leverage, Aibit pushes its AI tools. The platform says it uses AI to analyze market trends, predict price movements, and give users smarter entry and exit signals. But no one’s seen the actual AI. No whitepaper. No technical breakdown. No GitHub repo. Just marketing buzzwords. If you’re hoping for real predictive analytics, you’re probably going to be disappointed. For passive income, Aibit offers something called Aibit Earn. You can lock up your crypto for 14 days and earn a guaranteed 4% APR. That’s better than Coinbase Earn’s 1-3%, but it’s nowhere near Nexo’s 8-12% on stablecoins. The catch? You can’t touch your funds during those two weeks. There’s also a flexible savings option with no lock-up, but the interest rate isn’t listed anywhere. That’s a red flag. The exchange supports over 50 coins, including Bitcoin, Ethereum, Solana, and other major names. But compared to Binance’s 350+ tokens or Kraken’s deep altcoin selection, Aibit feels limited. If you’re into niche tokens or DeFi coins, you’ll likely need another exchange.How Aibit Compares to the Big Players

Let’s put Aibit next to the real industry leaders:| Feature | Aibit | Binance | Bybit | UEEx |

|---|---|---|---|---|

| Max Leverage | 425x | 125x | 100x | 100x |

| AI Trading Tools | Claimed, unverified | Basic indicators only | AI signals (limited) | None |

| Fixed Savings APR | 4% (14-day term) | Up to 5% (varies) | Up to 10% (stablecoins) | Up to 8% |

| Copy Trading | No | Yes | Yes | Yes |

| Fiat On-Ramp | Not confirmed | Yes (credit card, bank) | Yes | Yes |

| Referral Commission | Up to 80% (futures only) | Up to 40% | Up to 50% | 75% (spot + futures) |

| Security Audits | None disclosed | Multiple (CertiK, SlowMist) | Published audits | 90% cold storage |

| Mobile App Quality | Unknown | Highly rated | Highly rated | Good |

Aibit wins on leverage-no question. But it loses everywhere else. Binance and Bybit have years of user data, proven security, and real customer support. UEEx offers better affiliate payouts and copy trading. Aibit? It’s all potential and zero proof.

The Security Question

This is the biggest problem. Aibit doesn’t publish any security details. No cold storage ratios. No audit reports from CertiK, SlowMist, or any reputable firm. No insurance fund details. Nothing. Singapore requires all crypto exchanges to be licensed under the Payment Services Act (PSA). Aibit claims to be Singapore-based-but is it licensed? No source confirms this. And that’s terrifying. In 2023, Singapore shut down Zipmex for operating without a license. If Aibit isn’t compliant, it could vanish overnight. You’re not just risking your money on bad trades. You’re risking it on a platform that might not even be legal. And with 425x leverage, a single flash crash could trigger mass liquidations-something we’ve seen before during Bitcoin’s 2020 Black Thursday. The exchange might not survive that kind of pressure.

Who Is Aibit For?

Aibit isn’t for beginners. Not really. Sure, the interface looks simple. But trading at 425x leverage requires deep knowledge of liquidation prices, funding rates, and volatility spikes. Most people who try it lose everything in weeks. It’s also not for long-term holders. There’s no staking. No rewards for holding coins. Just futures and savings accounts with short terms. The only people who might benefit are experienced traders who:- Understand how to calculate liquidation points at extreme leverage

- Trade during high-volatility events (like Fed announcements or Bitcoin halving cycles)

- Use strict stop-losses and never risk more than 1-2% of capital per trade

- Have backup accounts on Binance or Bybit in case Aibit goes down

The Affiliate Program

If you’re looking to earn by referring others, Aibit offers up to 80% commission on futures trading fees. That’s high-but only on futures. Most users trade spot. UEEx gives you 75% on both spot and futures, plus multi-level referrals. Aibit’s program feels half-baked. No dashboard. No real-time tracking. No payout thresholds listed. If you’re serious about affiliate income, there are better options.

What’s Missing

Aibit has big gaps:- No mobile app reviews or performance metrics

- No customer support response times

- No Discord, Telegram, or community forums

- No educational content for new users

- No verified user testimonials

- No fiat on-ramp confirmed

Final Verdict

Aibit is a high-risk, high-reward experiment. It’s not a reliable exchange. It’s not a safe place to store crypto. It’s not even a good platform for most traders. If you’re a seasoned derivatives trader who understands the dangers of 425x leverage and wants to test a new platform with insane exposure, you might give it a small amount. But don’t go all in. And never use it as your main exchange. For everyone else-beginners, long-term holders, casual traders, or anyone who values security over hype-stick with Binance, Kraken, or Bybit. They’ve proven they can survive market crashes. Aibit hasn’t even made it through its first year without controversy. The AI? The leverage? The 4% savings? All flashy. But without audits, licensing, user data, or transparency, it’s all smoke and mirrors.Frequently Asked Questions

Is Aibit a legitimate crypto exchange?

Aibit claims to be based in Singapore and launched in July 2024, but there’s no public confirmation it holds a valid Payment Services Act (PSA) license from Singapore’s Monetary Authority. Without licensing, it operates in a legal gray area. No security audits, no insurance fund details, and no user reviews make it risky to trust with your funds.

Can I really trade with 425x leverage on Aibit?

Yes, Aibit offers up to 425x leverage on select perpetual futures contracts, which is higher than any other major exchange. But this is extremely dangerous. A tiny price movement against your position can wipe out your entire balance. Only experienced traders with strict risk controls should consider using this feature.

Does Aibit have a mobile app?

Aibit says it’s available on all major platforms, but there are no app store listings, user reviews, or performance metrics available. Without verified app quality, mobile trading could be unreliable or unsafe.

How does Aibit Earn work?

Aibit Earn offers a 14-day fixed-term savings product with a guaranteed 4% APR and a $100 minimum deposit. There’s also a flexible savings option with no lock-up, but the interest rate isn’t disclosed. Compared to other platforms, the 4% rate is decent for a short term, but not competitive with long-term stablecoin yields.

Is Aibit’s AI trading tool real?

Aibit markets itself as AI-powered, but there’s no technical documentation, whitepaper, or public proof of how the AI works. No examples of predictions, alerts, or risk-scoring tools are available. Until this is verified, treat the AI claims as marketing hype, not functionality.

Can I withdraw my funds from Aibit safely?

There are no verified reports of withdrawal delays or issues-but there are also no user testimonials at all. Without transparency or community feedback, there’s no way to know if withdrawals are reliable, especially during market volatility. Always test with a small amount first.

Should I use Aibit as my main crypto exchange?

No. Aibit lacks the security, liquidity, regulatory compliance, and user base of established exchanges. Use it only if you’re an advanced trader experimenting with extreme leverage-and even then, keep the majority of your funds on a trusted platform like Binance or Kraken.

This feels like a Ponzi scheme with a fancy website. 425x leverage? Bro, that's not trading, that's handing your money to a shadowy group in a Singapore basement and hoping they don't vanish before your next coffee break. No audits? No app reviews? No Discord? That's not a startup-that's a ghost town with a trading terminal.

I'm not even mad, I'm just disappointed. We've been here before. Zipmex. FTX. Terra. And now Aibit? Same script, different logo. They'll disappear the moment Bitcoin dips 1.5%. And you? You'll be left staring at a blank screen wondering where your life savings went.

Also, 'AI-powered'? Yeah right. If their AI could predict anything, it'd be how fast their servers would crash when the first 10,000 people get liquidated at once. I'd rather trust a Magic 8-Ball.

Don't be the guy who says 'I knew it was sketchy but I thought I'd get rich before it blew up.' You won't. You'll just be another cautionary tale in r/CryptoCurrency.

Stick with Binance. Or better yet-just HODL in a cold wallet and save your sanity.

While the article presents a comprehensive analysis, I must emphasize that the absence of verifiable security documentation is not merely a gap-it is a fundamental red flag in the context of financial infrastructure. The regulatory ambiguity surrounding Aibit’s jurisdictional compliance, particularly with respect to Singapore’s Payment Services Act, introduces systemic risk that cannot be mitigated by leverage ratios or marketing terminology. The lack of third-party audit disclosures further undermines any claim to operational integrity. In financial markets, transparency is not optional-it is the baseline standard. Without it, even the most technically sophisticated platform remains an unsecured vessel in a storm.

Okay, I get it-425x leverage is wild 😳 But can we just take a second to appreciate how nobody’s talking about the fact that this platform doesn’t even have a mobile app review? Like… zero? Not even one screenshot on Reddit? That’s not ‘new,’ that’s ‘not real.’

And the AI thing? Bro, if your AI is so smart, why’s it not posting on GitHub? Why’s it not showing a single prediction? I’ve seen bots that do more than this. 😅

Also, 80% referral commission? That’s not a business model-that’s a pyramid scheme with a trading interface. I’d rather make $5 on Binance than chase 80% on something that might vanish tomorrow.

Stay safe out there, folks. Don’t be the one who says ‘I thought I was smart.’ You’re not. You’re just early to the funeral.

This isn’t a crypto exchange-it’s a high-stakes casino run by clowns who think ‘marketing buzzwords’ replace due diligence. 425x leverage? Congrats, you’ve turned Bitcoin into a roulette wheel with a 99.7% house edge. The fact that they don’t disclose cold storage ratios is criminal. No audits? No transparency? No customer support metrics? That’s not innovation-that’s negligence dressed in neon.

And the AI? Please. If their algorithm were real, it’d be running on QuantConnect or Kaggle, not hiding behind a ‘coming soon’ banner. You don’t get to call something ‘AI-powered’ when you can’t even name the model, the training data, or the loss function. That’s not tech-it’s fraud.

Referral commissions at 80%? That’s not a revenue stream-that’s a Ponzi recruitment engine. And the fact that they’re silent on fiat on-ramps? That’s not ‘privacy-focused’-it’s ‘we don’t want regulators looking.’

Don’t trade here. Don’t even test it with $10. If you do, you’re not a trader-you’re a donor.

Look, I get it-you wanna make bank fast, right? But let me tell you something: if you’re thinking about putting real money into Aibit, you’re not being clever-you’re being dumb. 425x leverage? That’s not leverage, that’s suicide with a countdown timer.

And the AI? Ohhh, it’s AI-powered! Yeah, like my toaster is AI-powered because it has a timer. No whitepaper? No GitHub? No proof? That’s not innovation, that’s lying.

And don’t even get me started on the ‘no mobile app reviews’ thing. If they had a real app, people would be posting screenshots, complaining about bugs, loving it, hating it-anything! But silence? That means they don’t have one. Or worse-they do, and it’s a scam.

You think you’re trading? You’re just handing cash to a shell company hoping they don’t disappear before your next paycheck. I’ve seen this movie. The ending’s always the same.

Stick with Binance. Or Kraken. Or even Bybit. They’ve got years of proof. Aibit? Zero. Nada. Zip.

Don’t be the guy who loses everything because he thought ‘high leverage’ meant ‘high reward.’ It means ‘high risk.’ And this? This is risk with no safety net.

Just say no. Please.

so like… i just tried to sign up and their site crashed twice?? like??? is this even real??

Okay, I’m going to say this nice and slow because I care about everyone here. Aibit is NOT the next big thing. It’s a glittery trap wrapped in buzzwords. Yes, 425x sounds insane. But let me tell you what happens when you trade at that level-you don’t get rich. You get wiped out. Fast. Like, blink-and-you-miss-it fast.

And the AI? Honey, if it were real, they’d be showing us screenshots of it predicting the last 10 BTC swings. But nope. Nothing. Just marketing fluff.

And the savings? 4% for 14 days? That’s cute. But if you can’t touch your money? That’s not savings-that’s a lockbox with a fake interest rate.

Look, I’ve been in crypto since 2017. I’ve seen the hype cycles. I’ve lost money. I’ve made money. But I’ve never lost everything because I trusted a platform with zero transparency.

Don’t be scared of missing out. Be scared of losing it all. Stick with the platforms that have been tested in fire. Binance, Kraken, Coinbase-they’ve survived crashes. Aibit hasn’t even survived its first month without suspicion.

And if you’re thinking about the referral program? Please. Don’t recruit your friends into a sinking ship. That’s not smart. That’s cruel.

You got this. Stay safe. Stay smart. And please… don’t touch Aibit.

This exchange is dangerous. No one knows if it is legal. No one knows if it is real. Why take risk when you can use Binance? Simple.

Okay, I just wanna say-I’ve been trading since 2021 and I’ve seen a LOT of shady platforms, but Aibit? This one takes the cake 🎂

425x leverage? Bro, that’s not trading, that’s betting your rent money on a coin flip. And the AI? If it was real, they’d have a YouTube video showing it predicting the last 5 dips. But nope. Crickets.

And no app reviews? No community? No Discord? That’s not a startup-that’s a ghost. And ghost platforms don’t pay out. They vanish.

Also, the referral program at 80%? That’s not a bonus-that’s a recruitment tactic. Like, ‘hey, bring your friends so we can take their money too!’

I’m not saying don’t explore new stuff. But please, test it with $5. Just $5. If you can’t withdraw it in 24 hours? Run. Don’t walk.

And if you’re thinking, ‘I’m smart, I’ll time it right’-honey, you’re not. You’re just lucky so far.

Stick with the big guys. They’ve got the audits, the apps, the support. Aibit? It’s got vibes. And vibes don’t pay your bills.

wait so the ai is just… a buzzword? like no one has seen it? but they still say it’s powered by ai? that’s wild

How quaint. A platform that thinks ‘high leverage’ compensates for zero credibility. The AI claims are laughable-like a startup selling ‘quantum blockchain’ in 2018. And yet, somehow, people still fall for this. The fact that they don’t even bother with a mobile app review speaks volumes. This isn’t innovation-it’s a prelude to a liquidity event. For them. Not you.

Do you really think a platform that can’t even disclose its cold storage ratio deserves your capital? Please. If you’re not using Binance or Kraken, you’re not trading-you’re volunteering as a test subject.

Okay, so… no audits, no app reviews, no transparency, but they’ve got 425x leverage? That’s like buying a car with no brakes and calling it ‘high-performance.’

And the AI? If it were real, it’d be on GitHub. Or at least have a demo. But nope. Just ‘AI-powered’ on the homepage. That’s not tech-that’s a magic trick.

Also, no one’s posted about it on Reddit? No screenshots? No complaints? No praise? That’s not quiet-it’s dead. Or worse, fake.

I’m not saying don’t take risks. But this? This isn’t a risk. This is a trap with a fancy logo.

Just… don’t. Please.

They’re not even trying to hide it anymore. 425x leverage? That’s not innovation-that’s a surrender to greed. And the fact that they’re ‘Singapore-based’ but won’t prove it? Classic. They’re banking on American greed and global ignorance.

They know people will risk everything for a 10x return. They know you’ll ignore the lack of audits because you’re too busy dreaming of your Lambo.

And the AI? Oh, it’s AI. Sure. Like my toaster is AI because it has a ‘smart’ setting.

This isn’t a crypto exchange. It’s a psychological weapon. Targeting the desperate, the greedy, the naive.

And when it collapses? The regulators will shrug. The media will forget. And you? You’ll be left wondering why you didn’t listen.

Wake up. This isn’t the future. It’s the same scam, wrapped in new packaging.

425x leverage? That’s not trading-it’s a suicide pact with a crypto exchange. And the fact that they’re not licensed in Singapore? That’s not ‘innovative’-that’s illegal. They’re operating in a gray zone because they know they can’t pass a real audit.

No cold storage data? No insurance fund? No user testimonials? That’s not ‘new’-that’s a red flag the size of the moon.

And the AI? Please. If their AI could predict markets, they wouldn’t be running a crypto exchange-they’d be running a hedge fund and living on a private island.

Referral commissions at 80%? That’s not a business model-it’s a pyramid scheme with a trading interface. They’re not making money from trading fees-they’re making money from recruiting suckers.

And the fact that no one’s reviewed the app? That’s because it doesn’t exist. Or if it does, it’s malware.

This isn’t a platform. It’s a trap. And you’re the bait.

Don’t be the guy who loses everything because he thought ‘high leverage’ meant ‘high reward.’ It means ‘high risk.’ And this? This is risk with no safety net.

And if you still think it’s worth it? Fine. Go ahead. But don’t come crying to me when your account is gone and your friends won’t answer your texts.

Hey everyone-just wanted to say I appreciate how thorough this review is. It’s so easy to get caught up in the hype of ‘high leverage’ and ‘AI trading,’ but the truth is, crypto is already risky enough without adding unverified platforms.

If you’re new to this, please take a breath. Don’t rush into anything. Test with $10. See if you can withdraw. Check if their support responds. Look for real user feedback.

And if you’re experienced? Even then-ask yourself: Is this worth it? Is the potential reward worth the chance of losing everything because a platform didn’t publish a single audit?

You don’t need to chase the next big thing. You just need to protect what you have.

Stick with the platforms that have proven they can survive. Binance, Kraken, Coinbase-they’ve been through crashes. Aibit hasn’t even survived its first month without suspicion.

Be smart. Be safe. And remember: if it sounds too good to be true… it probably is.

The allure of extreme leverage is a seductive illusion, one that preys upon the human desire for rapid wealth accumulation. Aibit’s model does not represent innovation-it represents exploitation dressed in algorithmic rhetoric. The absence of verifiable security infrastructure, coupled with the non-disclosure of regulatory compliance, renders this platform not merely risky, but ethically indefensible.

Moreover, the claim of AI-driven predictive analytics, devoid of any technical substantiation, is not merely misleading-it is a deliberate obfuscation of operational incompetence. In financial markets, transparency is not a courtesy; it is the foundational pillar upon which trust is built.

One must question: if the technology were genuinely superior, why would its creators not publish their methodology? Why would they not invite independent scrutiny? The silence speaks louder than any marketing slogan.

For the novice trader, this platform is a minefield. For the seasoned one, it is a trap. The only responsible choice is to redirect capital toward entities that prioritize accountability over aspiration.

Oh wow. 425x leverage. That’s not trading. That’s giving your money to a guy in a basement who just learned how to code a website. And you call that ‘innovation’? Nah. That’s just capitalism with the brakes cut.

AI? LOL. If your AI was real, you wouldn’t be begging people to sign up-you’d be on a yacht in Monaco.

And no mobile app reviews? No Discord? No transparency? That’s not ‘quiet launch.’ That’s ‘we’re about to vanish.’

Also, 80% referral commission? That’s not a business model-that’s a pyramid scheme with a trading terminal.

Don’t be the guy who says ‘I knew it was sketchy but I thought I’d get rich before it crashed.’ You won’t. You’ll just be another statistic.

Stick with Binance. Or better yet-just HODL in a cold wallet and save your dignity.

wait so the ai is just a buzzword? i thought it was real lol

425x leverage is a mathematical guarantee of ruin for 99% of users. The platform’s lack of security disclosures, regulatory compliance, or user feedback indicates not innovation, but systemic negligence. The AI claims are not merely unsubstantiated-they are functionally meaningless without technical documentation. This is not a trading platform. It is a liquidity extraction mechanism designed to capitalize on behavioral biases. Proceed at your own peril.

Everyone’s acting like Aibit is the enemy. But what if it’s the future? What if the ‘big boys’ are just scared of real innovation? Binance has 350 coins? Big deal. So what? Aibit is going all-in on leverage and AI. That’s bold. That’s vision.

Maybe the reason there’s no audit is because they don’t want to be regulated. Maybe they’re building something the old guard can’t control.

And the AI? Maybe it’s proprietary. Maybe it’s too powerful to show.

People didn’t believe in Bitcoin either. Now look at it.

Maybe you’re not seeing the future because you’re too busy clinging to the past.

Just saying… don’t be the person who laughs at the revolution until it’s too late.

Wow. Someone actually defended Aibit. That’s… brave. Or dumb. Either way, I’m impressed.

So let me ask you this: if Aibit is ‘the future,’ why does it look exactly like every other scammy exchange that vanished in 2022? Same buzzwords. Same silence. Same ‘trust us, we’re different’ energy.

Bitcoin didn’t launch with zero audits and no app reviews. It launched with code. With transparency. With a whitepaper. With a community.

Aibit has none of that. Just leverage and lies.

So no. This isn’t the future. This is the past repeating itself. And you? You’re not a visionary. You’re just the next sucker who thinks ‘bold’ means ‘not a scam.’

While the contrarian perspective is intellectually stimulating, it conflates innovation with recklessness. True innovation does not operate in the shadows-it invites scrutiny. The absence of technical transparency, regulatory adherence, and community validation is not a sign of suppression by incumbents; it is a symptom of an unsustainable, non-viable model. History does not reward those who gamble with systemic trust-it rewards those who build upon verified foundations.