zk-Rollups: What They Are and Why They Matter in Crypto

When you hear zk-Rollups, a type of blockchain scaling solution that bundles hundreds of transactions into a single proof using zero-knowledge cryptography. Also known as zero-knowledge rollups, they let blockchains like Ethereum process way more transactions without slowing down or getting expensive. Think of them as a secret shortcut—instead of every node verifying each transaction one by one, zk-Rollups prove a whole batch is valid with one tiny cryptographic proof. That’s how they cut costs and speed things up, without sacrificing security.

They rely on zero-knowledge proofs, a cryptographic method that lets one party prove they know something without revealing what it is. This isn’t just theory—it’s what makes zk-Rollups trustworthy. You don’t need to see every trade to know the ledger is correct. That’s why big names like zkSync, Starknet, and Polygon zkEVM use them. These aren’t experimental toys; they’re live networks handling real money, DeFi trades, and NFT sales every day. And because they’re built on Ethereum, they inherit its security while solving its biggest problem: high fees and slow speeds.

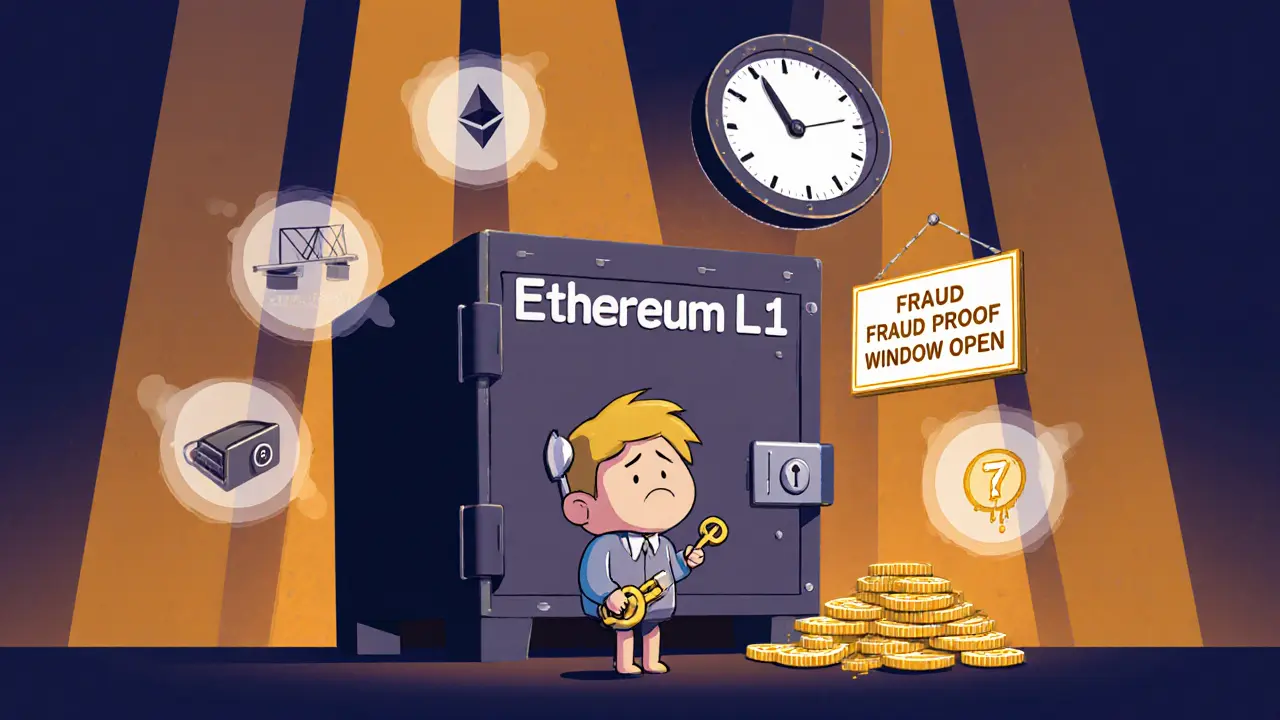

It’s not just about speed. Ethereum Layer 2, a secondary framework built on top of Ethereum to improve performance. It’s the category zk-Rollups belong to—and the most effective one right now. Other scaling tools like Optimistic Rollups exist, but zk-Rollups are faster to finalize and more secure out of the box. That’s why developers are shifting to them. Even exchanges and wallets are optimizing for zk-Rollup compatibility because users demand low fees and instant confirmations.

What you’ll find in this collection isn’t fluff. These are real stories: how people are using zk-Rollup-powered apps, what went wrong with fake airdrops pretending to be linked to them, and how projects like Monsoon Finance and ButterSwap quietly rely on this tech to keep transactions private and cheap. You’ll see how zk-Rollups aren’t just a buzzword—they’re the quiet engine behind the crypto world’s next leap. No hype. Just facts. And if you’re trying to understand why some tokens move fast and others die slow, this is where the answer starts.