Layer 2 solutions promised to fix Ethereum’s high fees and slow speeds without sacrificing security. But here’s the truth: Layer 2 security isn’t just weaker than Layer 1-it’s different. And that difference can cost you money.

How Layer 2 Security Actually Works

Layer 2s don’t reinvent security. They borrow it. They take the trust of Ethereum (or Bitcoin) and build on top of it. But borrowing isn’t the same as owning. Think of it like renting a safe. The bank’s vault is secure, but the key to your rented safe? That’s in someone else’s hand. There are three main types of Layer 2s, and each handles security in its own way:- State channels (like Lightning Network): Two parties open a direct channel, transact privately, then settle on-chain. Security relies on both parties watching for fraud. If one disappears, the other must act before a timer runs out. Miss the window? Your funds are stuck.

- Sidechains (like Polygon PoS): These run their own blockchains with their own validators. They’re faster and cheaper, but they’re not secured by Ethereum’s 835,000+ stakers. Polygon has about 100. That’s a huge drop in decentralization-and a bigger target.

- Rollups: These bundle hundreds of transactions into one on-chain proof. There are two flavors: Optimistic and zk-Rollups.

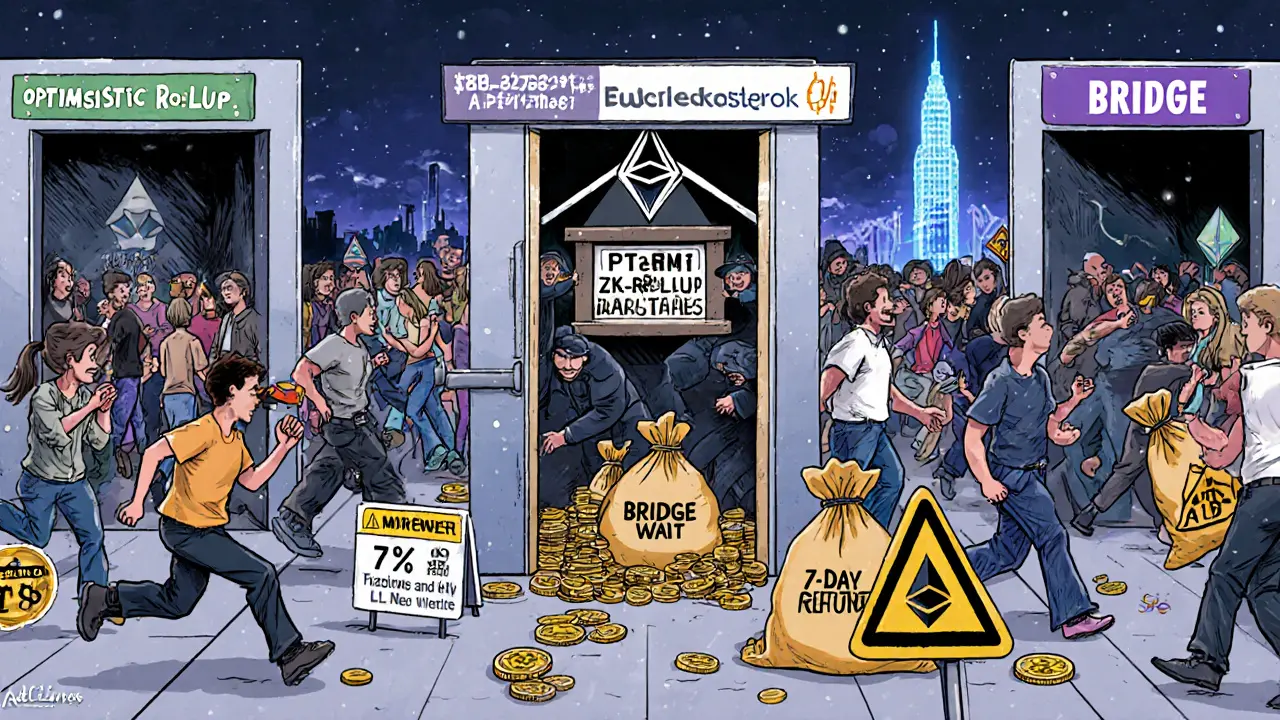

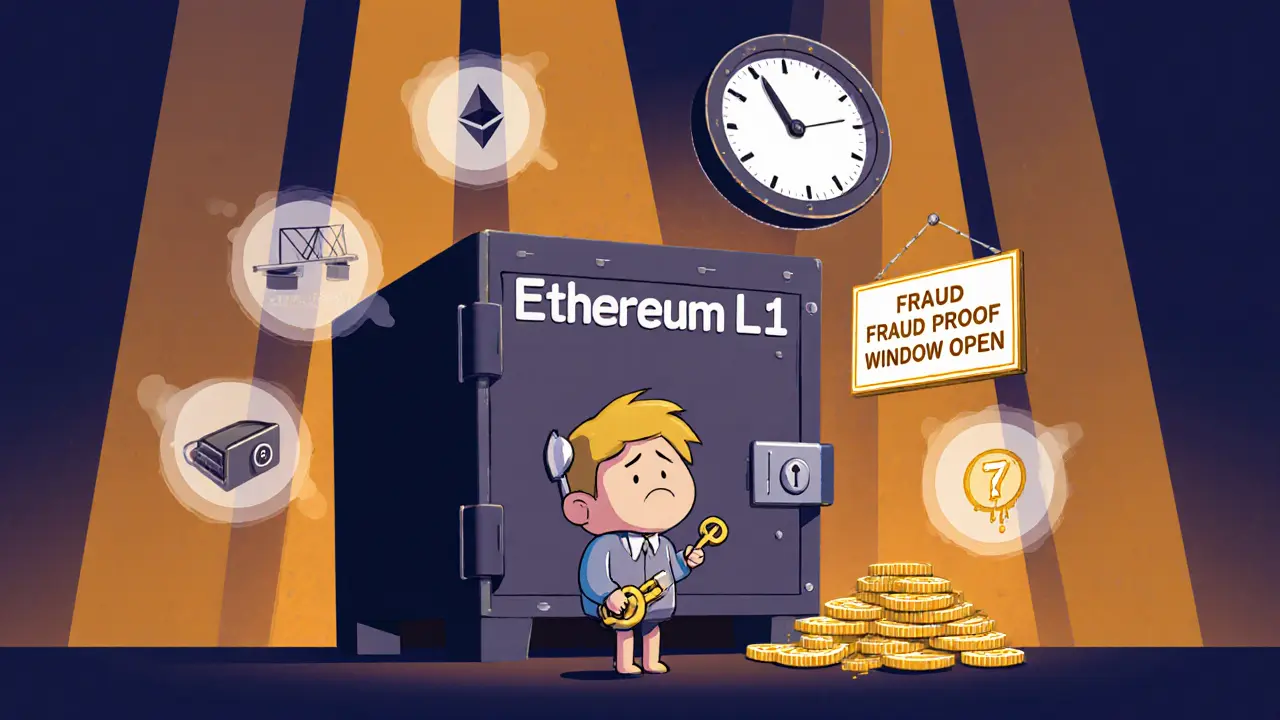

Optimistic Rollups: The 7-Day Waiting Game

Optimistic Rollups (like Arbitrum and Optimism) assume transactions are valid unless proven otherwise. If something looks off, anyone can submit a fraud proof. But here’s the catch: you have to wait up to 7 days to be sure. That delay isn’t just a technical quirk-it’s a vulnerability. In June 2023, Arbitrum lost $2.3 million because a sequencer withheld transaction data. Users couldn’t verify what was happening. The system worked as designed, but the design had a blind spot. And it’s not just sequencers. A lot of L2 wallets don’t warn users about the 7-day challenge period. People think their withdrawal is final when it’s not. Trezor’s team found 43% of L2 wallet integrations fail to explain this. That’s not user error-it’s bad design. Optimistic Rollups are cheap (95% cheaper than Ethereum L1) and decentralized. But they trade speed for safety. And if you’re moving large sums, that 7-day window is a risk you can’t ignore.zk-Rollups: Instant Finality, Complex Code

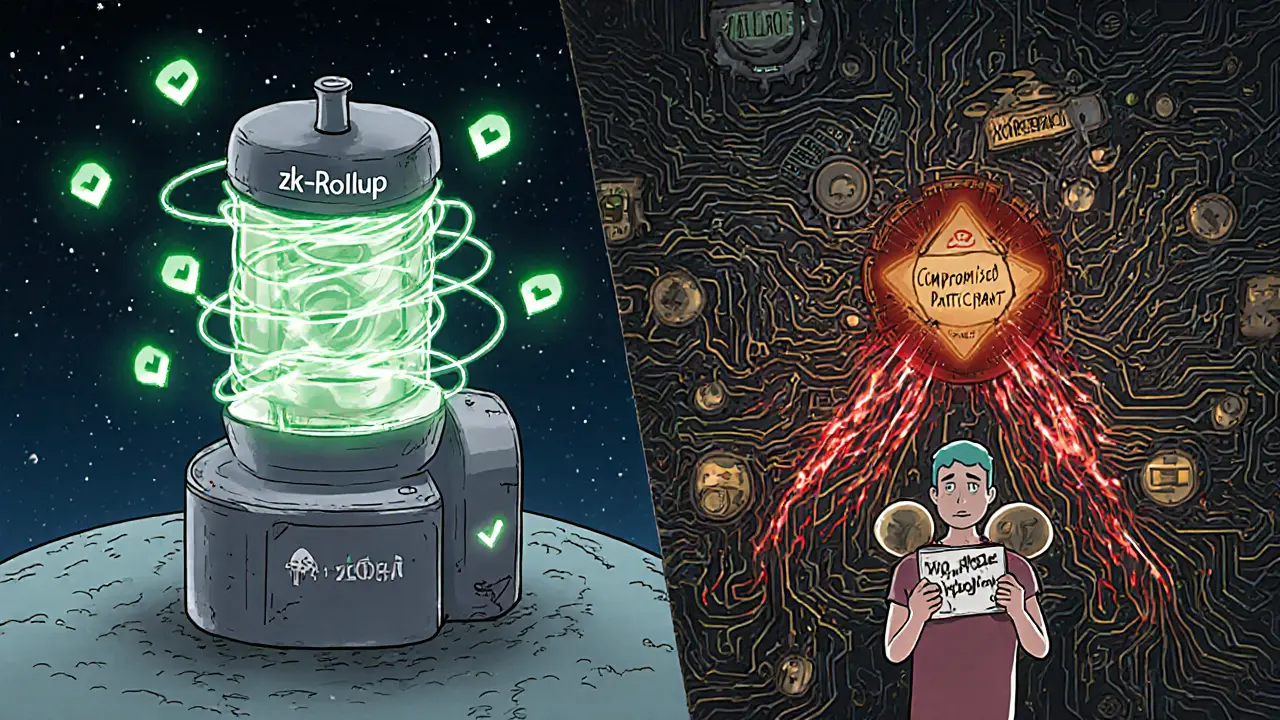

zk-Rollups (like zkSync and StarkNet) use zero-knowledge proofs to prove transactions are valid before they’re even added to Ethereum. No waiting. No fraud proofs. Just math. This gives them near-instant finality and stronger security guarantees. But here’s the downside: the math is hard. Building a zk-proof requires complex cryptography, and if the setup is flawed, the whole system breaks. StarkNet’s Cairo system needed a multi-party ceremony with 34 participants to generate initial parameters. If even one of them was compromised, the entire proof system could be backdoored. That’s not theoretical-it’s how many cryptographic systems have been broken in the past. And throughput? zk-Rollups can hit 2,000 TPS, but only because each proof is computationally heavy. That means higher costs for developers, slower innovation, and fewer apps. It’s a trade-off: security without delay, but at the cost of accessibility.

The Bridge Problem: Where Most Money Gets Stolen

The biggest security failures on Layer 2 aren’t in the rollups themselves-they’re in the bridges. Bridges connect L1 and L2. They’re the doors between your Ethereum wallet and your Arbitrum balance. And they’re the #1 target for hackers. In May 2021, attackers stole $23.8 million from Polygon’s bridge by compromising two-thirds of the signing keys. In 2023, bridge exploits accounted for 78% of all L2 losses, according to the Blockchain Security Alliance. That’s not a coincidence. Bridges are centralized, poorly audited, and often built by teams with little security experience. Even the most secure rollup is useless if the bridge to it is broken. And most users don’t realize that. They think, “I’m on Arbitrum, so I’m safe.” But if they used a bridge to get there? Their funds were exposed the moment they crossed.What Users Actually Experience

Real users aren’t reading whitepapers. They’re trying to swap tokens, send ETH, or play a game. And they’re running into problems:- A Reddit user lost $8,500 in July 2024 when Arbitrum’s data availability failed for 14 hours. Their transaction never confirmed. No refund.

- A CoinGecko survey of 1,247 L2 users found 63% worried about bridge security. Almost half were anxious about finality delays.

- Over 200 cases of “stuck withdrawals” have been documented since 2022. Average resolution time? 3.2 days.

What’s Getting Better

The good news? Security is improving fast. Ethereum’s Dencun upgrade in March 2024 cut L2 data costs by 90% with proto-danksharding. This means more data can be stored on-chain, reducing reliance on centralized data availability committees. Optimism’s Bedrock upgrade in July 2024 introduced decentralized sequencers. No single entity controls transaction order anymore. zkSync’s Era 2.0, released in September 2024, uses recursive proofs to scale to 100,000 transactions per second-all with cryptographic finality. Stanford researchers just published a new type of “Zero-Knowledge Bridge Proof” that could eliminate 95% of current bridge vulnerabilities. That’s not marketing. That’s peer-reviewed research.What You Need to Know Before Using Layer 2

If you’re using a Layer 2 solution, here’s what you must do:- Know which type you’re on. Is it an Optimistic Rollup? Then expect a 7-day wait for withdrawals. Is it a zk-Rollup? You’re safe from fraud-but only if the proof system is trusted.

- Never trust a bridge. Use only official, audited bridges. Avoid third-party aggregators. If you’re moving large amounts, wait for the bridge to be live for at least 6 months.

- Watch for warnings. If your wallet doesn’t explain the challenge period, switch wallets. Use MetaMask, Argent, or Rabby-they’re updated.

- Don’t assume security. Layer 2s are not as secure as Ethereum. They’re cheaper, faster, and mostly safe-but not bulletproof.

Final Reality Check

Layer 2 solutions are here to stay. They’re not a temporary fix. They’re the future of Ethereum. But they’re not magic. They’re engineering trade-offs. You’re not getting L1 security-you’re getting L1 security, with extra risks you have to manage. The most secure Layer 2 isn’t the one with the fanciest tech. It’s the one whose risks you understand. If you’re moving $10,000? Use a zk-Rollup with a trusted bridge. If you’re swapping $50 worth of tokens? An Optimistic Rollup is fine. But never treat them as if they’re the same as Ethereum. Security isn’t about being perfect. It’s about knowing what you’re trusting-and why.Are Layer 2 solutions safer than Layer 1 blockchains?

No, Layer 2s are not safer than Layer 1. They inherit security from Layer 1 but introduce new risks. Layer 1 (like Ethereum) is secured by hundreds of thousands of validators and has battle-tested consensus. Layer 2s rely on secondary systems-sequencers, bridges, fraud proofs-that can be exploited. While they’re generally secure for small transactions, they’re not as robust as the base layer.

What’s the biggest security risk with Layer 2s?

The biggest risk is bridge exploits. Over 78% of all Layer 2 thefts in 2023 happened through bridges connecting Layer 1 and Layer 2. These bridges often have centralized control, weak audits, and single points of failure. Even if your rollup is secure, if the bridge is compromised, your funds are gone.

Should I use Optimistic Rollups or zk-Rollups?

It depends on what you need. Use Optimistic Rollups (like Arbitrum or Optimism) if you want maximum decentralization and lower costs for everyday use. But be aware of the 7-day withdrawal delay. Use zk-Rollups (like zkSync or StarkNet) if you need instant finality and higher security for larger amounts-but be cautious of complex proof systems and limited app support.

Can I lose money even if I’m not hacked?

Yes. You can lose money due to network outages, sequencer failures, or data availability issues. In July 2024, Arbitrum had a 14-hour outage where users couldn’t confirm transactions. No hack occurred-but $8,500 was still lost because the system didn’t recover properly. Layer 2s depend on operators. If they fail, your funds can be stuck.

How do I know if my wallet supports Layer 2 securely?

Check if your wallet clearly warns you about challenge periods, uses official bridges, and shows the correct network name (e.g., “Arbitrum One” not just “Ethereum”). Wallets like MetaMask, Argent, and Rabby are updated regularly and include proper L2 security prompts. Avoid wallets that don’t explain withdrawal delays or that auto-connect to unknown bridges.

Is it safe to use Layer 2 for long-term holdings?

It’s not recommended. Layer 2s are optimized for frequent, low-cost transactions-not for storing large amounts long-term. If you’re holding crypto, keep it on Layer 1 or in a hardware wallet. Use Layer 2s only for active trading, DeFi, or gaming. The risk of bridge exploits, sequencer failures, and protocol bugs makes them unsuitable for cold storage.

Man, I just switched to zkSync last week and wow 😍 The withdrawals are instant and I didn’t even think about the 7-day wait anymore. Still, I triple-checked the bridge before sending anything. Don’t trust no third-party portals, folks. MetaMask + official bridge = peace of mind. 🙌

so like… i used arbitrum for a tiny swap and totally forgot about the 7 day thing and panicked when my eth didnt show up for 2 days 😅 turns out it was fine but my heart was racing. why dont wallets just scream THIS IS NOT FINAL??

Of course the system is flawed. It’s always the same-tech bros think math solves everything. But when you outsource trust to a few coders in a room with a whiteboard, you’re not building security-you’re building a cult. And cults always collapse. The Fed is just the next bridge waiting to be hacked.

They’re lying. Every single one of these ‘improvements’ is a backdoor. Dencun? Proto-danksharding? That’s just the Fed buying time before they fully centralize L2s under their control. And don’t get me started on the ‘multi-party ceremony’-if one guy was compromised, the whole system’s rigged. They don’t want you to know this. But I do. And now you do too.

Hey everyone-just wanted to say if you're new to L2s, don’t panic. It’s okay to feel overwhelmed. Start small. Use MetaMask, stick to well-known rollups, and always read the warnings. I’ve helped three friends avoid bridge traps just by asking, ‘Do you know how your funds got there?’ You’re not alone in this. We’re all learning together 💛

Layer 2s are not a luxury they are a necessity. Ethereum gas fees were killing innovation and the masses. Yes bridges are risky but so is driving a car without seatbelts. The solution is not to stop driving but to wear the belt. Use official bridges audit them wait 6 months if needed. And for gods sake dont use some random dApp that says 'bridge to Arbitrum with 0 fees' 🙏

Wow. So you're telling me the same people who told us DeFi was 'decentralized' are now selling us 'zk-proofs' like it's holy water? LOL. The math is hard? So is spelling your own name right. And yet here we are. Every 'secure' L2 is just a fancy Ponzi with more jargon.

i used arbitrum for a week and lost 50 bucks because my tx never went through and no one cared. why is this even a thing? if the sequencer goes down why cant i just pull my money back? its like renting a car and the keys get lost and you cant get your deposit back. dumb.

Let’s not romanticize zk-Rollups. The 2,000 TPS claim ignores the computational cost per proof. The infrastructure is centralized by necessity. And the 'cryptographic finality' is only as strong as the trusted setup. That 34-person ceremony? That’s a single point of failure with a fancy name. This isn’t security-it’s theater.

Everyone’s acting like Layer 2s are the future. Newsflash: the future is already here and it’s called Bitcoin. No bridges. No sequencers. No 7-day waits. Just pure, uncompromised decentralization. You people are trading security for convenience like it’s a lifestyle choice. It’s not. It’s surrender.

ok so like… i used a bridge and now my eth is stuck?? is it gone forever?? i thought it was just like sending to another wallet?? why is this so confusing??

While the risks outlined are valid, it is important to recognize that Layer 2 solutions represent a necessary evolution in blockchain scalability. The industry is responding with increased decentralization, improved auditing standards, and academic research such as the Zero-Knowledge Bridge Proof. These are not minor fixes-they are foundational upgrades. Caution is prudent, but rejection is counterproductive.

i just started using L2s last month and i thought they were magic. now i know theyre just faster and cheaper but still kinda risky. i only use small amounts now. if i had more i would keep it on L1. thanks for the warning guys

Why are people still using Optimistic Rollups? The 7-day delay is a joke. If you’re not using zk-Rollups for anything over $100, you’re either naive or lazy. And don’t even get me started on bridges-those are just honeypots for bots. Stop being a sheep.

It’s funny how we treat blockchain like it’s a religion-some call it decentralized, others call it a trap. But the truth is, it’s neither. It’s a tool. And like any tool, it’s only as safe as the person holding it. The 7-day wait? It’s not a flaw-it’s a buffer. The bridge exploit? It’s not the tech-it’s the people who built it without accountability. We’re not fighting code. We’re fighting human greed wrapped in whitepapers. And until we address that, no proof system will save us.

Hey I just want to say I’ve been using Arbitrum for months and never had a problem. The bridge was fine, the wallet warned me, and my withdrawals came through. Maybe you guys just picked bad wallets or shady bridges? Don’t blame the tech-blame the user. And honestly, if you’re scared of 7 days, maybe crypto isn’t for you 😊

Guys I just want to say I’m so glad I found this thread! I’ve been using L2s for months but never knew about the bridge risks-I thought if it was on Ethereum it was safe 😅 Now I’m switching to Argent and only using official bridges. Also, I just learned about the 14-hour Arbitrum outage and I’m so glad I didn’t have big funds in there. Thank you for sharing this info-it literally saved me money 💕

so wait… if the sequencer goes down and my tx never confirms… is my money gone? or just stuck? like can i get it back? or is it like… forever lost? this is so confusing

Oh honey, you’re using L2s? How… quaint. 😏 I mean, if you’re not using StarkNet with recursive zk-proofs and a multi-sig bridge from a DAO audited by the MIT Crypto Lab, you’re basically playing with Monopoly money. Honestly, if you don’t understand zero-knowledge circuits, you shouldn’t even be touching a wallet. Just sayin’.