TradeOgre Shutdown: What Happened and What It Means for Crypto Traders

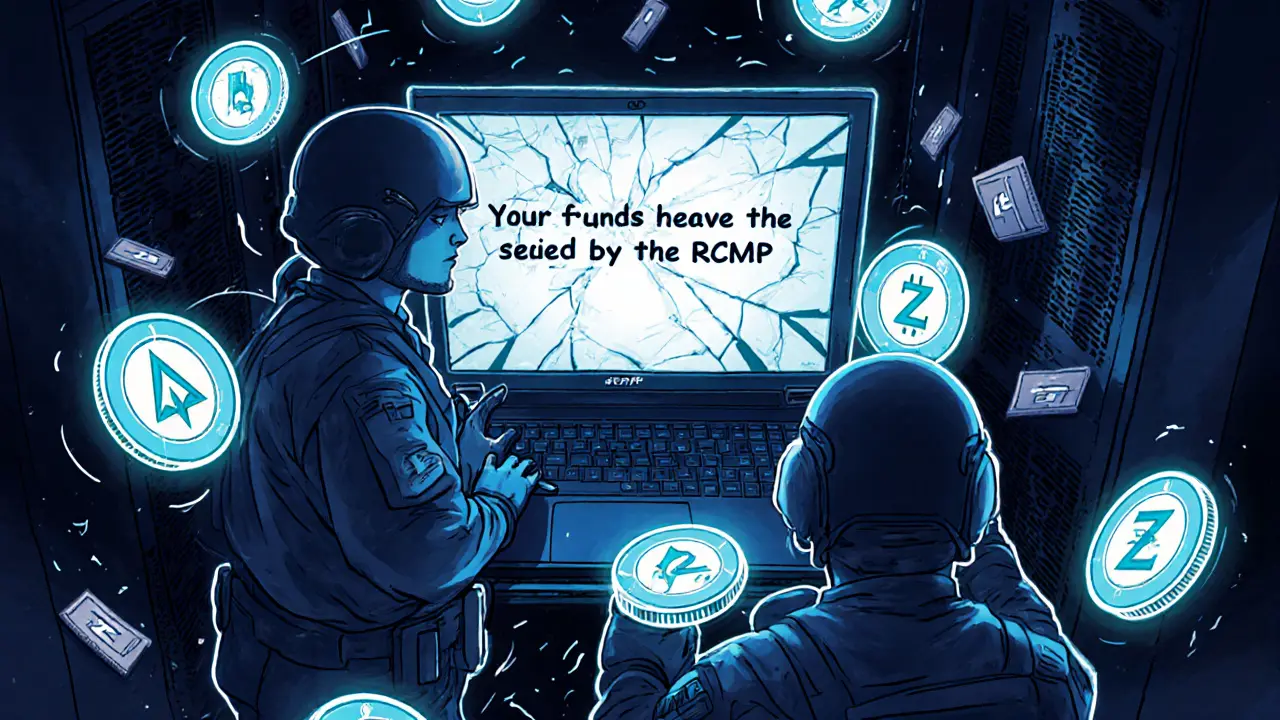

When TradeOgre, a long-running, no-KYC crypto exchange popular among privacy-focused traders suddenly went dark in early 2025, it wasn’t just another website going offline. It was the end of a trusted hub for thousands who relied on it to trade Bitcoin, Monero, and obscure altcoins without handing over personal documents. TradeOgre didn’t fail because of bad code or slow updates—it collapsed under pressure from regulators, rising operational costs, and the growing risk of being flagged as a haven for illicit activity. For users, it meant frozen balances, lost access, and no official refunds. This isn’t rare. In fact, decentralized exchange, a type of crypto platform that lets users trade directly without a central authority shutdowns are becoming more common as governments tighten oversight and payment processors cut ties.

TradeOgre’s story mirrors what happened to AlphaX, another no-KYC exchange that abruptly halted trading in late 2025, and even earlier cases like Coinfloor, the UK’s first auditable Bitcoin exchange that shut down after failing to scale. These platforms thrive on anonymity, but that same anonymity makes them targets. Banks refuse to process their funds. Payment gateways pull support. Legal threats pile up. And when the pressure hits, there’s often no safety net—no customer service line, no email reply, no public statement. Just silence. That’s why trading on unregulated exchanges isn’t just risky—it’s like playing Russian roulette with your crypto. You might win big, but if the platform vanishes, your assets vanish with it.

What’s left for traders who want privacy? Some turn to peer-to-peer networks like LocalMonero or use privacy-focused wallets with built-in swap features. Others accept KYC on regulated platforms like VirgoCX or COEXSTAR just to avoid the risk of losing everything overnight. The truth is, the era of completely anonymous, no-questions-asked exchanges is ending. The ones still standing are either adapting to compliance or quietly preparing to disappear. The posts below dig into real cases of failed exchanges, how to spot red flags before you deposit, and what to do if your favorite platform goes offline. You’ll find breakdowns of exchanges that vanished, scams disguised as trading sites, and practical tips to protect your funds—even if you still prefer to stay off the radar.