TradeOgre wasn’t just another crypto exchange. For seven years, it was one of the last holdouts in a world that was rapidly turning away from anonymity. If you wanted to trade Monero, Pirate Chain, or Dero without handing over your ID, TradeOgre was one of the few places left that let you do it. No passport. No selfie. No questions asked. Just an email and a wallet address. That’s why people stuck with it - even when the interface looked like it was built in 2012 and the order book for some coins would vanish overnight.

How TradeOgre Worked (Before It Disappeared)

TradeOgre operated as a crypto-to-crypto exchange only. That meant you couldn’t deposit USD, EUR, or any fiat money. You had to already own Bitcoin, Litecoin, or one of the 120+ altcoins it supported, then trade them for something else. No bank links. No credit cards. No on-ramps. That kept things simple - but also limited who could use it.

Trading fees were flat: 0.2% per trade. That was average for the time. But where TradeOgre stood out was withdrawal fees. For Bitcoin, you paid just 0.00005 BTC per withdrawal. Most other exchanges charged 5 to 10 times that. If you were moving large amounts of BTC, that saved real money. For privacy coins like Monero, withdrawal fees were even lower - sometimes fractions of a cent. That made it a favorite for XMR traders who needed to move coins quickly and cheaply.

The platform had an API. Not a polished one, but it worked. Developers could pull market data, place orders, and check balances using simple HTTP requests and JSON. There was no official documentation, so the community built it. GitHub had a repo called tradeogre-api-docs with over 1,200 stars before the site went dark. People relied on it.

The Privacy Coin Advantage

TradeOgre didn’t try to compete with Binance or Coinbase. It didn’t have futures, staking, or NFTs. It focused on one thing: privacy coins. Monero (XMR) was its crown jewel. At its peak, TradeOgre handled 15-20 BTC worth of XMR trades every day. Other no-KYC exchanges had dropped below 5 BTC. That made TradeOgre the go-to spot for people who cared about untraceable transactions.

Why? Because Monero’s privacy features don’t play well with regulators. Exchanges that listed XMR were already under scrutiny. TradeOgre didn’t care. It didn’t ask for your name, address, or phone number. That made it a magnet for users in countries where crypto was restricted - places like Nigeria, Venezuela, Iran, and parts of Eastern Europe. SimilarWeb data showed over 60% of its traffic came from those regions.

It wasn’t perfect. The interface was clunky. The charts were basic. But if you just needed to swap XMR for BTC without jumping through hoops, TradeOgre worked. And that’s why, despite everything, people kept using it.

The Downside: Liquidity, Delays, and Broken Orders

But here’s the catch: TradeOgre’s low volume outside of privacy coins was a nightmare.

Users on Slashdot reported that Kaspa - a newer privacy-focused coin - had zero buyers. You could put up a sell order at any price. The system would say “no buyers.” But if you checked the order book, you’d see TradeOgre’s own bots were quietly buying at 10% below your price. You couldn’t sell. Not even at a loss. That’s not just bad UX - that’s manipulation.

Withdrawals weren’t instant. They took 12 to 24 hours on average. Sometimes longer. And if you asked for help? Email support took 3 to 4 days to reply. No live chat. No phone. No Twitter DMs that got answered. You were on your own.

Trustpilot reviews painted a grim picture. Out of 87 reviews before shutdown, 63% were negative. The top complaints? “Liquidity disappeared overnight” and “I couldn’t withdraw my coins.” Only 22% gave positive feedback - and most of them just said, “No KYC was worth it.”

That’s the trade-off: total anonymity, or reliable access to your money. TradeOgre chose anonymity. And for many, that wasn’t worth the risk.

Why TradeOgre Shut Down - The Million Seizure

On July 30, 2025, TradeOgre vanished. Its website went offline. Its Twitter account went silent. And Canadian authorities announced they had seized $40 million in cryptocurrency assets.

This wasn’t a hack. It wasn’t a scam by the founders. It was a regulatory takedown. Canada’s Financial Transactions and Reports Analysis Centre (FINTRAC) acted after years of pressure from the Financial Action Task Force (FATF). The FATF had been pushing global regulators to enforce the Travel Rule - which requires exchanges to collect and share sender/receiver data for transactions over $1,000. TradeOgre didn’t collect any of that data. Ever.

It was the first time a full crypto exchange was shut down by a Western government for non-compliance. The Canadian government called it their “biggest crypto bust.” Bloomberg and CoinDesk covered it. The message was clear: no-KYC exchanges were no longer tolerated.

By mid-2025, only about 12 no-KYC centralized exchanges were still operating in the U.S. TradeOgre was one of them. Now, there are none.

What TradeOgre’s Shutdown Means for Crypto Users

TradeOgre’s end wasn’t just the death of one exchange. It was the end of an era.

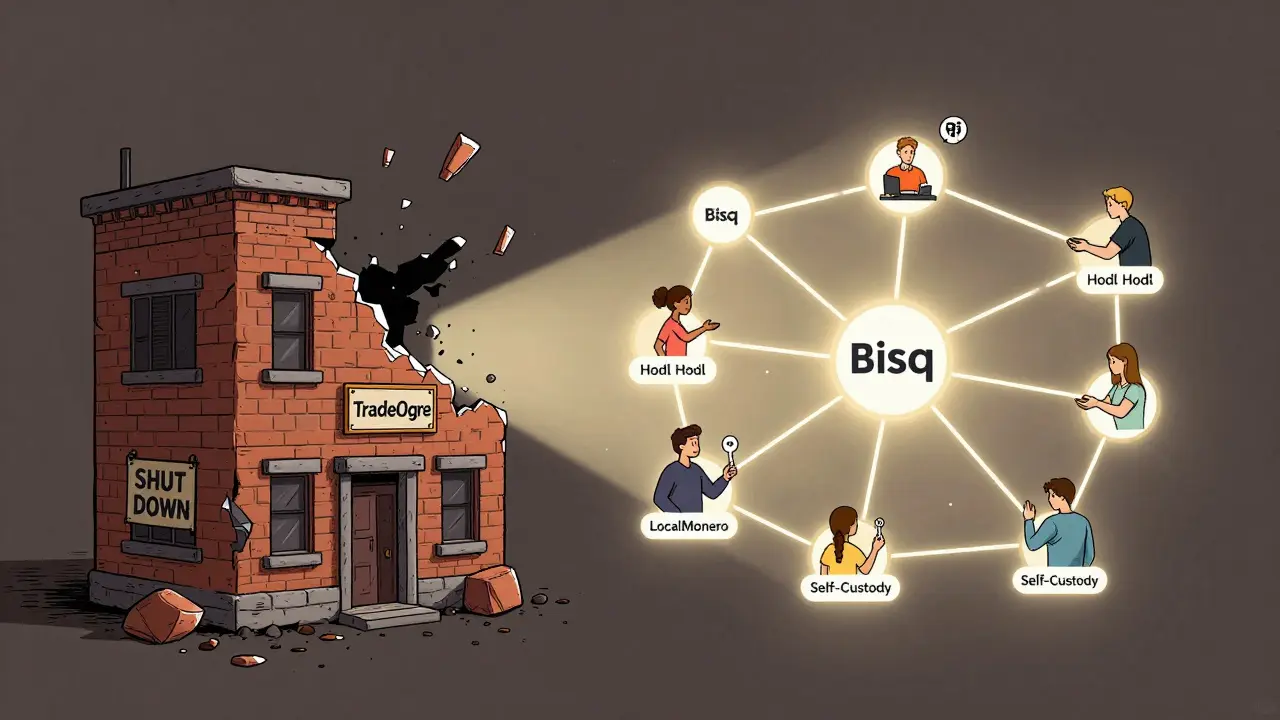

Before 2021, there were over 50 no-KYC centralized exchanges. By late 2025, almost all of them either added KYC or disappeared. The ones that survived - like Bisq or Hodl Hodl - are decentralized. They’re peer-to-peer. No central server. No company to seize.

TradeOgre was centralized. That made it easy to shut down. It also made it easy to use. But now, that model is dead.

For privacy-focused users, the future lies in self-custody wallets and decentralized swaps. You can still trade Monero without KYC - but now you have to manage your own security. No one will hold your keys. No one will fix your mistakes. And if you send coins to the wrong address? Too bad.

TradeOgre gave you convenience. But it also gave you a false sense of safety. You thought you were anonymous. But the exchange itself was a single point of failure - and regulators knew it.

Alternatives to TradeOgre (And Why They’re Different)

If you’re looking for something like TradeOgre, you won’t find it. But here’s what’s left:

- Bisq - Decentralized, peer-to-peer. No server to shut down. Requires Bitcoin to trade. Steeper learning curve.

- Hodl Hodl - P2P marketplace. You trade directly with others. No KYC. But slower, and you’re exposed to counterparty risk.

- LocalMonero - Focused only on Monero. P2P. No KYC. Good for XMR traders who want privacy.

- Kraken or Bitfinex - If you can handle KYC, these have deep liquidity and strong security. But you give up anonymity.

None of these are TradeOgre. None offer the same mix of simplicity and no-KYC. But they’re the only options left.

Final Verdict: Was TradeOgre Worth It?

TradeOgre was a relic. A stubborn, clunky, sometimes broken relic - but one that served a real need.

If you were a privacy advocate who didn’t trust banks or governments, and you were okay with slow withdrawals and sketchy order books - then yes, it was worth it. For Monero traders, it was the last reliable no-KYC option.

But if you wanted reliability, fast support, or to trade anything other than privacy coins? No. You’d have been better off with a regulated exchange - even if you had to upload your ID.

Its shutdown wasn’t a surprise. It was inevitable. The world was moving toward compliance. TradeOgre refused to move. And when regulators came knocking, there was no defense.

Now, the lesson is clear: if you want privacy in crypto, you have to control your own keys. No exchange can protect you from the law - not even the ones that say they don’t ask questions.

Is TradeOgre still operational?

No. TradeOgre shut down permanently on July 30, 2025, after Canadian authorities seized approximately $40 million in cryptocurrency assets. The website is offline, and its social media accounts are inactive.

Why did TradeOgre shut down?

TradeOgre was shut down by Canadian regulators for failing to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. It operated without collecting user identities, which violated the Financial Action Task Force’s Travel Rule. This led to Canada’s first-ever full exchange seizure.

Did TradeOgre support fiat currencies like USD or EUR?

No. TradeOgre only allowed crypto-to-crypto trading. You couldn’t deposit or withdraw dollars, euros, or any fiat money. You had to already own cryptocurrency to use the platform.

What were TradeOgre’s trading and withdrawal fees?

TradeOgre charged a flat 0.2% fee on every trade. Withdrawal fees varied by cryptocurrency. For Bitcoin, the fee was 0.00005 BTC - much lower than most exchanges, which typically charge 0.0005-0.001 BTC. Privacy coins like Monero had even lower fees.

Was TradeOgre safe to use?

It was risky. While it offered no-KYC privacy, users reported liquidity issues, delayed withdrawals, and suspected order manipulation - especially with lesser-known coins like Kaspa. The platform had no customer support and minimal documentation. Its shutdown confirmed that centralized no-KYC exchanges are vulnerable to regulatory action.

What are the best alternatives to TradeOgre today?

There are no direct replacements. For no-KYC trading, your best options are decentralized platforms like Bisq, Hodl Hodl, or LocalMonero. These are peer-to-peer, so no central authority can shut them down - but you’re responsible for your own security. If you need liquidity and reliability, regulated exchanges like Kraken or Bitfinex are safer, though they require KYC.

Can I still trade Monero without KYC?

Yes, but not through centralized exchanges. You can trade Monero peer-to-peer using platforms like LocalMonero or Bisq. You can also use privacy-focused wallets and decentralized swaps. However, you’ll need to manage your own security - there’s no customer service or recovery option if you make a mistake.