Rollups Ethereum: How Layer 2 Solutions Are Changing Crypto Speed and Cost

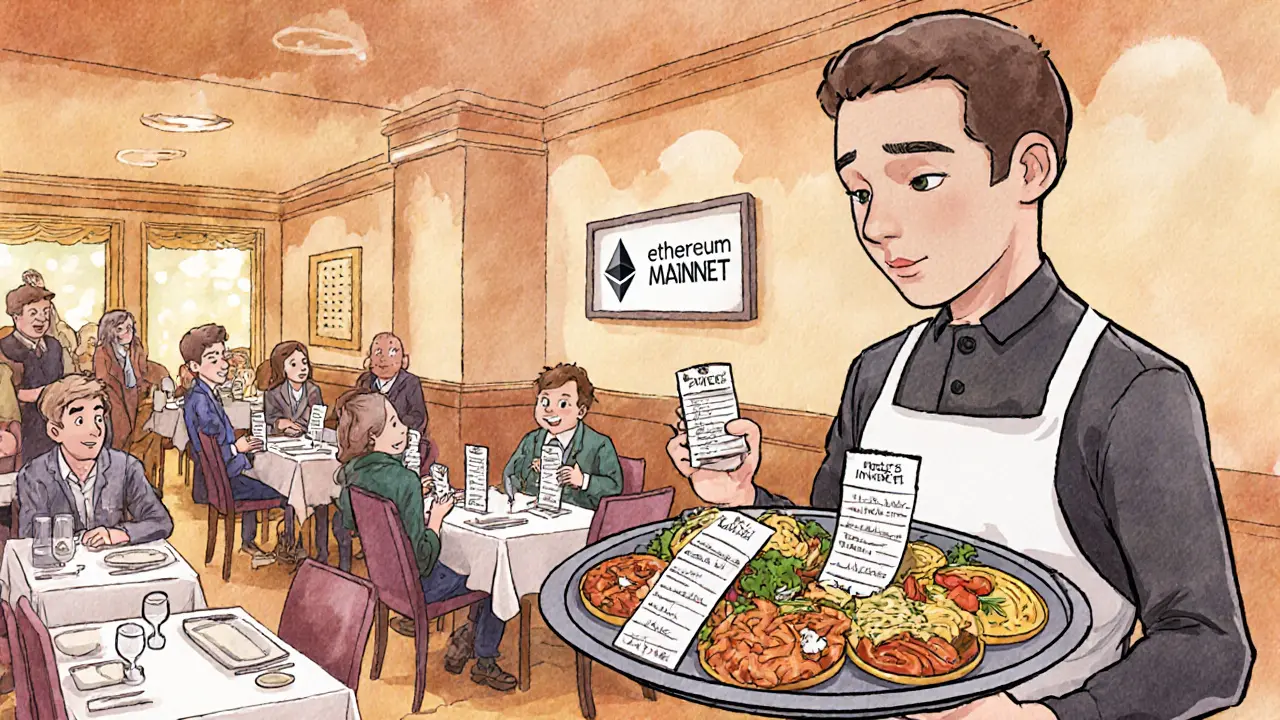

When you send a transaction on Ethereum, a decentralized blockchain network that runs smart contracts and powers most decentralized apps. Also known as Ethereum mainnet, it's the backbone of DeFi, NFTs, and Web3—but it's slow and expensive when traffic spikes. That’s where rollups, a type of Layer 2 scaling solution that processes transactions off-chain but posts proof back to Ethereum for security. Also known as Ethereum layer 2, they’re the reason you can now swap tokens for pennies instead of dollars. Rollups don’t replace Ethereum. They work alongside it, handling the heavy lifting so the main chain stays secure and doesn’t get overwhelmed.

There are two main types: zkRollups, use cryptographic proofs to verify batches of transactions quickly and securely. Also known as zero-knowledge rollups, they’re faster and cheaper for complex operations like swaps and lending. And Optimistic Rollups, assume transactions are valid unless someone challenges them within a dispute window. Also known as fraud-proof rollups, they’re more flexible for smart contracts but take longer to finalize. Both cut Ethereum gas fees by 90% or more. Projects like Arbitrum, zkSync, and Polygon zkEVM are built on these, and they’re why you can now trade meme coins, stake stablecoins, or play on-chain games without breaking the bank.

But rollups aren’t magic. They still rely on Ethereum for security, so if Ethereum goes down, rollups do too. And not all are equal—some have longer withdrawal times, limited token support, or complex user interfaces. That’s why you’ll find reviews here of niche DEXs like DerpDEX on zkSync or LFJ v2.2 on Arbitrum. These aren’t just tools—they’re real-world tests of how well rollups deliver on speed, cost, and usability. You’ll also see how they connect to airdrops, tokenomics, and even crypto taxation, because once you’re transacting on Layer 2, your tax trail changes too. This collection doesn’t just explain rollups. It shows you who’s using them, what’s working, and where the traps are hiding.