FTM Cryptocurrency: What It Is, How It Works, and Where It Stands in 2025

When you hear FTM cryptocurrency, the native token of the Fantom blockchain, designed for high-speed, low-cost transactions and DeFi applications. Also known as Fantom token, it’s not just another crypto coin—it’s the fuel behind a blockchain built to fix the slow, expensive problems of older networks like Ethereum. Unlike chains that struggle with congestion, Fantom uses a unique consensus called Lachesis, which lets transactions confirm in under two seconds and costs pennies. That’s why developers and users who hate gas fees and long waits are turning to it.

FTM isn’t just a payment token—it’s the backbone of a whole ecosystem. DeFi on Fantom, a growing collection of lending, trading, and yield platforms built on the Fantom network includes popular apps like SpookySwap and Beefy Finance. These platforms let you earn interest, swap tokens, and stake FTM without waiting hours for a transaction. And because Fantom is EVM-compatible, you can use MetaMask and other wallets you already know—no learning curve. Meanwhile, Fantom blockchain, a scalable, secure, and energy-efficient layer-1 network that supports smart contracts is being used by real businesses, not just speculative traders. From gaming to remittances, projects are choosing it because it works at scale without burning through cash.

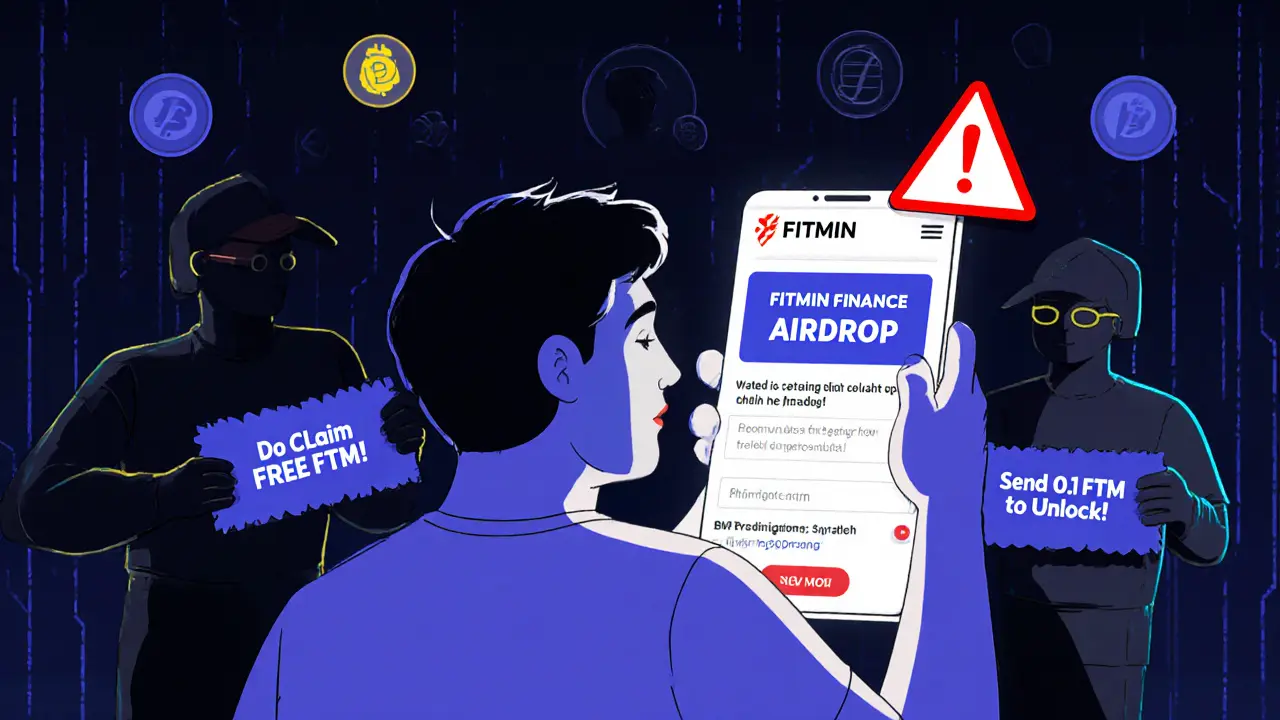

But FTM isn’t without risks. Some DeFi projects on Fantom have collapsed, and like any crypto, its price swings hard. Still, the network keeps growing: more developers, more liquidity, more real usage. If you’re tired of paying $10 to swap a token or waiting 15 minutes for a transfer, FTM offers a real alternative. You’ll find posts here that break down how to buy FTM safely, which wallets work best, how staking rewards actually work, and which projects on Fantom are still alive in 2025—not just hype. Whether you’re new to DeFi or just looking for faster options, the guides below give you the facts, not the fluff.