Fitmin Finance Token: What It Is, How It Works, and Why It Matters

When you hear Fitmin Finance token, a cryptocurrency designed to support a decentralized finance platform with yield-focused mechanics. Also known as FITMIN, it’s one of hundreds of obscure tokens that pop up in DeFi spaces—promising rewards, but rarely delivering lasting value. Unlike major coins like Bitcoin or Ethereum, this token doesn’t have a well-known team, public roadmap, or exchange listings on top platforms. It exists in the shadows of smaller DEXs, often tied to low-liquidity pools and community-driven campaigns that fade quickly.

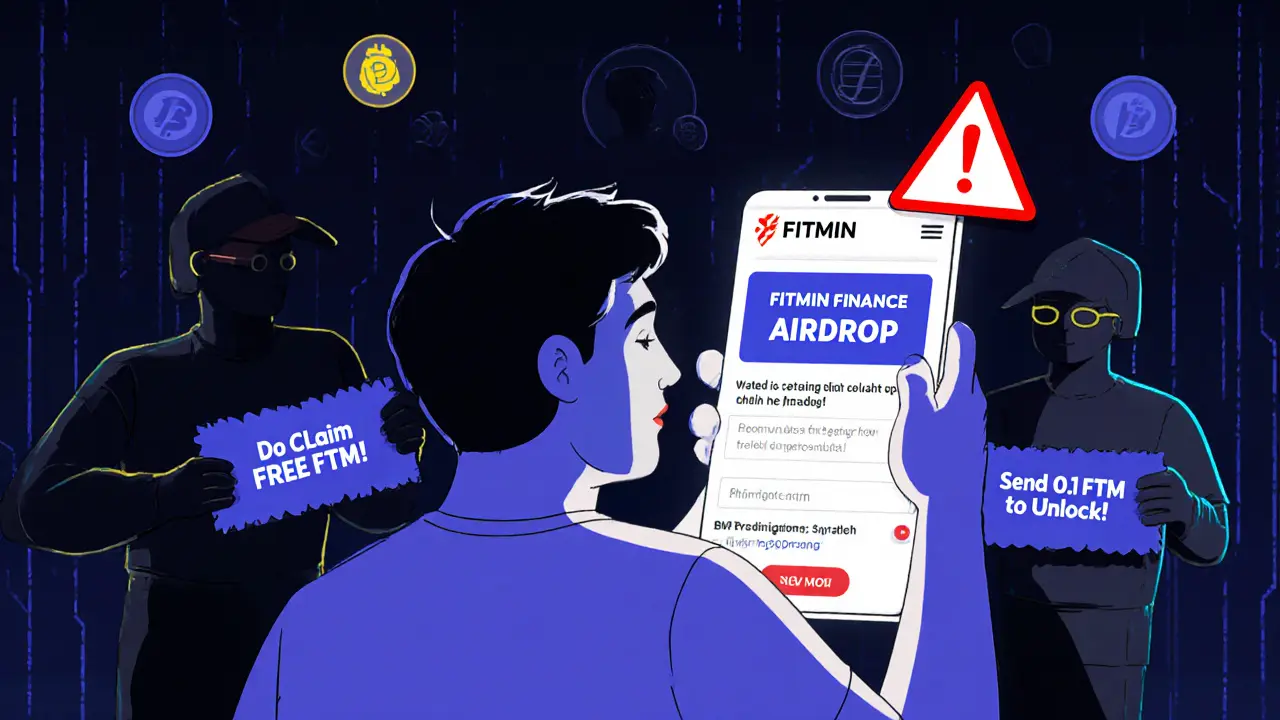

What makes a token like this worth paying attention to? Not the hype. Not the Discord influencers. It’s whether the underlying DeFi protocol, a blockchain-based system that automates financial services without banks has real utility. Most tokens in this space—like MIMO, the nearly dead governance token for the PAR stablecoin, or POP Network Token, a token with 99.5% value loss and no active development—fail because they offer no real use case. Fitmin Finance token follows the same pattern: no clear product, no transparent team, and no verifiable track record. If it’s not solving a problem people actually have, it’s just a speculative gamble dressed up as innovation.

Here’s what you’ll find in the posts below: real breakdowns of tokens like Fitmin Finance that look promising on paper but collapse under scrutiny. You’ll see how MCASH, a privacy-focused token earned through anonymous cross-chain swaps actually works versus fake airdrops claiming to give it away. You’ll learn why HPY, a utility token for enterprise crypto wallets has real business use, while Fitmin doesn’t. And you’ll get straight answers on what to avoid—because in crypto, the biggest risk isn’t price drops. It’s wasting time on projects that vanish overnight.

There’s no magic formula to spot winners, but there’s a clear pattern to avoid losers. The posts here cut through the noise. No fluff. No promises of riches. Just what’s real, what’s dead, and what you should walk away from—starting with tokens like Fitmin Finance that look like opportunities but are built on sand.