Ethereum: The Backbone of DeFi, Smart Contracts, and Crypto Innovation

When you think about Ethereum, a decentralized blockchain platform that runs smart contracts and powers thousands of apps. Also known as ETH, it’s not just another cryptocurrency—it’s the operating system for most of Web3. While Bitcoin is digital gold, Ethereum is digital infrastructure. It’s where DeFi protocols like Uniswap and Aave live, where NFTs like CryptoPunks get minted, and where airdrops like the Maiar EarnDrop or SHARDS token distribution happen. Without Ethereum, most of the crypto projects you’ve heard about wouldn’t exist.

Ethereum isn’t just a network—it’s an ecosystem. It smart contracts, self-executing code that runs automatically when conditions are met enable trustless transactions. You don’t need a bank to send money—you need a contract on Ethereum. It DeFi, a financial system built on open blockchains without middlemen lets you lend, borrow, or trade without a brokerage. And it’s the reason why platforms like Camelot V3 and Marswap exist—they’re built on Ethereum or its sidechains because that’s where the users and liquidity are. Even when projects like EvmoSwap or SheepDex try to copy its model, they fail because they can’t replicate the network effect Ethereum built over a decade.

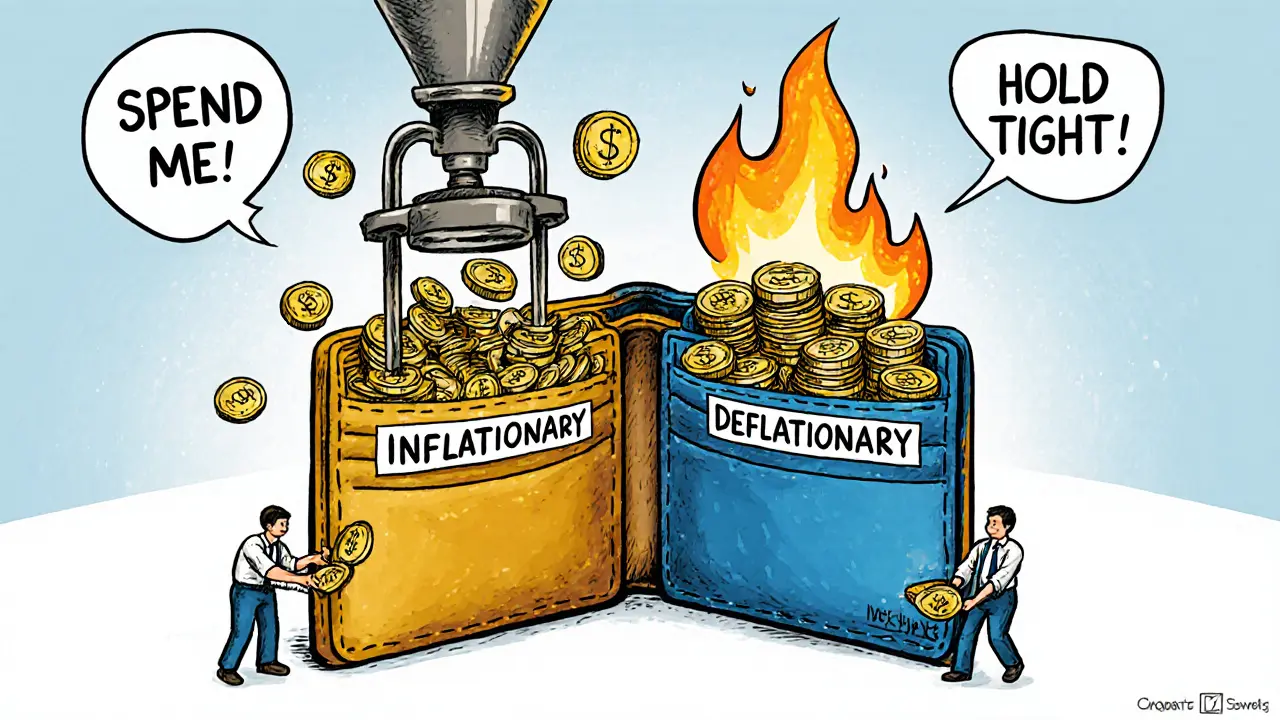

But Ethereum isn’t perfect. It’s been expensive, slow, and energy-heavy in the past—until the Merge in 2022 changed everything. Now it’s 99.95% more energy efficient, and layer-2 solutions like Arbitrum and Optimism make transactions cheap and fast. That’s why you see so many posts here about Arbitrum DEXes, Solana-based scams trying to piggyback on Ethereum’s reputation, and airdrops tied to Ethereum-based tokens. The real action isn’t on isolated chains—it’s where the code runs, where developers build, and where users keep their assets. That’s Ethereum.

You’ll find posts here that cut through the noise: what ETH really does behind the scenes, how gas fees work, why so many airdrops require an Ethereum wallet, and why fake tokens like BTC2.0 or CHEEPEPE still try to ride its coattails. This isn’t about hype. It’s about understanding what makes Ethereum the foundation—and how to use it without getting burned.