Optimistic Rollups: What They Are and Why They Matter for Ethereum Scaling

When you hear Optimistic Rollups, a type of Layer 2 scaling solution for blockchains that processes transactions off-chain but posts summaries back to Ethereum for security. Also known as optimistic L2s, they’re one of the most practical ways to make Ethereum faster without breaking its security promises. Think of them like a private office where a team handles hundreds of transactions in silence, then sends one clean report back to the main office—no need to check every single detail unless something looks wrong. That’s the core idea: assume everything is fine until proven otherwise. It’s not magic—it’s math, cryptography, and smart design.

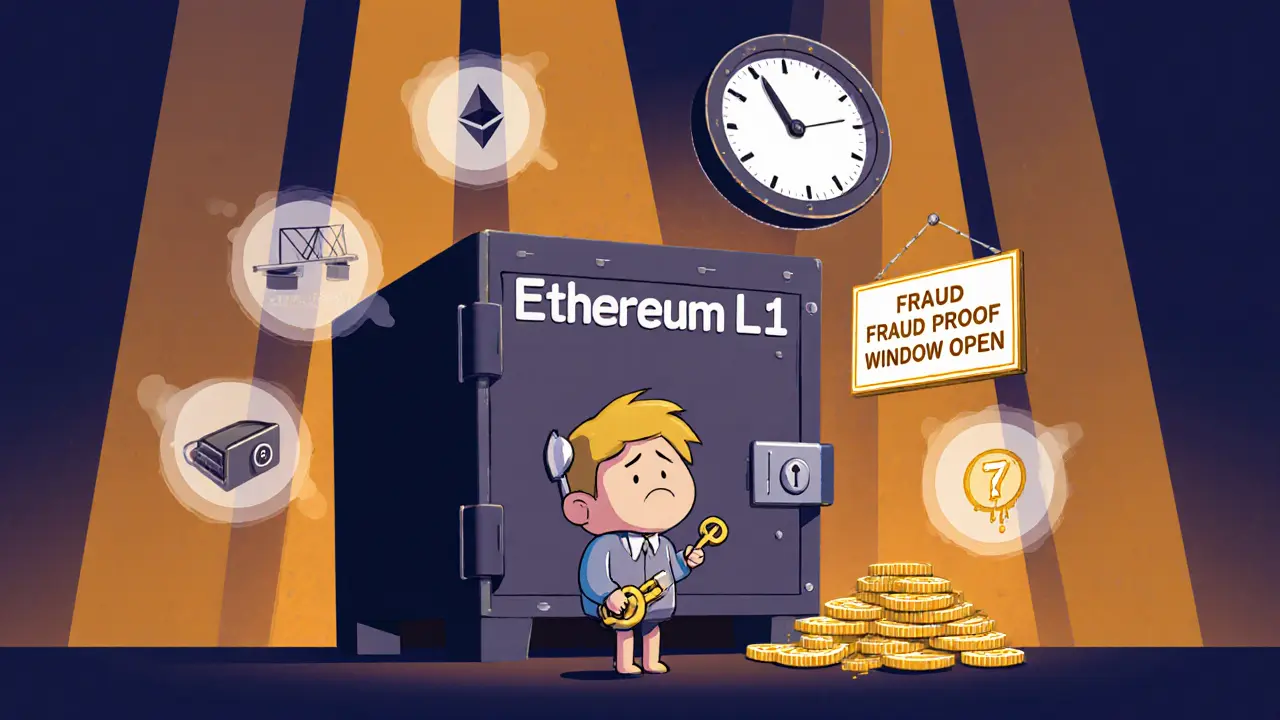

They work because of fraud proofs, a mechanism that lets anyone challenge a bad transaction within a set time window. If someone tries to cheat by submitting fake data, another user can prove it’s wrong using a cryptographic proof. The system then rolls back the bad state and punishes the cheater. This keeps the network honest without needing every node to verify every transaction. That’s why transaction throughput, the number of transactions a system can handle per second jumps from 15-30 on Ethereum mainnet to thousands on Optimistic Rollups. And fees? They drop by 90% or more. That’s not a small improvement—it’s the difference between paying $20 to send crypto and paying 20 cents.

They’re not perfect. The withdrawal period can take up to a week if you need to move funds back to Ethereum, because the system waits to make sure no one files a fraud proof. That’s a trade-off for lower costs and higher speed. But for everyday use—swapping tokens, playing games, sending payments—it’s more than enough. That’s why projects like Optimism and Arbitrum are now handling billions in daily volume. They’re not just theory anymore—they’re running real apps, real users, real money.

You’ll find posts here that dig into what makes these systems tick, how they compare to other scaling methods, and why some crypto projects choose them over others. You’ll also see how they connect to real-world use cases: from DeFi apps that need low fees to gaming platforms that demand fast confirmations. Some posts even warn you about scams pretending to be Optimistic Rollup-based tokens. This isn’t hype—it’s the infrastructure quietly powering the next wave of crypto adoption. What you’re about to read isn’t just about technology. It’s about what’s possible when you fix Ethereum’s biggest flaw.