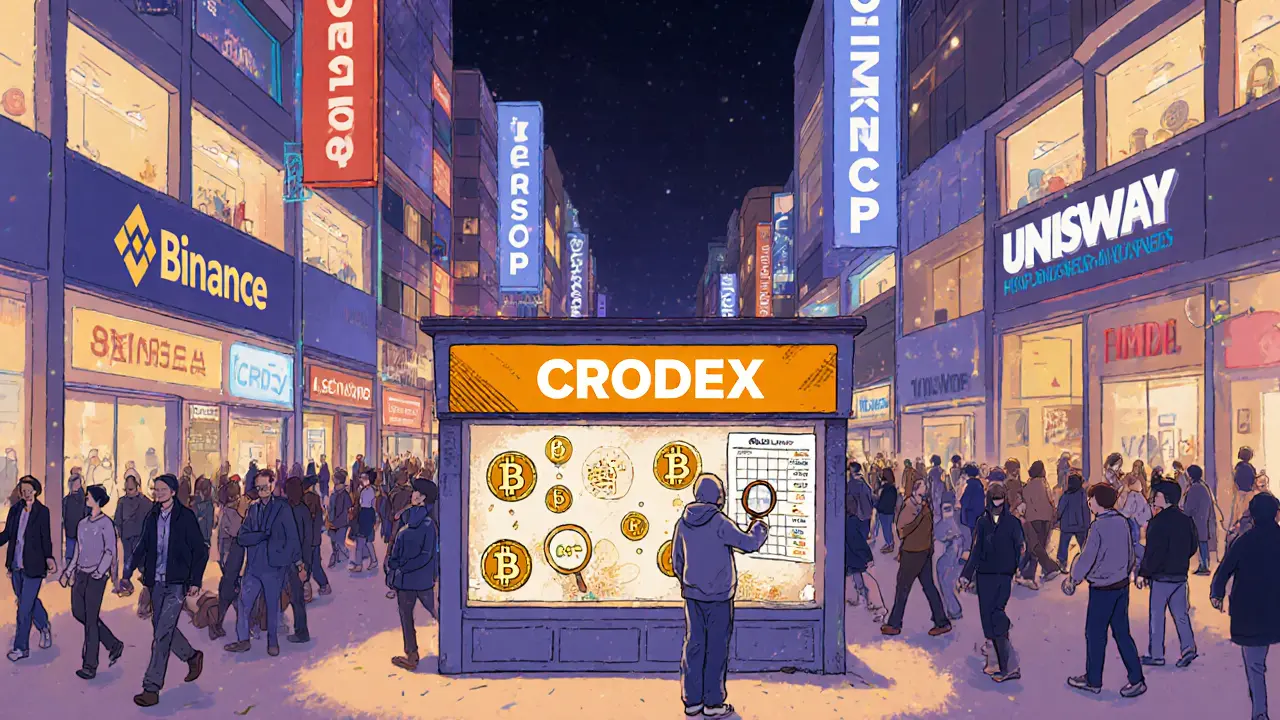

CRODEX Exchange: What It Is, Why It Matters, and What You Need to Know

When you hear CRODEX exchange, a decentralized trading platform built around the Cronos blockchain and its native CRO token. It's not a giant like Binance, but it's a focused tool for users already in the Cronos ecosystem. Unlike centralized exchanges that hold your keys, CRODEX lets you trade directly from your wallet—no sign-ups, no KYC, just smart contracts doing the work. This makes it fast, but also risky if you’re not careful.

CRODEX exchange is part of a bigger picture: the Cronos network, which tries to bridge Ethereum’s DeFi tools with faster, cheaper transactions. It’s not just a DEX—it’s one piece of a chain designed for gaming, NFTs, and everyday crypto use. Related to this are CRO token, the native coin powering fees, staking, and governance on Cronos, and decentralized exchange, a peer-to-peer trading system without intermediaries. These aren’t just buzzwords—they’re the backbone of what CRODEX actually does. If you’re trading stablecoins, swapping CRO for other Cronos-based tokens, or trying to avoid high Ethereum gas fees, CRODEX might be worth a look. But if you’re chasing big altcoins or need customer support, you’ll hit walls fast.

What you won’t find here is the safety net of a regulated platform like BICC Exchange or the deep liquidity of Fraxswap. CRODEX is for users who know what they’re doing—people who check contract addresses, understand slippage, and don’t panic when a trade takes 12 seconds. It’s not for beginners. It’s not for casual traders. But for those already in the Cronos world, it’s one of the few tools that actually works without middlemen. The posts below dig into real user experiences, hidden risks, and how CRODEX stacks up against other niche platforms like ShadowSwap and DerpDEX. You’ll see what’s working, what’s broken, and whether this exchange is just another dead end—or a quiet gem in a crowded space.