CORE Token: What It Is, How It Works, and Where It’s Used

When you hear CORE token, the native cryptocurrency of the Core blockchain, a Bitcoin-secured network designed for smart contracts and DeFi. It’s not just another altcoin—it’s a bridge between Bitcoin’s security and Ethereum’s functionality. Unlike tokens built on top of Ethereum or Solana, CORE runs on its own chain that anchors to Bitcoin’s ledger, giving it unique stability and trust. This means the network inherits Bitcoin’s resistance to censorship and attacks, while still letting developers build dApps, lend, swap, and stake like they would on Ethereum.

The Core blockchain, a Layer 1 network that uses Bitcoin’s consensus to validate its own transactions is what makes CORE different. It’s not a sidechain or a wrapped solution—it’s a standalone chain that syncs with Bitcoin every 10 minutes. This lets users lock BTC into the network and use it directly in DeFi apps without needing WBTC or other intermediaries. The Core ecosystem, a growing collection of DeFi protocols, NFT marketplaces, and gaming apps built natively on the Core chain includes tools like DEXs, lending platforms, and yield aggregators—all running on real Bitcoin-backed security. You’ll find projects here that are trying to solve the same problems as Ethereum, but without the high fees or network congestion.

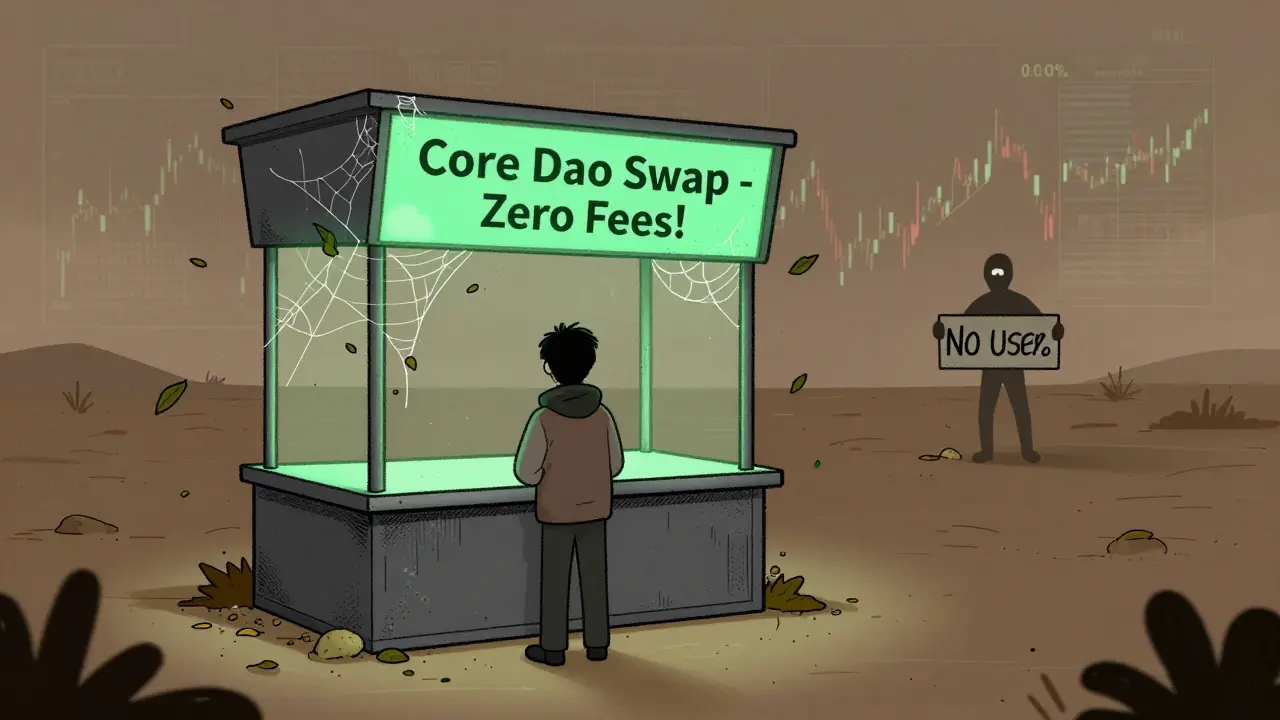

Why does this matter? Because if you believe Bitcoin should do more than just store value, CORE gives you a real path forward. It’s not hype—it’s code running on a live, growing network with active developers and real users. The token isn’t just for trading; it’s used for gas fees, staking rewards, and governance votes. And unlike many chains that rely on centralized validators, Core uses a decentralized set of nodes anchored to Bitcoin’s mining power. That’s why you see projects like ShadowSwap and other niche DEXs popping up here—they’re betting on a chain that doesn’t compromise on security for speed.

What you’ll find in the posts below are real, verified deep dives into how CORE fits into the bigger crypto picture. Some posts explain how it compares to other Bitcoin-linked chains. Others break down the DEXs built on it, or warn you about fake airdrops pretending to be tied to CORE. There are no fluff pieces here—just facts about what’s working, what’s risky, and what’s actually happening on the network right now. Whether you’re holding CORE, considering staking it, or just trying to understand why it’s getting attention, the articles below will show you what’s real and what’s noise.