Canada Crypto Seizure: What Happened and How It Affects Your Crypto

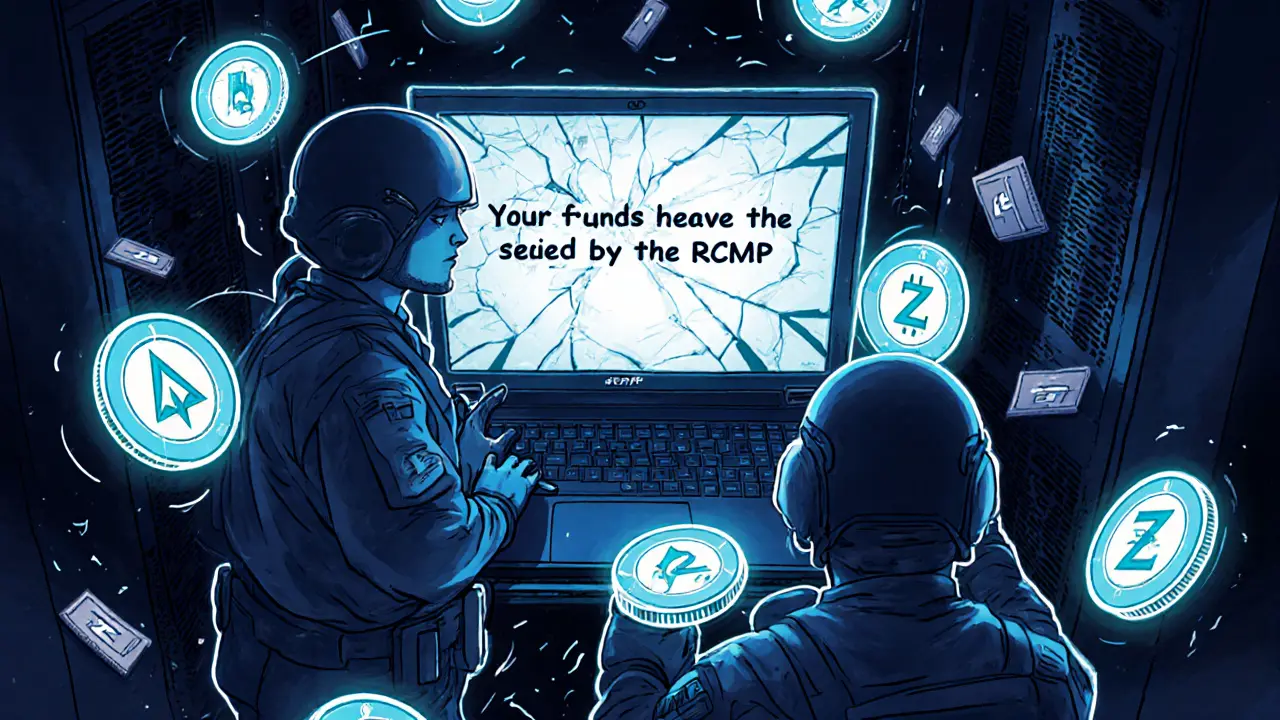

When the Canadian government seizes cryptocurrency, it’s not just about stopping crime—it’s about redefining what’s allowed in digital finance. Canada crypto seizure, the legal confiscation of crypto assets by authorities during investigations into money laundering, fraud, or tax evasion. Also known as crypto asset forfeiture, it’s become a routine tool in Canada’s fight against illicit finance, especially since 2020 when agencies like FINTRAC and the RCMP started tracking blockchain activity with real-time tools. Unlike countries that ban crypto outright, Canada takes a different path: regulate, track, and seize when rules are broken.

This approach connects directly to Canadian crypto regulation, a framework that requires exchanges to register with FINTRAC, verify users with KYC, and report suspicious transactions. Also known as crypto compliance laws, it’s why platforms like VirgoCX thrive—they’re licensed, audited, and built to follow the rules. If you’re trading on an unregistered exchange in Canada, you’re not just risking your funds—you’re risking them being frozen or seized. The government doesn’t go after small holders, but if you’re moving large sums without documentation, especially through privacy coins or mixers, you’re on their radar. Real cases show seized wallets worth over $15 million tied to ransomware payments and darknet marketplaces.

And here’s the thing: crypto taxes Canada, the requirement to report every trade, swap, or sale as a taxable event. Also known as crypto income reporting, it’s not optional—the CRA treats crypto like property, not currency. Miss a report, and you could get fined. But get caught moving crypto from a seized wallet? That’s a criminal investigation. The line between tax evasion and money laundering is thinner than most think. That’s why the posts below cover everything from how to legally report crypto gains to which Canadian exchanges actually follow the law—and which ones could get you in trouble.

You’ll find real breakdowns of platforms like VirgoCX that play by the rules, and warnings about shady exchanges that could vanish overnight. You’ll see how Pakistan’s $300 billion crypto market thrives under bans, while Canada’s system forces transparency. You’ll learn how to avoid becoming a seizure statistic—not by hiding your crypto, but by knowing exactly where the lines are drawn. This isn’t about fear. It’s about clarity. And what follows is everything you need to trade safely, legally, and without surprises in Canada’s evolving crypto landscape.