Blockchain & Crypto: What Actually Matters for Your Holdings

When you hear Blockchain, a public digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively. Also known as distributed ledger technology, it's the backbone of everything from Bitcoin to NFTs. Most people think it’s just about money. But it’s really about trust—no banks, no middlemen, just code enforcing rules. And that changes everything about how value moves.

Crypto, digital assets built on blockchain networks that use cryptography for security and control the creation of new units. Also known as cryptocurrencies, it’s not one thing—it’s dozens of different systems with different goals. Some, like Bitcoin, are designed to get rarer over time. Others, like Dogecoin, keep printing more. This isn’t just technical detail—it’s the difference between holding an asset that could grow in value, and one meant to be spent right away. That’s where tokenomics, the economic design behind a cryptocurrency, including supply, distribution, and incentives comes in. It tells you if a coin is built to be saved, used, or traded. And if you don’t get tokenomics, you’re guessing instead of deciding.

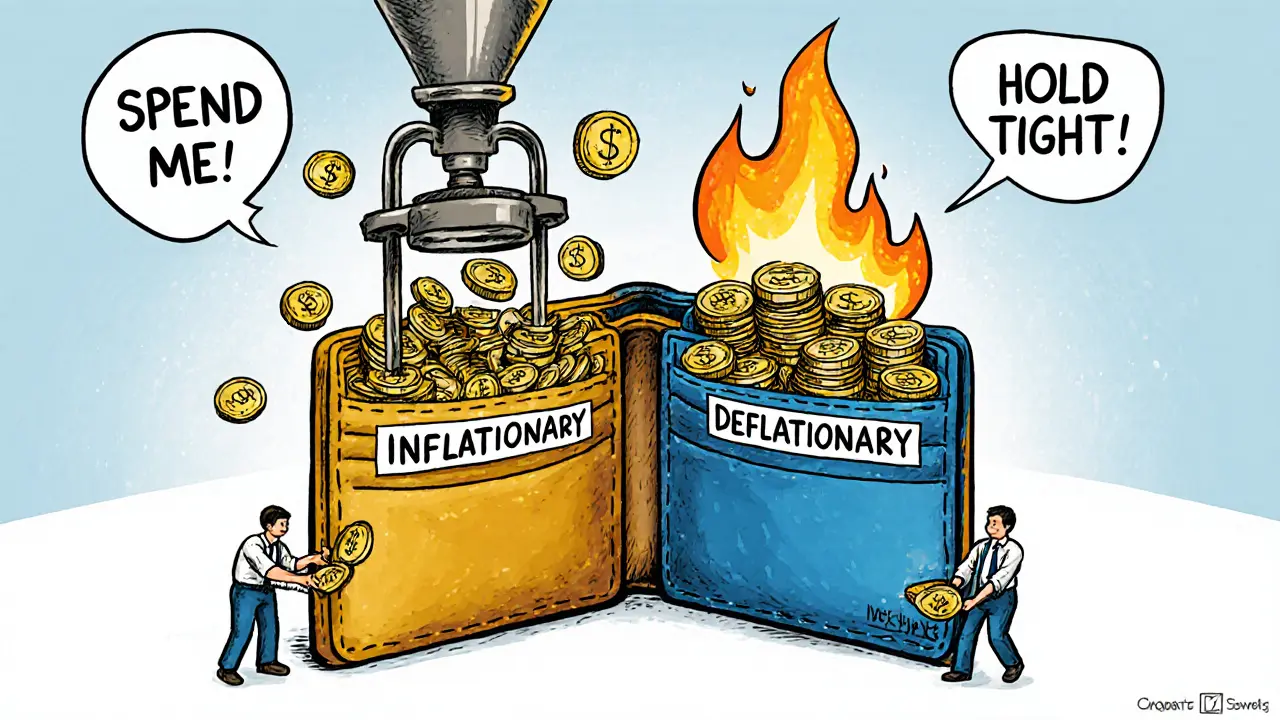

Take deflationary tokens, cryptocurrencies with a capped or decreasing supply, making them scarcer over time. Bitcoin’s limit is 21 million. That’s not a suggestion—it’s coded into the system. Every time someone loses a wallet or forgets a password, the total supply shrinks a little. That’s why people treat it like digital gold. On the other side, inflationary tokens, cryptocurrencies with an increasing or unlimited supply, designed to encourage spending and network growth like Dogecoin or Shiba Inu, keep making more coins. Their value doesn’t come from scarcity—it comes from how many people use them right now. One isn’t better. It just serves a different purpose.

You don’t need to know every blockchain project out there. But you do need to know why some tokens rise while others fade. It’s not hype. It’s supply, demand, and the rules built into the code. The posts below break down real examples—not theory. You’ll see how Bitcoin’s fixed supply compares to Ethereum’s shifting model. You’ll learn what makes an airdrop worth your time, and why some exchanges are safer than others. No fluff. No buzzwords. Just what you need to spot the real opportunities and avoid the traps.