Uniswap v3: What It Is, How It Works, and Why It Matters for DeFi Traders

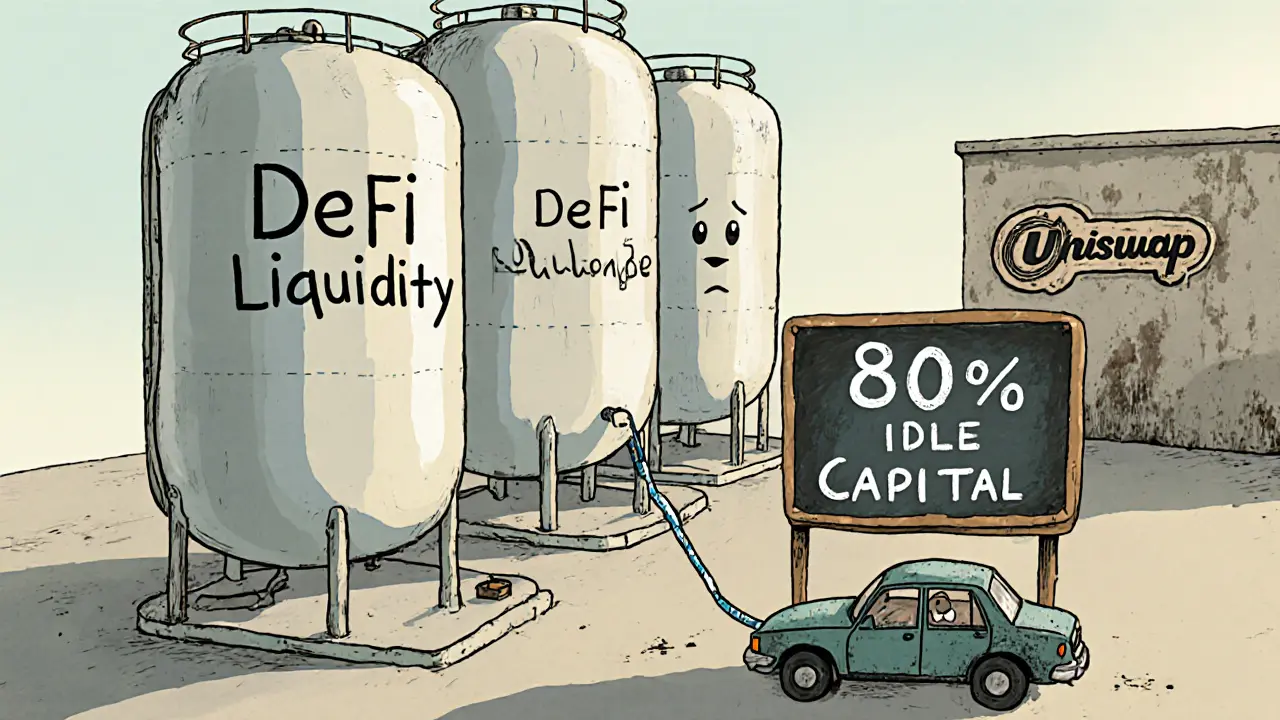

When you trade crypto on a decentralized exchange, you’re likely using Uniswap v3, the third-generation automated market maker that lets users trade tokens without intermediaries by using smart contracts on Ethereum. Also known as Uniswap Protocol v3, it’s the most efficient DEX ever built — and it changed how liquidity providers earn fees. Unlike earlier versions that spread liquidity across all price ranges, Uniswap v3 lets you pin your funds exactly where you think the price will move. This is called concentrated liquidity, a feature that lets liquidity providers focus their capital within custom price ranges to earn more fees per dollar invested. It’s like turning your crypto into a precision tool instead of a shotgun.

Uniswap v3 runs on Ethereum, the blockchain that powers most major DeFi apps and smart contracts. But it doesn’t just work for ETH and stablecoins — it supports thousands of tokens, from big names like LINK and AAVE to obscure memecoins. The magic is in how it handles trades. Instead of relying on a simple average price like Uniswap v2, it uses AMM, an automated market maker system that calculates prices based on the ratio of tokens in a liquidity pool. The result? Lower slippage, tighter spreads, and higher returns for those who know how to position their liquidity.

But here’s the catch: Uniswap v3 isn’t for beginners. Setting up concentrated liquidity requires understanding price ranges, volatility, and fee tiers (0.01%, 0.05%, 0.3%, and 1%). If you put your funds too wide, you’ll earn less than on v2. Too narrow, and you risk getting pulled out of the range during a price swing. That’s why most users stick with aggregators like Jupiter or 1inch — they handle the complexity behind the scenes. Still, if you’re serious about DeFi, knowing how Uniswap v3 works means you can spot better opportunities, avoid bad liquidity positions, and even build your own tools on top of it.

Behind the scenes, Uniswap v3 introduced fee tiers, a system that lets liquidity providers choose how much risk they take — lower fees for stable pairs like USDC/ETH, higher fees for volatile tokens. It also made it possible to create non-fungible liquidity positions — each one is unique, tracked on-chain as an NFT. That’s why you’ll see people talking about "LP NFTs" in DeFi forums. It’s not just trading anymore — it’s managing positions like assets.

And it’s not just Ethereum. Uniswap v3’s architecture inspired clones on Arbitrum, Optimism, Polygon, and even Solana. Camelot V3 on Arbitrum? That’s a direct descendant. Lifinity on Solana? It borrowed the concentrated liquidity idea. This isn’t just an upgrade — it’s a new standard. The posts below dive into real examples: how traders used Uniswap v3 to earn more than staking, how scams mimic its interface, and why some DEXs fail to copy its success. You’ll see what works, what doesn’t, and how to avoid losing money while trying to keep up.