There’s no shortage of crypto exchanges promising low fees, fast trades, and easy sign-ups. But when you search for BitTok, you hit a wall. No official website. No verified social media. No reviews on CoinMarketCap, CoinGecko, or Trustpilot beyond a handful of scattered posts. And that’s not just inconvenient-it’s a red flag.

If you’re thinking of depositing money into BitTok, stop. Right now. Here’s why.

BitTok Doesn’t Show Up Anywhere Legit

Every major crypto exchange in 2025 has a public footprint. Binance, Coinbase, Kraken, Crypto.com-they’re all listed on industry rankings, covered by financial news outlets, and debated on Reddit and Twitter. Their trading volumes are public. Their security audits are published. Their customer support teams answer questions in real time.

BitTok? Nothing. Not a single mention on CoinGecko’s exchange rankings. Not a verified page on Trustpilot. No regulatory license listed anywhere. Even the name is ambiguous. One obscure site, Bitok.me, has a 3.8/5 rating from 15 users-but there’s no proof it’s the same company. No domain ownership records. No contact info. No legal address. That’s not a startup. That’s a ghost.

Scam Patterns Match Perfectly

The California Department of Financial Protection and Innovation tracks crypto scams every month. Their most common pattern? A platform that looks real-clean design, professional logo, smooth app interface-and lets you withdraw small amounts to build trust. Then, when you deposit more, withdrawals freeze. Customer support vanishes. The website disappears.

That’s exactly what BitTok does-or would do, if you tried to use it. No one can verify its ownership. No one can confirm its security. No one can prove it holds user funds in cold storage. And if it can’t prove it’s real, it’s not real.

What Legit Exchanges Do That BitTok Doesn’t

Here’s what you should expect from any crypto exchange worth your money:

- Regulatory compliance: Coinbase is licensed in 50+ U.S. states. Kraken is registered with FinCEN. Crypto.com holds licenses in Europe, Asia, and North America.

- Transparency: All top exchanges publish monthly proof-of-reserves reports. BitTok? No reports. No audits. No public data.

- Security: Binance uses multi-sig wallets, cold storage for 90% of assets, and has a $1 billion SAFU fund. BitTok? Zero public info on security.

- Support: Gemini has 24/7 live chat. Kraken answers support tickets within hours. BitTok? No contact email, no phone, no chat.

- Trading volume: Top exchanges process billions daily. BitTok? No data. No liquidity. No trades you can verify.

BitTok checks none of these boxes. And that’s not negligence-it’s a warning sign.

Why People Fall for BitTok

It’s not because BitTok is clever. It’s because people are desperate.

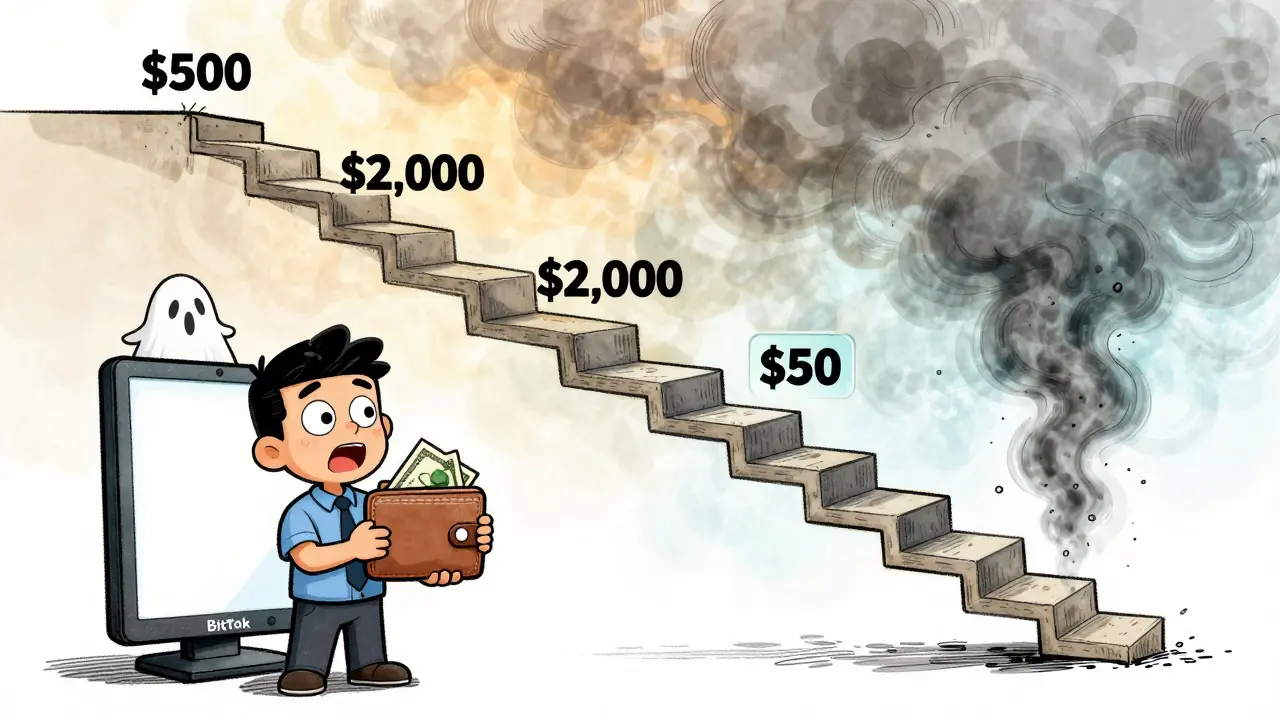

After years of high fees on Coinbase and slow withdrawals on Binance, traders look for alternatives. They see a site that says “0.1% fees” and “instant deposits.” They click. They deposit $50. They get it out. They think, “This is amazing!” Then they deposit $500. Then $2,000. And then-nothing. The withdrawal button disappears. The chatbot stops replying. The website goes dark.

This isn’t speculation. This is the exact script used by dozens of fake exchanges shut down by regulators in 2024 and 2025. BitTok fits the pattern perfectly.

What to Use Instead

If you’re looking for a safe, reliable exchange in 2025, here are your real options:

- Crypto.com: Best overall. 350+ coins, zero fees on crypto-to-crypto trades, insurance on holdings, top-rated mobile app.

- Kraken: Best for advanced traders. 350+ coins, fees as low as 0.16%, transparent security audits, strong privacy controls.

- Coinbase: Best for beginners. Simple interface, FDIC-insured USD balances, 235+ cryptocurrencies, regulated in the U.S. and EU.

- Binance US: Best for low fees. 158 coins, 0.1% maker fees, high liquidity, but limited to U.S. users.

- Gemini: Best for security. FDIC-insured USD, cold storage, licensed in New York, trusted by institutions.

All of these have public records, verified customer support, and years of user feedback. None of them vanish after you deposit money.

How to Spot a Crypto Scam Before It’s Too Late

Here’s your quick checklist before you deposit a dime:

- Search the exchange name + “scam” on Google. If you see more than 2-3 negative results, walk away.

- Check Trustpilot, Reddit, and CryptoCompare. Legit exchanges have hundreds of reviews. Scams have 5-10 vague ones.

- Look for a physical address and company registration number. If it’s a P.O. box or “offshore,” that’s a red flag.

- Try to contact support. Send a test question. If they don’t reply in 24 hours, it’s not real.

- Search the exchange on CoinGecko or CoinMarketCap. If it’s not listed, it’s not trusted by the industry.

BitTok fails every single one.

Final Verdict: Don’t Even Click

There’s no middle ground here. BitTok isn’t “new and underrated.” It’s not “a hidden gem.” It’s a classic crypto scam waiting for its next victim.

Every dollar you put in is a dollar you’ll likely never see again. Even if it works for a week, the pattern is clear: small wins, big losses. That’s how these things work.

If you want to trade crypto safely, use one of the major platforms. They’re not perfect-but they’re transparent, regulated, and accountable. BitTok? It’s invisible. And in crypto, invisible means dangerous.

Is BitTok a real crypto exchange?

No, BitTok is not a verified or legitimate crypto exchange. It doesn’t appear on any major industry platforms like CoinGecko, CoinMarketCap, or Trustpilot. There are no public regulatory licenses, security audits, or verified contact details. The limited mentions online point to a likely scam or unregistered platform.

Can I withdraw my funds from BitTok?

There is no reliable evidence that BitTok allows consistent withdrawals. Scam exchanges often let users withdraw small amounts at first to build trust. Once larger deposits are made, withdrawals are blocked, customer support disappears, and the platform shuts down. If you’ve deposited funds, assume they are at high risk.

Is BitTok the same as Bitok.me?

There is no confirmed link between BitTok and Bitok.me. Bitok.me has a few reviews on Trustpilot, but no official connection to BitTok has been proven. Even if they were related, Bitok.me has only 15 reviews and lacks the transparency of regulated exchanges. Do not assume they are the same.

Why don’t major crypto sites list BitTok?

Major platforms like CoinGecko and CoinMarketCap only list exchanges that meet strict criteria: verified ownership, public trading volume, regulatory compliance, and user feedback. BitTok meets none of these. Its absence is not an oversight-it’s a signal.

What should I do if I already deposited money into BitTok?

Stop using the platform immediately. Do not deposit more. Try to withdraw any remaining balance, but expect delays or failure. Report the platform to your local financial regulator and to the FBI’s IC3 (Internet Crime Complaint Center). Unfortunately, recovering funds from unregulated exchanges is extremely rare.

Are there any safe alternatives to BitTok?

Yes. Crypto.com, Kraken, Coinbase, Binance US, and Gemini are all regulated, audited, and trusted by millions. They offer transparent fees, strong security, and reliable customer support. Stick with these platforms-avoid anything with no public track record.

BitTok? Bro, I saw that site last week and thought it was a phishing clone until I checked CoinGecko-zero listings. Even the domain was registered under a privacy shield. If you’re seeing ‘0.1% fees’ and no KYC, RUN. I lost $300 to a clone like this in 2023. No second chances.

The absence of regulatory footprint isn't just a red flag-it's a full systemic failure of accountability. In decentralized finance, transparency isn't optional; it's the foundational contract between user and platform. BitTok operates in a vacuum of trust, which is mathematically incompatible with any legitimate financial instrument.

Bro I tried BitTok yesterday just to test it-deposited $20, got it out in 12 mins. Thought I hit the jackpot. Then I put in $500 and the app crashed. Now I’m stuck. Why do these scams always look so legit? 😭

This is all part of the globalist crypto takeover. The Fed and the IMF are pushing these fake exchanges to kill cash. They want you to put your money where they control it. BitTok? Probably owned by the same people who run the deep state blockchain projects. Don’t fall for it.

While the emotional tone of this post is understandably urgent, the structural analysis is methodologically sound. The absence of verifiable regulatory compliance, public audit trails, and institutional recognition constitutes a prima facie case of operational illegitimacy. One cannot reasonably expect trust in an entity that refuses to be observed.

I used to think ‘new exchange’ meant ‘hidden gem’-until I got ghosted after depositing $800. Now I only use ones with a Wikipedia page. BitTok doesn’t even have a LinkedIn. If you can’t find their CEO’s name, it’s not a company. It’s a front.

BitTok? More like BitFak. The whole thing smells like a 3am Fiverr gig where someone bought a template, slapped on a neon logo, and called it ‘Web3 revolution.’ The only thing being traded here is hope-and it’s all fake currency.

Y’all need to stop scrolling and start checking. I’m a blockchain auditor-I’ve reviewed 87 exchanges this year. BitTok? Zero on-chain activity. No wallet traces. No liquidity pools. No API endpoints. It’s a static HTML page with a fake WebSocket simulator. If you’re thinking of depositing, I’m begging you: don’t. 🚨💸

Why do Americans keep falling for these? In China, crypto exchanges are regulated. In Europe, they’re audited. Here? We let anyone with a domain name and a Canva account become a ‘financial institution.’ BitTok is the logical endpoint of deregulation. And we’re all complicit.

There’s a quiet horror in how easily people are lured by the illusion of access. The promise of speed, low fees, simplicity-it’s not greed. It’s exhaustion. We’re tired of slow systems, overpriced platforms, bureaucratic nonsense. And so we reach for the mirage. BitTok doesn’t exploit greed. It exploits despair.

Big shoutout to the OP-this is exactly the kind of deep-dive post we need more of. I’ve been helping new traders for years and I tell everyone: if you can’t find a Reddit thread with 500+ comments about it, it’s not real. BitTok? Crickets. Stick with the big names. They’ve got skin in the game.

BitTok: where your crypto goes to take a nap… forever. 😴💰 I mean, seriously-0.1% fees? That’s like saying your toaster has ‘quantum heating.’ If it sounds too good to be true, it’s probably a phishing link wrapped in a Shopify theme.

Don’t deposit. Don’t click. Don’t even hover. This isn’t a warning-it’s a mandate. Your money is not a suggestion.

Let me be clear: this isn’t about trust. It’s about infrastructure. Legitimate exchanges are built on layers of accountability-legal, technical, financial. BitTok is a single-layered illusion. One click, and the whole thing evaporates. This isn’t a scam. It’s a digital ghost town.

Think about it: why does a platform that claims to be the future of finance refuse to exist in the present? No domain history. No IP records. No social proof. It’s not a business-it’s a temporal anomaly. Like a thought that never had a brain. BitTok doesn’t operate in time. It operates in the liminal space between hope and ruin. And we’re all just passing through.

While I appreciate the thorough breakdown, I’d urge everyone to consider that not all unlisted platforms are scams. Some are simply too small to meet listing criteria. That said, BitTok’s complete lack of transparency, combined with its aggressive marketing tactics, makes it an outlier. Proceed with extreme caution-preferably not at all.

i tried bitok too… sent 50 usdt… got out… then sent 200… gone. no reply. sad.

Verified. I checked the WHOIS for bitok.me. Registered via Namecheap privacy. No business license. No contact. Same pattern as 12 other scams I’ve reported to IC3. Don’t engage. Report. Move on.