Concentrated Liquidity Range Calculator

Optimal Price Range Calculator

Based on article guidance: "Set your range 1.5x wider than the max daily swing"

Optimal Price Range

Capital Efficiency Estimate

Risk Assessment

Learn more

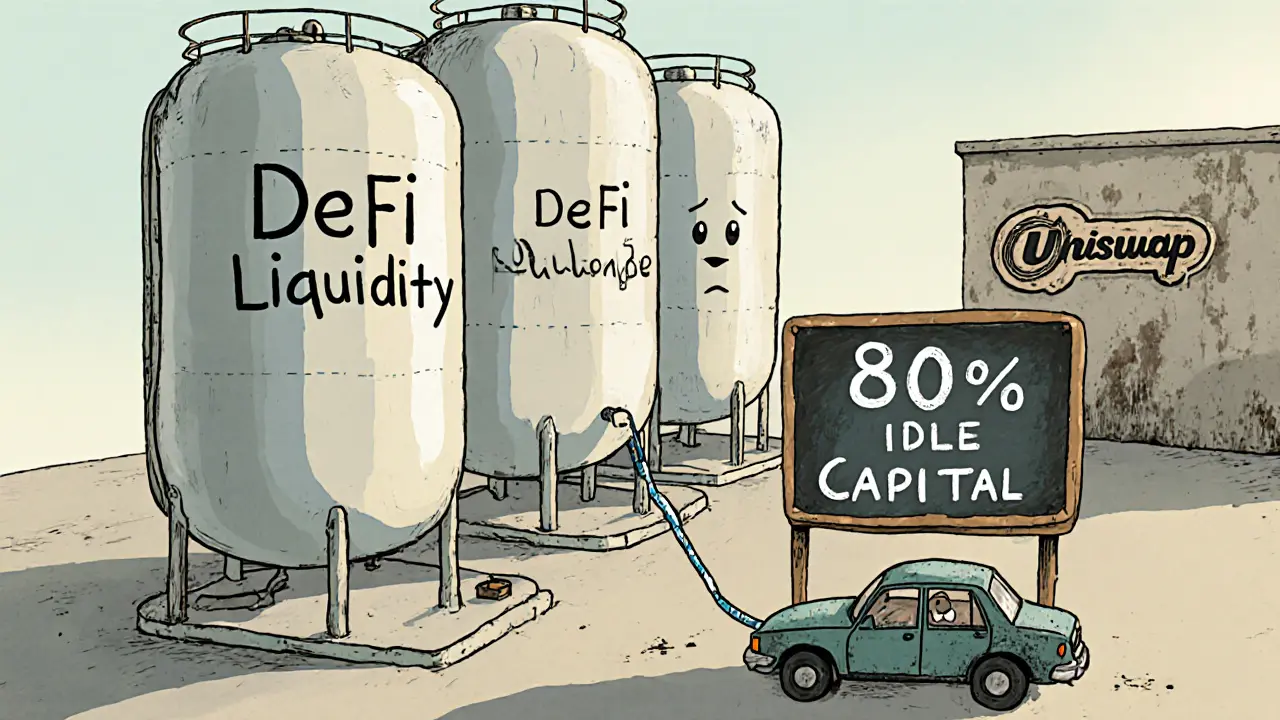

Why Most DeFi Liquidity Is Sitting Idle

Imagine you own a gas station. You keep 10,000 gallons of fuel on hand, but only 2,000 gallons get sold every day. The other 8,000 gallons just sit there, collecting dust. That’s what most decentralized exchanges looked like before 2021. Liquidity providers deposited millions of dollars into pools, but most of it never got used. According to Timlrx’s 2022 research, around 80% of capital in early AMMs like Uniswap v2 was inactive. That’s not just inefficient-it’s expensive. For every $1 million in daily trading volume, you needed $10 million in locked-up capital just to keep prices stable. That’s why DeFi felt slow, expensive, and inaccessible.

How Uniswap v3 Changed Everything

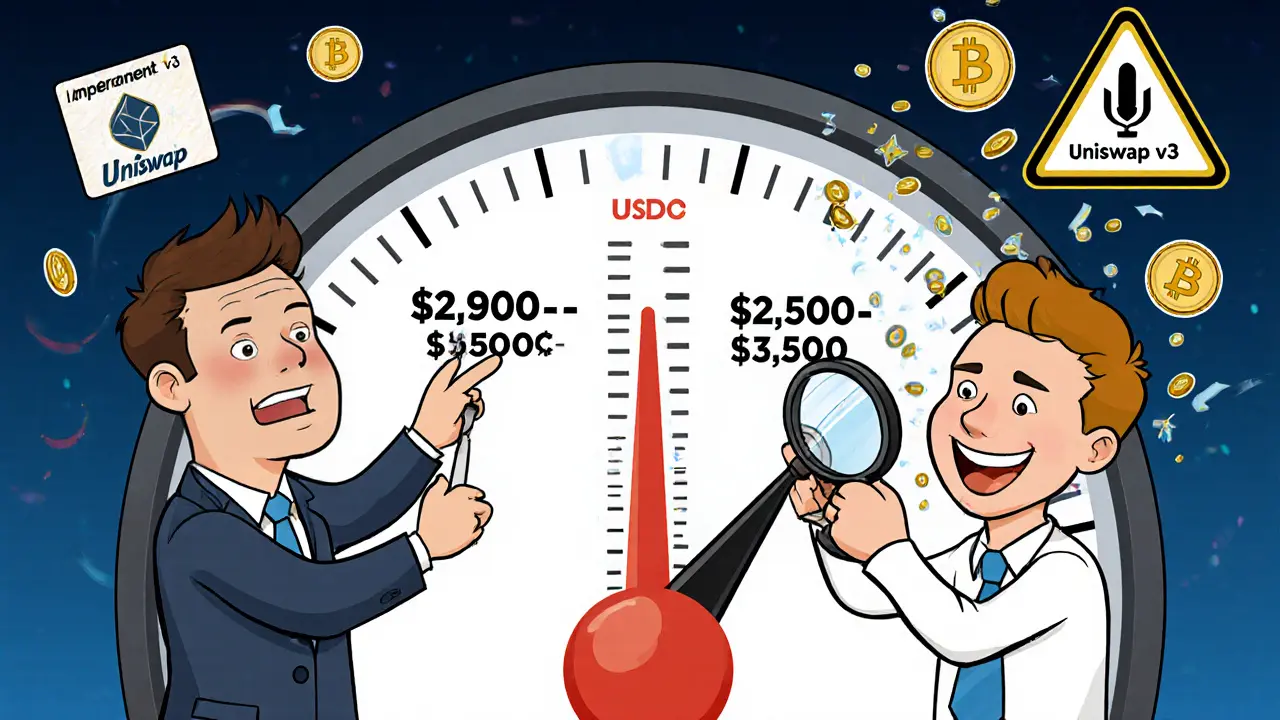

In May 2021, Uniswap v3 launched with a radical idea: let liquidity providers choose where their money works. Instead of spreading funds evenly across every possible price (like v2 did), you could now lock your ETH/USDC liquidity between, say, $2,800 and $3,200. If the price stays in that range, every trade generates fees-directly for you. If it moves outside, your capital stops earning. This is called concentrated liquidity. The result? Capital efficiency jumped from under 20% to 60-85%. You could now earn 4 to 10 times more fees per dollar deployed. A $5,000 position in v3 could outperform a $50,000 position in v2-if managed well.

But It’s Not That Simple

Here’s the catch: if you pick the wrong price range, your liquidity becomes useless. If ETH drops to $2,500 and you only set your range between $2,900 and $3,100, you’re out of the market. You’re not earning fees. You’re just holding tokens that might be losing value. And if the price swings fast-like during a market crash-you can get stuck with an inactive position for days. Gauntlet Network found that 68% of Uniswap v3 positions are poorly managed. Many users lose money not because the protocol is broken, but because they don’t know how to set ranges or rebalance. One Reddit user lost $287 in two weeks by setting a range too narrow. Another earned $147 in one month by tracking volatility and adjusting every 5 days. The difference? Knowledge.

Other Protocols That Do It Better

Uniswap v3 wasn’t the only answer. Curve Finance built its whole model around stablecoins, using a special formula that keeps prices ultra-stable within tiny ranges. For USDC/DAI or USDT/USDC pools, it hits 90%+ efficiency because stablecoins rarely move more than 1%. But if you try to use Curve for ETH/BTC, it fails-efficiency drops to 30-40%. Then there’s DODO’s Proactive Market Maker (PMM). Instead of letting users pick ranges, DODO automatically concentrates liquidity near the current price, mimicking how centralized exchanges work. Users report 50-70% better efficiency than v2, with less hassle. Sigmadex takes it further: it uses real-time price feeds and volatility data to shift liquidity automatically. No manual rebalancing needed. It averages 75% efficiency, even on volatile assets.

Virtual AMMs: The Extreme Case

Some protocols don’t even use real tokens. Perpetual Protocol, for example, uses virtual AMMs (vAMMs). Instead of holding ETH or BTC, they hold USDC as collateral and trade synthetic versions of assets. This means nearly 90%+ capital efficiency-because the “liquidity” is just math, not actual tokens. But there’s a trade-off: traders risk liquidation if prices move too far. It’s not for everyone, but for perpetual futures trading, it’s the only way to scale. This model shows that capital efficiency doesn’t always mean more real assets-it can mean smarter systems.

The Real Cost of Efficiency

Higher efficiency doesn’t mean zero risk. In fact, it often means more risk. When your capital is concentrated in a narrow price band, you’re more exposed to impermanent loss. If ETH drops 30% and you’re only active between $3,000 and $3,500, you’ll end up with more stablecoin but less ETH than if you’d just held. The more efficient the AMM, the more you’re essentially betting on price stability. That’s why experts like Dan Robinson from Paradigm call concentrated liquidity a “user-level inefficiency.” It’s not the protocol’s fault-it’s that most people don’t have the time, tools, or training to manage it. And that’s why, even in 2024, 85% of new liquidity providers still use Uniswap v2 or Curve instead of v3.

Who’s Actually Using These Advanced Models?

It’s not retail users. According to Nansen’s Q2 2024 data, only 35% of concentrated liquidity positions come from individual traders. The rest? Institutions, hedge funds, and professional yield farmers. They have algorithms, dashboards, and teams monitoring volatility in real time. Hashnote reports that 65% of their institutional clients now use concentrated liquidity. Meanwhile, retail users stick with simple pools because they’re easier, even if they earn less. The gap isn’t just about money-it’s about access. Tools like Gamma XYZ help by automating rebalancing for a 0.3% fee, but that still eats into returns. And not everyone trusts third-party services.

What’s Next? AI, Automation, and Simpler Interfaces

The next wave of AMMs is trying to fix the complexity problem. In July 2024, Uniswap added automated range suggestions in its mobile app. PancakeSwap’s “Concentrated Liquidity 2.0” uses volatility algorithms to set ranges for you. Projects like Arrakis Finance and Ambient Finance are testing machine learning models that predict optimal price bands based on historical data, trading volume, and market sentiment. The goal? 90%+ efficiency with zero user input. If they succeed, retail users could finally get institutional-level returns without needing a finance degree. Messari predicts these innovations could cut total DeFi liquidity needs by 40-60% over the next three years-meaning less capital locked up, more trading volume, and lower fees for everyone.

Should You Use Capital-Efficient AMMs?

Here’s the practical breakdown:

- If you’re new to DeFi: Stick with stablecoin pools on Curve or Uniswap v2. You’ll earn less, but you won’t lose money to bad ranges.

- If you’re comfortable with volatility: Try Uniswap v3 on ETH/USDC with a 1.5x volatility range (use Uniswap’s built-in calculator). Rebalance every 5-7 days. Use tools like Volmageddon to track historical swings.

- If you don’t want to manage anything: Try DODO or Sigmadex. Their auto-concentration works well, even if fees are slightly lower than optimized v3 positions.

- If you have $10,000+ to deploy: Consider Gamma XYZ or similar managers. The 0.3% fee is worth it if you’d otherwise underperform.

The bottom line: capital efficiency isn’t magic. It’s a tool. And like any tool, it’s only as good as the person using it. The best AMM isn’t the one with the highest efficiency number-it’s the one you can actually use without stress.

How to Get Started Today

- Start with a stablecoin pair (USDC/DAI) on Curve Finance. It’s low-risk and high-efficiency.

- Watch the price of ETH/USDC for a week. Note how far it swings daily.

- Go to Uniswap v3 and use their range calculator. Set your range 1.5x wider than the max daily swing.

- Deposit a small amount-$500 or less-to test.

- Check your position every 5 days. If the price moved outside your range, adjust it.

- Use YouTube channels like DeFi Dad for walkthroughs. They show real examples, not theory.

You don’t need to be a coder. You just need to pay attention.

Uniswap v3 is wild when it works. I’ve seen people turn $2k into $200 in fees over 3 months just by setting ranges around volatility bands. But god, the mental load. You gotta watch charts like a hawk or get wiped out by a 10% swing while you’re asleep. It’s not DeFi anymore-it’s day trading with a liquidity apr.

v3 is great if you know what you are doing but most people just deposit and forget then wonder why they lost money

so you’re telling me the entire DeFi ecosystem is just a glorified day trading simulator where the only winners are the ones who coded their own bots and the losers are the ones who thought ‘concentrated liquidity’ was a yoga pose?

also i typed ‘uniswap’ as ‘uniswape’ twice. i’m not sorry.

i tried v3 once with eth/usdc and set my range too tight… ended up with 0 liquidity for 4 days while eth dropped 15%. felt like leaving your car unlocked in a bad neighborhood. now i stick to curve for stablecoins. no stress, no panic checks.

has anyone tried sigmadex? i heard it auto-adjusts ranges based on on-chain volume spikes. tried it last week with wbtc/usdc and got 7% apy without touching my phone. no rebalancing, no stress. maybe this is the future?

capital efficiency is just a fancy way of saying ‘risk concentration.’ the more efficiently you use your money, the more you’re betting that price won’t move. but markets don’t care about your spreadsheets. they move when you’re not looking. so maybe the real question isn’t how to be efficient-it’s how to survive when efficiency fails.

v3 is for bots not people

HEY! if you're new to this, START WITH CURVE! 🌟 USDC/DAI is like a savings account that pays you 5-7% without you lifting a finger. i made $42 last month just sitting there. no ranges, no panic, no math. just chill and earn. you don't need to be a genius to make money in DeFi 😊

they say ‘capital efficiency’ like it’s enlightenment. but really it’s just capitalism wearing a blockchain hoodie. you’re not ‘optimizing’-you’re being exploited by a system that rewards vigilance and punishes sleep. the real inefficiency? believing that finance should require a 3am chart check just to keep your money from vanishing.

v2 is for losers who can't handle responsibility. if you can't manage a range you don't belong in DeFi. stop blaming the protocol and get educated

just wanted to say huge props to the people building tools like Gamma XYZ and Ambient. even if you’re not a pro, knowing there’s someone automating the nightmare for you? that’s hope. i used to feel overwhelmed by v3-now i just hit ‘auto-rebalance’ and go for a walk. DeFi shouldn’t feel like a second job.

AI-driven AMMs coming soon 🚀 just wait till your wallet auto-optimizes your liquidity while you sleep 💤💰

It is imperative to recognize that the systemic adoption of concentrated liquidity mechanisms has, in fact, exacerbated the digital divide within decentralized finance. The cognitive burden placed upon retail participants-many of whom lack access to real-time analytics, algorithmic tools, or financial literacy-is not merely an operational inefficiency; it is an ethical failure of the DeFi ecosystem. We must advocate for inclusive design, not just technical innovation.

v3 is overrated. everyone uses it wrong. the data says 68% of positions are bad. so why are we still talking about it?

why do americans make everything so complicated? in india we just buy and hold. no ranges no bots. simple. better.

i started with curve last year and made more in 6 months than i did with v3 in a year. i don’t need to be a genius to earn. i just need to be patient.

As a Nigerian participant in DeFi, I must commend the depth of this exposition. However, let us not forget that capital efficiency, while technologically elegant, remains inaccessible to the majority of our population who lack reliable internet, stable electricity, or even basic financial education. The real innovation is not in the algorithm, but in the democratization of access. Until we bridge this chasm, we are merely optimizing for the privileged few.

you think this is about efficiency? it’s about control. the rich use bots. the rest of us get confused by ranges and blame ourselves. the system was never meant to be fair. it was meant to look fair.