DeFi Explained: Real Decentralized Finance Platforms and How They Work

When you hear DeFi, short for decentralized finance, it means financial services running on blockchains without banks or middlemen. Also known as decentralized finance, it lets you lend, borrow, trade, and earn interest using crypto—directly from your wallet. This isn’t theory. Real platforms like Camelot V3, a zero-fee DEX built for the Arbitrum network and Lifinity, a Solana-based exchange trying to cut impermanent loss are live right now. But not everything calling itself DeFi is real. Many fake exchanges like EvmoSwap, a scam site copying the Evmos blockchain trick users into sending crypto to empty wallets.

DeFi isn’t just about trading. It’s about control. You don’t need a bank account to use a DEX, a decentralized exchange that lets you swap tokens peer-to-peer. You just need a wallet and some crypto. That’s why tools like USDT.a, Tether’s stablecoin running on Algorand matter—they keep value stable while moving fast on chains like Algorand or Arbitrum. But stablecoins aren’t magic. Sending USDT.a to an Ethereum address? You’ll lose it. DeFi demands attention to detail.

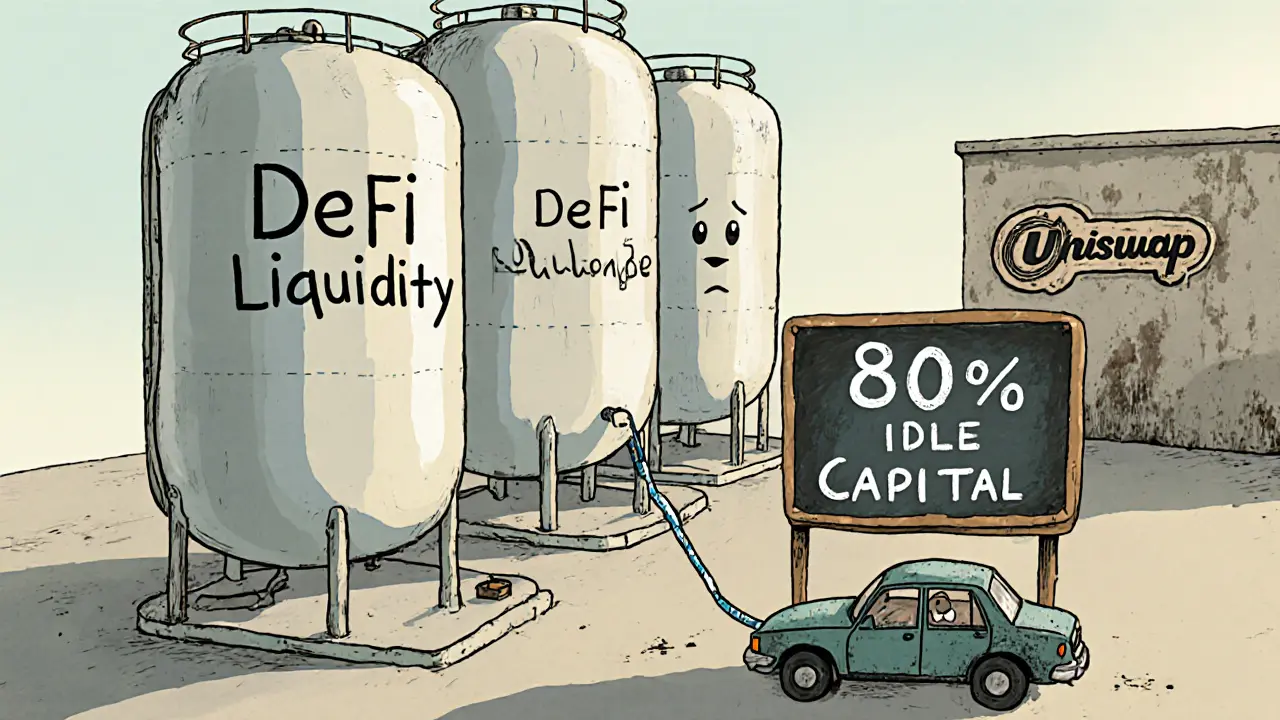

Some DeFi projects promise big returns but deliver nothing. Take SheepDex, a platform with zero trading volume and no audits. It looks official but has no users. That’s why you need to check for real activity—liquidity, volume, community—before trusting any platform. DeFi rewards those who do their homework. The posts below show you exactly which DEXs work, which airdrops are legit, and which tokens are just noise. You’ll see real examples of what to use, what to avoid, and how to protect your crypto in a space full of imitators.