Crypto Exchange Eastern Europe: Best Platforms, Regulations, and Real User Experiences

When you're looking for a crypto exchange Eastern Europe, a platform where people in countries like Poland, Romania, Ukraine, or Kazakhstan buy, sell, and hold digital assets. Also known as cryptocurrency exchange in Eastern Europe, it’s not just about trading—it’s about navigating strict banking rules, local taxes, and sometimes outright bans. Unlike Western Europe, where exchanges like Binance or Kraken are widely accepted, Eastern Europe has a patchwork of rules. Some countries treat crypto like property, others like currency, and a few still treat it like a threat.

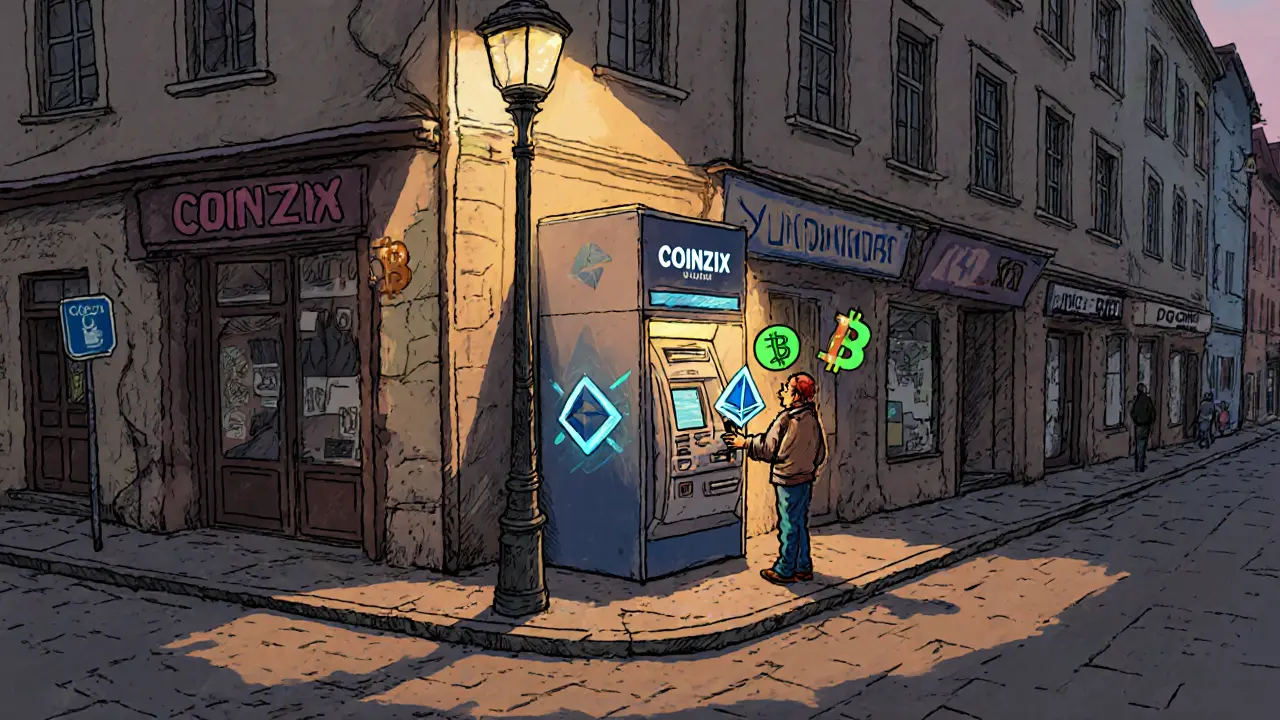

That’s why the best crypto exchange Eastern Europe, a platform that works under local financial laws and supports local payment methods like bank transfers or e-wallets. Also known as regulated crypto platform Eastern Europe, it’s the one that lets you deposit in złoty, leu, or hryvnia without getting blocked by your bank. VirgoCX, for example, isn’t in Eastern Europe, but it’s used heavily by Eastern Europeans because it accepts e-Transfers and has strong security—exactly what people need when their local banks refuse crypto deposits. Meanwhile, COEXSTAR in the Philippines shows how a regulated exchange can thrive with clear rules, even in regions with shaky banking systems. That’s the model Eastern Europe needs: transparency, not secrecy.

It’s not just about which exchange you use—it’s about crypto regulation Eastern Europe, the local laws that determine whether you can legally trade, how you report gains, and if your money can be frozen. Also known as cryptocurrency laws Eastern Europe, it’s what makes Kazakhstan shut down mining after an energy crisis, or why Pakistan handles $300 billion in crypto despite banking bans. These aren’t random events. They’re reactions to inflation, capital controls, and a lack of trust in traditional finance. If you’re in Eastern Europe, you’re not just trading crypto—you’re using it to protect your savings, send money home, or bypass broken systems.

And then there’s the crypto wallet Eastern Europe, the tool you need to store your coins safely when exchanges get shut down or frozen. Also known as self-custody crypto wallet, it’s the difference between losing everything when an exchange disappears—like AlphaX or Coinfloor—and keeping your assets secure in your own hands. No exchange is forever. But a wallet? That’s yours. That’s why users in Ukraine and Moldova rely on hardware wallets and non-custodial apps more than anywhere else in Europe.

What you’ll find below aren’t just reviews of exchanges. They’re real stories from people who’ve been burned by fake platforms like Wavelength, survived regulatory crackdowns in Cambodia and Kazakhstan, and found ways to trade even when banks said no. You’ll see what works, what’s dead, and what’s still alive—no fluff, no hype, just what you need to know before you click "buy."