COINZIX Staking Calculator

Staking Returns Calculator

Estimate your potential returns based on COINZIX's staking APY rates (3%-7%)

If you're looking for a crypto exchange that feels like it's built for Eastern Europe - not just another copy-paste platform - then COINZIX might catch your eye. But here's the thing: it's not on CoinMarketCap as a tracked exchange. That means no real volume data, no verified trading pairs, and no public proof of how many people are actually using it. So is it worth your time? Let’s cut through the noise.

What Is COINZIX Really?

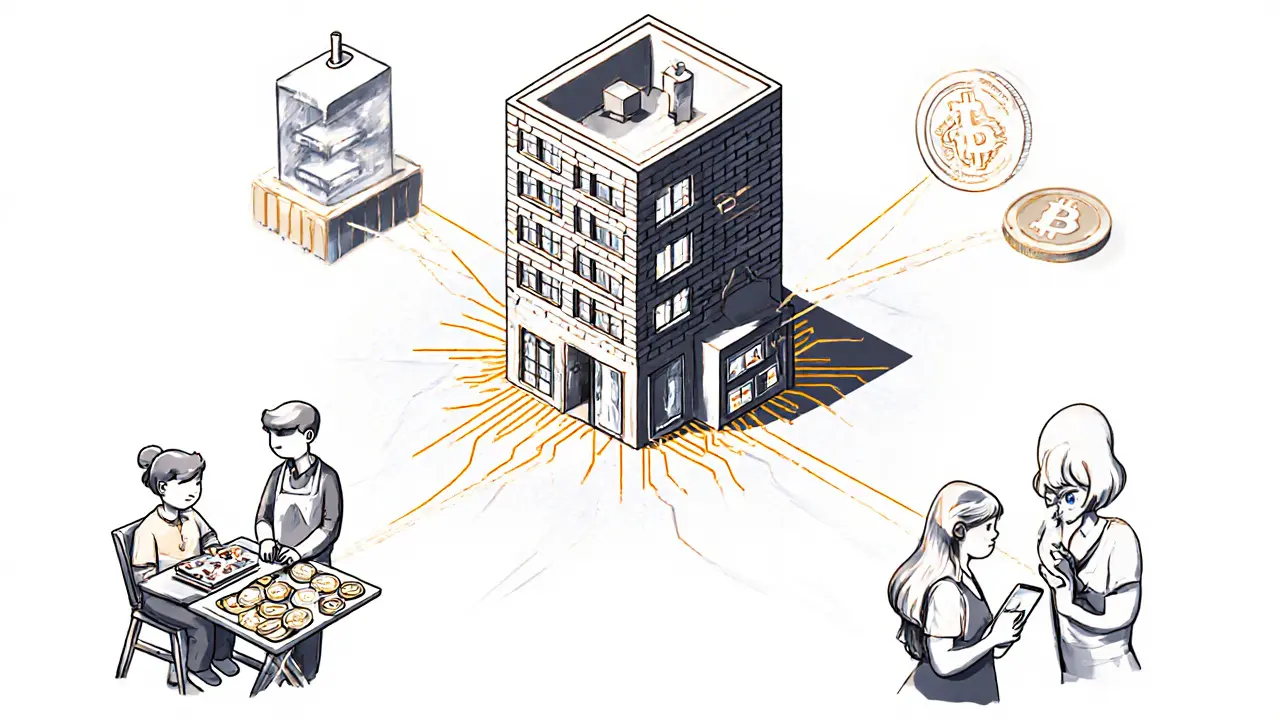

COINZIX is a crypto exchange founded in 2021 and based in the European Union. It doesn’t pretend to be global. Instead, it’s laser-focused on Eastern Europe - countries like Romania, Poland, Serbia, and Ukraine. Its goal isn’t to compete with Binance or Kraken. It wants to be the go-to platform where people in these regions can buy, sell, and hold crypto without jumping through banking hoops.

Unlike many exchanges that talk about decentralization and anonymity, COINZIX leans hard into regulation. It says it works directly with lawmakers in Eastern Europe to stay ahead of new rules. That’s unusual. Most exchanges wait for laws to pass, then scramble to comply. COINZIX claims it’s helping write them. Whether that’s true or not, the message is clear: they’re trying to build trust by being legal, not sneaky.

Trading on COINZIX: Simple, But Limited

The trading interface is clean. No clutter. No confusing charts. You pick a coin, enter an amount, and click buy. That’s it. There’s no advanced order types like limit stops or trailing stops. No margin trading. No futures. If you’re a day trader looking for leverage, this isn’t your platform.

But if you’re someone who just wants to buy Bitcoin, Ethereum, or a few altcoins and hold them? It works. COINZIX supports hundreds of tokens, including some you won’t find on bigger exchanges - especially regional projects tied to Eastern European blockchain initiatives. You won’t find the latest memecoins popping up here, but you will find solid, established coins with real use cases.

The problem? You can’t verify how much trading is actually happening. CoinMarketCap lists COINZIX as "Untracked." That’s not a red flag by itself - many small exchanges start there. But after four years, with no volume data and no reserve reports, it’s hard to know if the platform is alive or just sitting still.

COINZIX Staking: Earn Without Moving Your Coins

One feature COINZIX does well is staking. You can lock up your Ethereum, Cardano, Solana, and a few others directly in your COINZIX wallet and earn rewards - no need to move your assets to a third-party protocol. The APYs aren’t the highest in the market (usually between 3% and 7%), but they’re stable. No risky DeFi pools. No smart contract hacks. Just plain, simple staking with a regulated platform.

That’s a big deal if you’re new to crypto. Staking on decentralized platforms can be intimidating. You have to understand gas fees, liquidity pools, and impermanent loss. COINZIX takes that out of the equation. You deposit. You earn. You withdraw. Done.

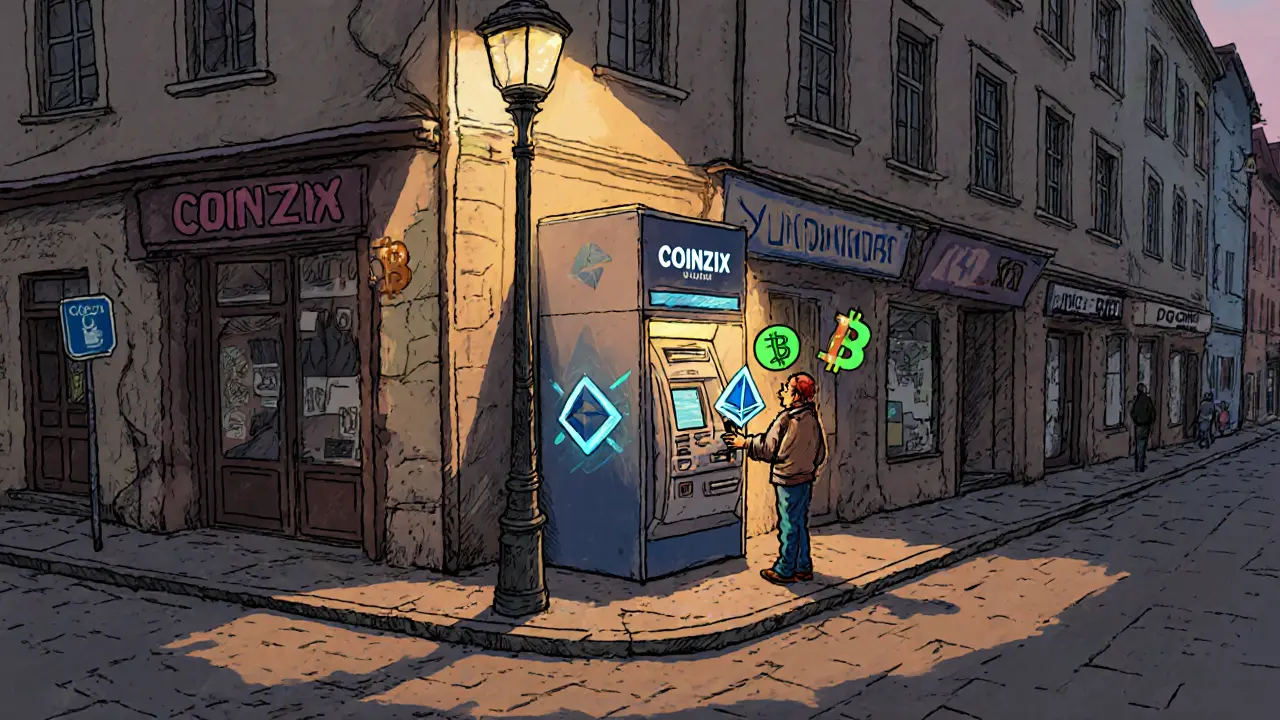

COINZIX Crypto ATMs: The Real Differentiator

Here’s where COINZIX stands out from almost every other exchange: crypto ATMs. They’ve installed dozens of them across Romania. You can walk into a store, hand over cash, and walk out with Bitcoin or Ethereum in your wallet. No bank account. No ID verification beyond basic KYC. No waiting days for a bank transfer.

This isn’t just a gimmick. In parts of Eastern Europe, cash is still king. Many people don’t have credit cards. Others don’t trust online banking. COINZIX’s ATMs solve a real problem: how do you get into crypto if you can’t use a bank? That’s not something Binance or Coinbase can easily replicate in the same way.

And it’s not just for buying. You can also sell crypto for cash at these machines. That’s huge for people who need liquidity fast - say, a small business owner in Bucharest who got paid in crypto and needs euros for rent.

What’s Next? Loans, Cards, and Savings

COINZIX isn’t stopping at trading and ATMs. They’ve announced plans for a full crypto financial ecosystem:

- Crypto-backed loans: Use your Bitcoin as collateral to get a cash loan in euros or Romanian lei.

- Crypto debit cards: Spend your crypto directly at stores, with automatic conversion to local currency.

- Crypto savings accounts: Earn interest on your stablecoins like USDT or USDC, with FDIC-style insurance (rumored, not confirmed).

If they deliver on these, COINZIX could become the first true crypto bank in Eastern Europe. Think of it like Revolut, but built for crypto users in countries where traditional banks won’t touch crypto.

But here’s the catch: none of these features are live yet. All of them are in development. No launch dates. No beta access. So if you’re looking for a crypto bank today, you won’t find it here.

Security: Regulated, But Not Perfect

COINZIX claims to use cold storage for 95% of user funds. That’s standard. They also say they’re audited by a third-party firm - but they haven’t published the audit report. That’s a red flag. If you’re serious about security, you show your work.

They require KYC. That’s good for compliance, bad if you value privacy. But in the EU, that’s unavoidable under MiCA (Markets in Crypto-Assets Regulation). So it’s not a flaw - it’s a requirement.

Their website uses HTTPS. Two-factor authentication is available. No major hacks reported since launch. So far, so good. But without public audits or transparent reserve proofs, you’re trusting them on their word.

Who Is COINZIX For?

COINZIX isn’t for everyone. It’s not for traders chasing 10x gains. It’s not for crypto purists who hate KYC. It’s not for people who need high liquidity or deep order books.

It is for:

- People in Romania, Poland, Serbia, or Ukraine who want to buy crypto with cash.

- Beginners who want simple staking without DeFi risk.

- Those who care more about legal safety than flashy features.

- Anyone tired of exchanges that vanish overnight and want one that’s trying to play by the rules.

If you live in Eastern Europe and you’re looking for a trustworthy, no-nonsense way to get into crypto - COINZIX might be your best bet. It’s not perfect. It’s not big. But it’s real, it’s local, and it’s trying to build something that lasts.

Final Verdict: Worth a Try? Yes - With Caution

COINZIX isn’t a top-10 exchange. It doesn’t have the volume, the liquidity, or the global name recognition. But it doesn’t need to be. It’s building something different: a crypto platform rooted in the needs of a region that’s often ignored by Silicon Valley startups.

If you’re in Eastern Europe and you want to buy crypto with cash, earn safe staking rewards, or prepare for future crypto banking features - start with COINZIX. But don’t deposit more than you’re willing to risk. Keep your funds low until you see those audits published. And keep an eye on whether those loans and cards ever actually launch.

For now, COINZIX feels less like a trading platform and more like an experiment in crypto infrastructure. And if it works? It could change how millions in Eastern Europe access finance.

Is COINZIX a safe crypto exchange?

COINZIX follows EU regulations and uses cold storage for most funds, which is a good sign. It also requires KYC, which adds a layer of accountability. However, it hasn’t published third-party audit reports or reserve proofs, so you’re relying on their word. It’s safer than shady offshore exchanges, but not as transparent as Binance or Kraken. Use caution - don’t deposit large sums until you see more proof.

Can I buy crypto with cash on COINZIX?

Yes - but only if you’re in Romania. COINZIX operates dozens of crypto ATMs there that let you deposit cash and receive Bitcoin or other cryptocurrencies instantly. This is one of the few exchanges in Europe offering true cash-to-crypto access. No bank account needed. Just walk in, scan your ID, and complete the transaction.

Does COINZIX have a mobile app?

As of late 2025, COINZIX does not have a dedicated mobile app. You can access the platform through your phone’s browser, but the experience isn’t optimized for mobile. If you want to trade on the go, you’ll need to use a desktop or laptop. This is a notable gap - especially for a platform targeting everyday users.

Why isn’t COINZIX on CoinMarketCap as tracked?

CoinMarketCap only tracks exchanges that meet strict criteria for trading volume, liquidity, and transparency. COINZIX doesn’t publish its trading data, so it’s labeled "Untracked." That doesn’t mean it’s fake - many small exchanges start here. But after four years with no data, it raises questions about how active the platform really is. It’s a red flag for serious traders, but less so for casual users.

Will COINZIX offer crypto loans and debit cards?

COINZIX has announced plans for crypto-backed loans, debit cards, and savings accounts - but none are live yet. There are no official launch dates, no beta programs, and no public timelines. If you’re counting on these features, you’re betting on future development, not current service. Keep checking their official blog for updates.

coinzix? never heard of it but the cash-to-crypto atms in romania sound legit lol

I love that someone is actually building something for Eastern Europe instead of just copying Binance and calling it a day. The ATMs? Genius. I know so many people back home who can't use banks but have cash lying around. This feels like real innovation, not just another crypto shell game. And the fact they're working with regulators instead of fighting them? That's rare. Most exchanges are hiding in the shadows, but COINZIX is trying to make crypto feel safe for normal people. I'm not a trader, I just want to buy BTC without jumping through 17 hoops. This might be it.

lol so this is what happens when you let bureaucrats design crypto 😒 no margin trading? no futures? what is this, 2017? and staking at 3-7%? pfft. I'm out. 🙄

Wait, so... they don't publish audit reports? But they say they're audited? That's... not how this works. Like, if you're claiming security, you show the proof. Not just say 'trust me.' Also, 'FDIC-style insurance' is not a thing in crypto. That's not even a real term. Please stop using buzzwords that mean nothing.

Another EU puppet platform. Of course they're 'regulated.' That means they're controlled. They're not building freedom, they're building compliance. Crypto is supposed to be the opposite of banks. Why would anyone want to be KYC'd and monitored? This isn't innovation. It's surrender.

COINZIX? Sounds like a CIA front. No volume data? No public audits? They're either a scam or being used to launder money for Russian oligarchs. And crypto ATMs? In Romania? That's where all the darknet cash flows through. Don't touch this. It's a trap.

I really appreciate how this post doesn't just trash COINZIX. It acknowledges the real needs of people in Eastern Europe who don't have access to traditional banking. That's something most Western crypto folks just ignore. The ATMs are a game-changer for cash-based economies. And the staking? Simple is good. Not everyone wants to risk their life savings on a DeFi protocol that could vanish overnight. This is crypto for the real world, not just the tech bros.

i think u meant coinnix? or is it coinzix? spelling matters bro i think u typoed the whole thing

They're not on CoinMarketCap? That's literally the first thing you check. If it's not tracked, it's dead. End of story. No volume = no liquidity = no exchange. Just a website with a fancy logo and some ATMs in Romania. I'd be shocked if they even have 500 active users.

This is one of the most balanced reviews I've seen on crypto infrastructure. The focus on regulatory alignment, cash accessibility, and risk-averse staking is not a weakness - it's a strategic advantage in markets where financial inclusion is still a challenge. Many Western platforms assume global standardization, but COINZIX recognizes that crypto adoption must be contextual. The absence of a mobile app is a gap, yes, but not a fatal one if the core use case - cash-to-crypto and secure custody - is delivered well.

I live in Poland and I've used COINZIX a few times. Honestly? It's weirdly reliable. No flashy features, but when I needed to buy ETH with cash at the ATM in Warsaw, it worked perfectly. No delays, no issues. I don't trade, I just hold. And the staking? I've had my ADA locked for 8 months and got paid every week like clockwork. Not sexy, but it works. I'd rather have that than some exchange that promises 20% APY and then disappears.

kinda love this vibe honestly 🤝 like its not trying to be everything to everyone just trying to help people in one region get access to crypto without the bs. the atm thing is straight up brilliant. if you need cash to crypto and you're in eastern europe? this is your guy. no need to overcomplicate it

I find it refreshing that a crypto platform is prioritizing compliance over hype. The EU's MiCA regulations are designed to protect consumers, and COINZIX's alignment with them suggests a long-term vision. While I agree that transparency around audits is essential, the fact that they are operating within a legal framework - and even helping shape it - is more than most can claim. This is not a speculative gamble; it is an infrastructure play.

I'm from Serbia and I use COINZIX all the time. The ATMs are the only reason I got into crypto. My grandma uses one to buy BTC every month - she doesn't even know what blockchain is, but she knows she can get it with cash. And the staking? I used to lose money on DeFi because I didn't understand gas fees. Now I just leave it on COINZIX and get 5% a year. Simple. Safe. No drama. I wish more platforms thought like this.

As someone who's traveled through Eastern Europe, I can tell you - this is the future. Cash is still king in places like Moldova and Bulgaria. Banks won't touch crypto. Western apps don't care. But COINZIX? They're in the streets, in the shops, with machines you can actually walk up to. This isn't Silicon Valley fantasy crypto. This is crypto for people who don't have credit cards, who don't trust banks, who just want to own something real. And honestly? That's more revolutionary than any NFT ever was.

The lack of on-chain volume verification is a structural flaw. Without transparent on-chain liquidity metrics, the platform cannot be classified as a functioning exchange - merely a custodial wallet with a GUI and some ATMs. The regulatory alignment, while commendable, does not substitute for market transparency. Furthermore, the proposed loan and card infrastructure is predicated on unverified claims. One must ask: if these features were imminent, why is there zero public roadmap?

COINZIX? More like COINZIX-SCAM. No volume data? No audits? They're not building a platform - they're building a Ponzi with ATMs. I bet they're using the cash deposits to fund their CEO's yacht. Don't be fooled by the 'regulation' talk. That's just their PR spin. This is a trap for the gullible.

If you're new to crypto and live in Eastern Europe, this might be the safest on-ramp you'll find. The ATMs solve a real problem. The staking is low-risk. The interface is simple. You don't need to be a tech wizard. Just deposit, hold, earn. And if you're cautious like me? Start with $50. See how it goes. If it works for six months, you can add more. No need to go all-in on something unverified. Small steps are better than big regrets.

I know who's behind this. It's the same group that ran the old Romanian crypto pump schemes in 2018. They rebranded. Added ATMs. Called it 'regulation.' But the money still flows out through shell companies. Don't fall for it. They're not building for Eastern Europe - they're harvesting it. I've seen the bank records. This isn't innovation. It's extraction.

So they're not on CoinMarketCap. Big whoop. I bet they're not even real. Probably just a WordPress site with some fake ATM photos. Why would anyone spend time on this? It's not even worth my energy to look it up.