Capital Efficiency in Crypto: How Smart Projects Maximize Resources

When we talk about capital efficiency, how well a project turns every dollar spent into real progress or value. Also known as resource optimization, it's what separates crypto projects that last from those that vanish after their first marketing push. In a market full of tokens with no revenue, no users, and endless fundraising rounds, capital efficiency isn’t just nice to have—it’s survival.

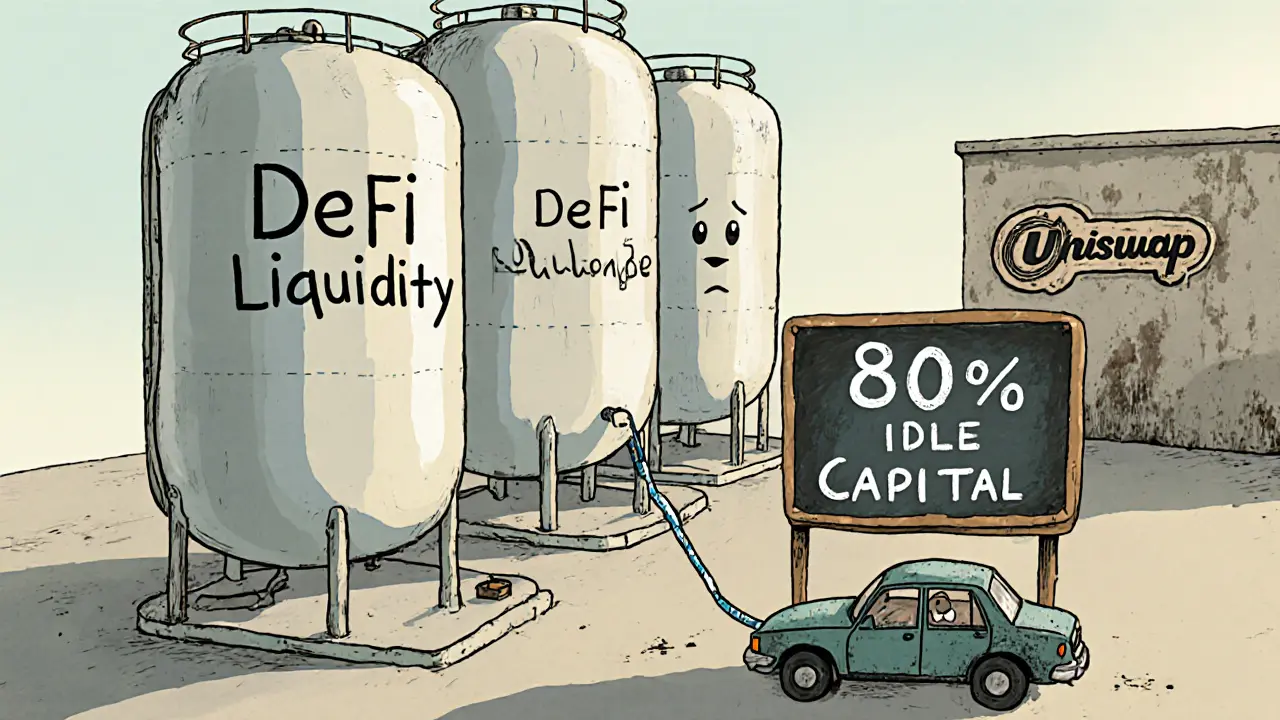

Think of it like running a restaurant. You could spend $1 million on fancy lighting and a celebrity chef, but if no one shows up to eat, you’re out of money. Or you could spend $50,000 on great food, simple service, and word-of-mouth buzz—and still thrive. That’s capital efficiency. In crypto, it shows up in how teams use funding: do they build real tech, or just pay influencers? Do they grow user adoption, or just inflate trading volume with bots? Projects like Camelot V3, a zero-fee DEX built for Arbitrum traders and Lifinity, a Solana DEX trying to cut impermanent loss prove that efficiency matters. They don’t need massive VC backing to function—they optimize their code, their fees, and their liquidity to serve users directly. Meanwhile, projects with no trading volume, like SheepDex or EvmoSwap, burn cash on hype and vanish when the money runs out.

Capital efficiency also ties into tokenomics, how a token’s supply, distribution, and incentives are designed. A token that rewards users for using the platform—like earning fees or governance rights—is more efficient than one that just dumps tokens on early buyers. Look at the Maiar EarnDrop, a reward system for EGLD stakers on MultiversX. It doesn’t give away free tokens randomly—it pays users for doing something valuable: locking up their crypto. That’s capital efficiency in action. And it’s why airdrops like WorldShards and Artify X CoinMarketCap worked—they required real participation, not just wallet addresses.

When you see a crypto project, ask: Are they building something people actually use? Or are they just trying to raise money before the next market cycle? The ones that focus on capital efficiency don’t need flashy ads. They grow quietly, with real users, real usage, and real returns. Below, you’ll find deep dives into exchanges, tokens, and airdrops that got it right—and the ones that didn’t. Learn what to look for before you invest, so you don’t fund vaporware again.