AMM Protocols: How Decentralized Exchanges Work and Why They Matter

When you trade crypto on a decentralized exchange like AMM protocols, automated market makers that replace traditional order books with algorithm-driven liquidity pools. Also known as automated market makers, these systems let you swap tokens without a middleman—no one holds your money, no one matches your buy and sell orders. Instead, smart contracts use math to set prices based on how much of each token is in the pool. This is the backbone of every major DEX today, from Uniswap to Camelot V3, and it’s why you can trade tokens like $GRAIL or $MSWAP without signing up for an account.

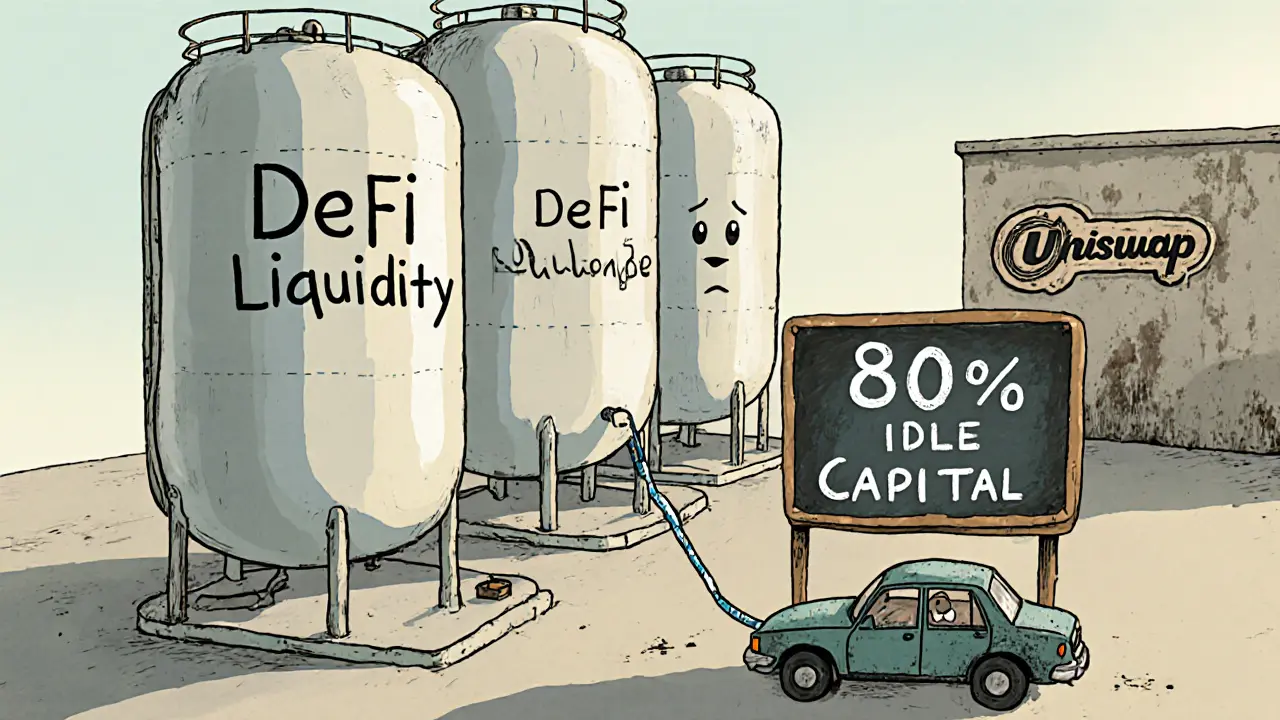

AMM protocols rely on liquidity pools, reserves of two tokens locked in a smart contract that enable instant trades. If you want to swap ETH for USDT, the protocol doesn’t find someone else selling USDT—it pulls from a pool where other users deposited both tokens. The more liquidity in the pool, the smoother and cheaper your trade. But here’s the catch: if a pool has low liquidity, your trade can cause big price swings, a problem called slippage, the difference between the expected price of a trade and the price you actually get. That’s why some DEXes like Lifinity and Marswap struggle—they don’t have enough users depositing tokens to keep prices stable.

AMM protocols also introduce impermanent loss, the risk that you lose value by providing liquidity compared to just holding your tokens. If one token in the pool spikes or crashes, the algorithm rebalances the pool, and you might end up with fewer tokens than you started with—even if the overall value went up. That’s why traders on Solana DEXes like Jupiter stick to high-volume pairs, while newer platforms like SheepDex and EvmoSwap fail—they have no real liquidity, no users, and no reason for anyone to trust their pools.

Some AMM protocols go further. Camelot V3 uses concentrated liquidity, a feature that lets liquidity providers focus their funds in specific price ranges to earn more fees. Others, like Marswap, tie their AMM to a single blockchain—Shibarium—so they only support tokens built there. These aren’t just technical tweaks; they’re strategic choices that determine who wins and who gets left behind.

You’ll see this play out in the posts below. Some are reviews of real AMM-powered DEXes like Camelot V3 and Lifinity, showing what works and what doesn’t. Others expose fake platforms like EvmoSwap and SheepDex—projects that copy the name of real protocols but have no liquidity, no audits, and no users. Then there are airdrops tied to AMM usage—like the BSCStarter or Arbitrum-based rewards—where simply using a DEX can earn you free tokens. None of this makes sense unless you understand how AMM protocols actually work. They’re not magic. They’re code. And knowing how that code behaves is the difference between making smart trades and losing money to empty pools and scams.