Tokenomics Explained: How Crypto Token Design Drives Value and Adoption

When you buy a crypto token, you're not just buying a digital asset—you're betting on its tokenomics, the economic structure that governs how a token is created, distributed, and used within its ecosystem. Also known as token economics, it’s the hidden blueprint that determines if a project lasts or collapses. Many coins surge on hype, then crash because their tokenomics are broken—too many tokens given to insiders, no real use case, or endless printing with no burn mechanism. The ones that stick? They balance supply, incentives, and utility like a well-tuned engine.

Good token supply, the total number of tokens that exist or will ever exist, including circulating and locked amounts isn’t just about big numbers. A limited supply like Bitcoin’s 21 million cap creates scarcity. But some tokens, like BTC2.0 or CHEEPEPE, have infinite supplies with no controls—making them worthless long-term. Then there’s token distribution, how tokens are allocated among founders, investors, team, and the public. If 40% goes to the team with no vesting schedule, you’re risking a dump. Real projects lock up team tokens for years, like EGLD Maiar EarnDrop or WorldShards airdrop, to prove they’re in it for the long haul.

And then there’s utility token, a token designed to be used within a platform’s ecosystem—not just traded. Think of it like a coupon you can actually spend. USDT.a lets you move value fast on Algorand. GRAIL token powers fee discounts on Camelot V3. BID coin rewards creators for using AI agents. Without utility, a token is just a speculative gamble. That’s why projects like Fluence (FLT) and CreatorBid (BID) focus on real-world use cases—they’re not just selling tokens, they’re selling access to a system.

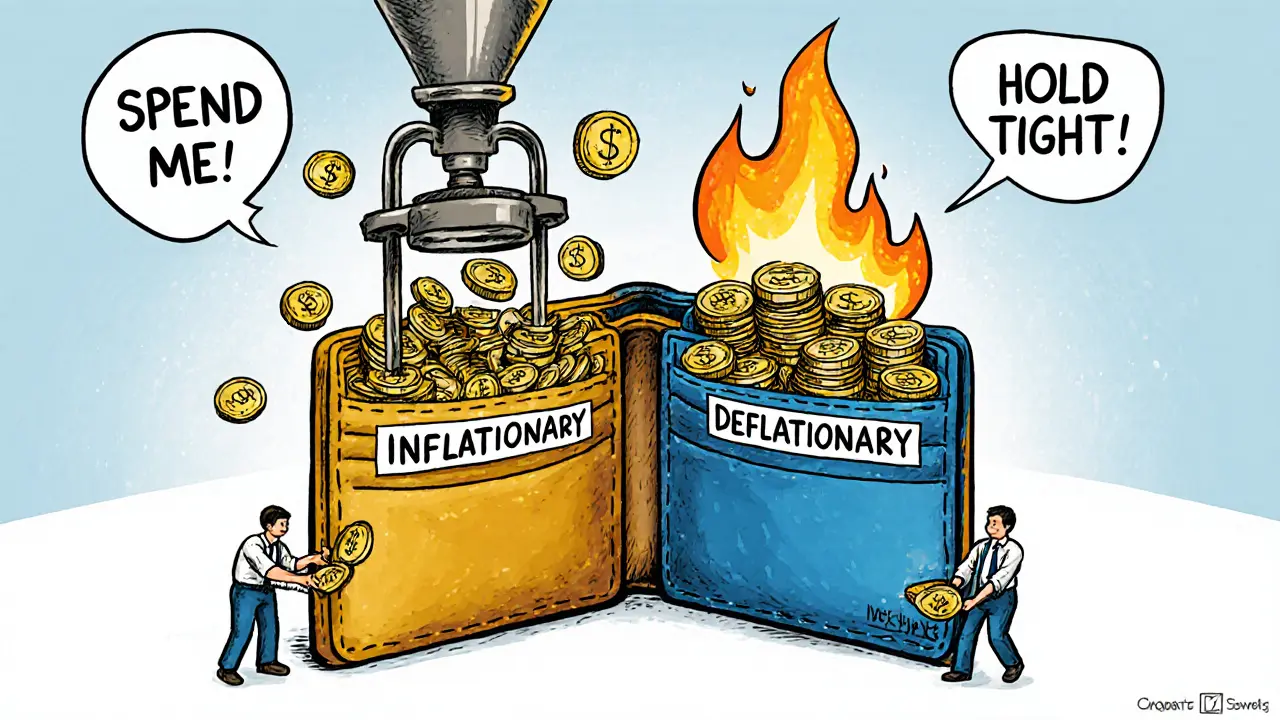

Tokenomics also includes burn mechanisms, staking rewards, and inflation controls. Some tokens, like those in Lifinity or Camelot V3, reward liquidity providers to keep trading active. Others, like Radio Caca (RACA), tie token rewards to NFT ownership and community actions. It’s not magic—it’s math. If more people are earning tokens than spending them, the price drops. If tokens are burned faster than they’re minted, scarcity rises. That’s why you’ll see capital efficiency and AMM protocols tied to tokenomics—they’re all part of the same system.

You don’t need a finance degree to read tokenomics. Look at the whitepaper—or better yet, look at what’s actually happening. Who holds the tokens? Are they locked? Is the token used for anything besides trading? Is the supply capped? If the answers are fuzzy, walk away. The best crypto projects don’t just promise returns—they build economies that keep running, even when the hype fades. Below, you’ll find real-world breakdowns of tokenomics in action—from airdrops that rewarded real users, to scams that had zero economic logic. Let’s see what works, what doesn’t, and why it matters.