Staking your crypto isn’t just about earning passive income-it’s about helping secure a blockchain network. But if you pick the wrong validator, you could lose money, miss out on rewards, or even get slashed. The difference between a good validator and a bad one isn’t just about the APR they advertise. It’s about uptime, transparency, fees, and how much of their own money they’ve put at risk. This isn’t guesswork. It’s a process-and if you do it right, you can earn consistent returns without putting your assets in danger.

Why Validator Selection Matters More Than You Think

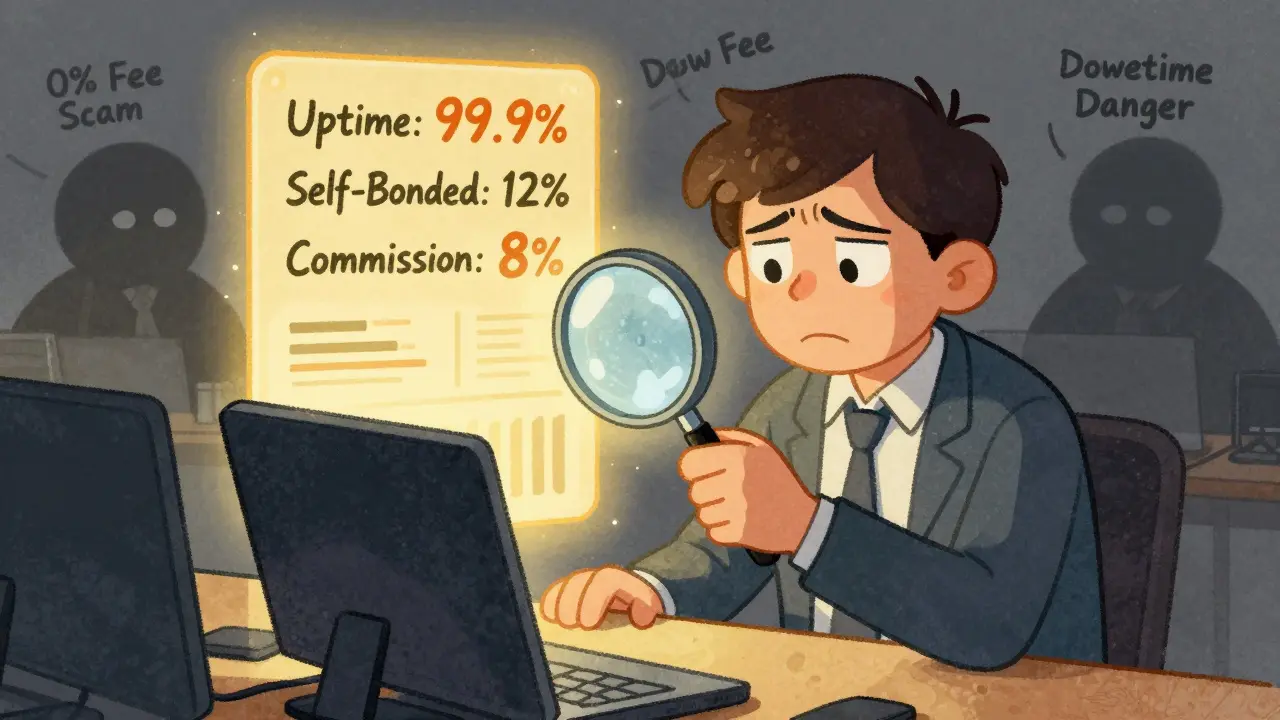

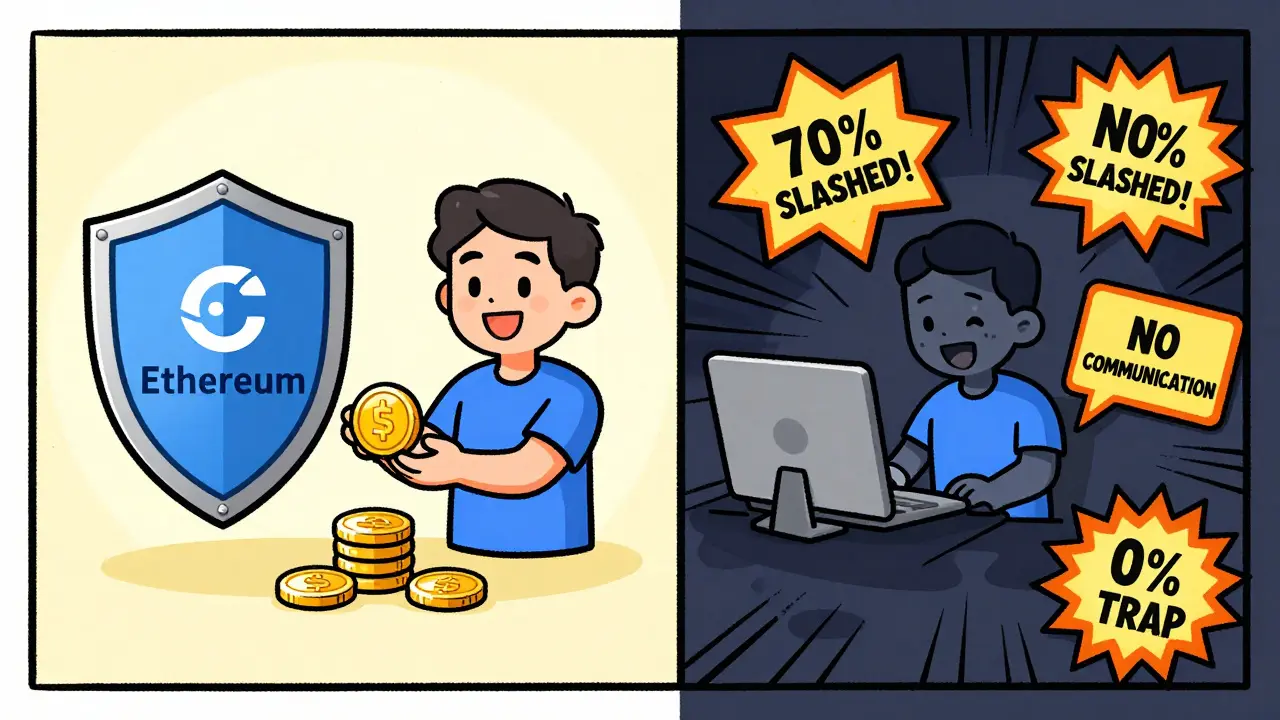

When you stake, you’re not mining. You’re not running expensive hardware. Instead, you’re locking up your tokens to help validate transactions on a proof-of-stake (PoS) blockchain. In return, you earn rewards. But those rewards aren’t guaranteed. They depend entirely on who you delegate to. A validator with poor uptime might miss block proposals. A validator with a 0% commission fee? That’s usually a red flag. Some scam operators lure users in with fake low fees, then suddenly raise them to 100% after you’ve delegated. Others don’t even have enough of their own tokens staked to be trustworthy. According to DAIC Capital’s 2024 guide, validators with less than 5% self-bonded ratio are 37% more likely to get slashed than those with 10% or more. Ethereum validators, for example, can lose 0.5 ETH for a minor infraction-and their entire stake if they double-sign. Polkadot validators can lose up to 70% of their stake for malicious behavior. Your rewards aren’t just affected by network conditions. They’re directly tied to the validator’s behavior.What Makes a Validator Reliable?

Not all validators are created equal. Here’s what separates the good from the risky:- Uptime above 99.9% - If a validator is offline for even a few minutes, you lose rewards. Ethereum loses about 0.000015 ETH per minute of downtime. That adds up fast.

- Self-bonded ratio of 10% or higher - This means the validator has skin in the game. If they’re risking their own tokens, they’re more likely to act responsibly.

- Transparent communication - Top validators update their community via Discord, email, or social media during outages or upgrades. Those who stay silent? Avoid them.

- Commission between 5% and 15% - Anything below 5% is suspicious. Anything above 15% eats into your returns too much. Zero percent? Almost always a trap.

- Proven performance history - Look at their track record. Are they consistently hitting target, source, and head voting accuracy? Top validators maintain 99.5%+ across all three.

Network Differences: Ethereum vs. Polkadot vs. Solana

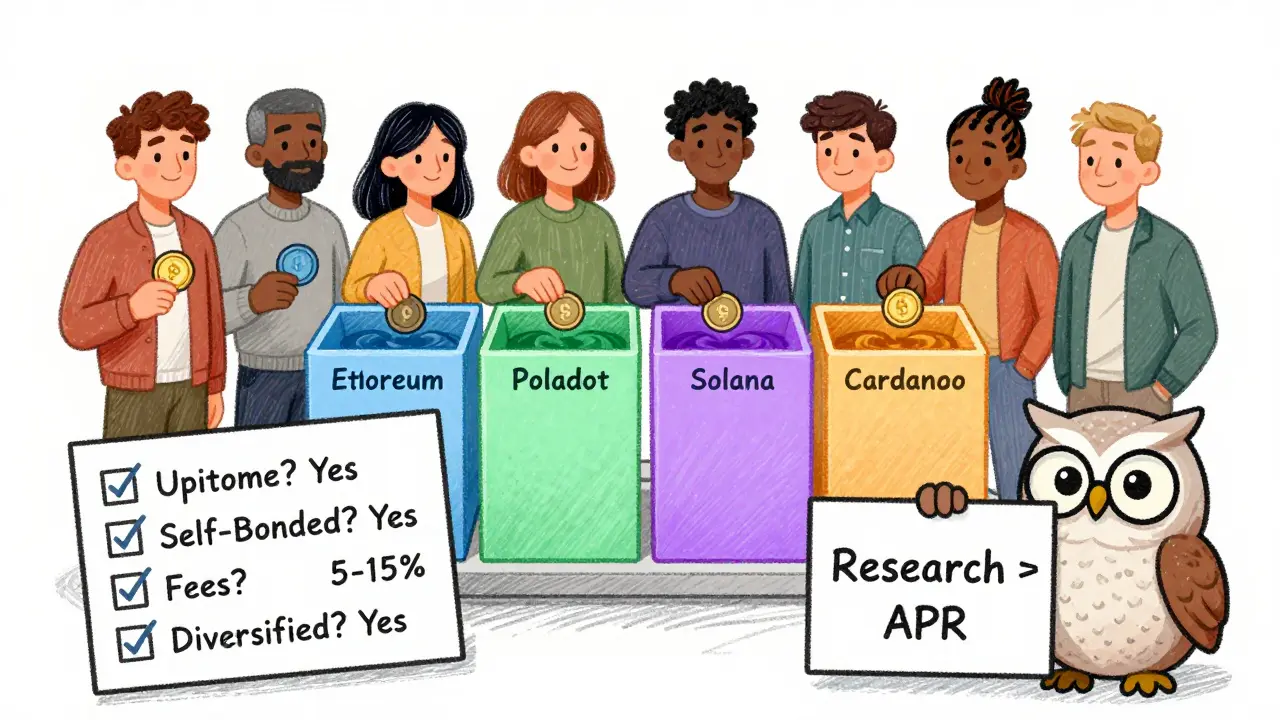

Each blockchain has its own rules. You can’t treat them the same. Ethereum requires 32 ETH to run your own validator. That’s over $100,000. Most people delegate through staking pools. Delegators earn around 3.5-4.2% APR after commissions. Validators here are chosen randomly every 12 seconds using RANDAO. Those who get selected as proposers earn more. So look for validators with high proposal rates-not just high uptime. Polkadot offers the highest yields among major chains-up to 14.34% APR for delegators. You can stake as little as 1 DOT through nomination pools. But slashing is harsh: up to 70% of your stake can be removed if your validator misbehaves. Polkadot validators are judged heavily on trust metrics from nominators. Check their nomination history. Solana pays around 7.38% APR. It’s faster and cheaper than Ethereum, but it’s also more volatile. Validators here need strong hardware and network connectivity. Downtime is punished quickly. Solana’s network has had outages in the past, so pick validators with proven resilience during congestion. Cardano is more conservative, offering only 4.6% APR. But it’s stable. Ideal for beginners who want slow, steady returns without drama.

How to Pick Validators (Step-by-Step)

You don’t need to be a developer to choose well. Here’s a simple five-step process:- Set up a secure wallet - Use a hardware wallet like Ledger or Trezor. Never stake from an exchange unless you’re okay with giving up control.

- Decide how much to stake - Ethereum needs 32 ETH for solo staking. For everyone else, use delegation pools. Start with what you’re comfortable losing.

- Research at least 5-7 validators - Use tools like Staking Rewards, ValidatorDB, or Polkadot.js. Filter by uptime, commission, and self-bonded ratio.

- Diversify across 4-12 validators - Don’t put all your tokens with one. Spreading risk reduces the chance of total loss if one validator fails.

- Delegate and monitor weekly - Spend 15-30 minutes a week checking performance. Watch for commission changes, downtime spikes, or silence from the validator.

Red Flags That Should Make You Walk Away

Here’s what to avoid at all costs:- 0% commission - No legitimate validator operates this way. They need to cover server costs, security, and labor.

- Self-bonded ratio under 5% - They’re not risking their own money. Why should you?

- No public communication - If they don’t post updates during outages, they’re hiding something.

- Too many delegators with no track record - A new validator with 10,000 delegators but zero history? That’s a lottery ticket.

- Only advertising high APR - If they don’t mention uptime, security, or commission structure, they’re not serious.

What the Data Shows About Real-World Results

Community feedback tells the real story. On Reddit’s r/ethstaker, 68% of users said they struggled to understand validator metrics. 42% didn’t know the minimum stake requirements. And 31% got stuck on the technical setup. But those who followed the process? They saw results. Trustpilot reviews show 78% of positive feedback mentions “consistent monthly rewards.” 65% praised responsive communication. Meanwhile, 41% of negative reviews cited unexpected fee hikes-and 37% complained about being left in the dark during downtime. One August 2024 incident saw 147 validators slashed after a coordinated attack. All had uptime below 95%. Total losses: $2.3 million. That wasn’t bad luck. That was poor selection.What’s Changing in 2026

The staking landscape is evolving fast. Ethereum’s Pectra upgrade (launched October 2024) made validator performance data more transparent. You can now see exactly how often a validator proposes blocks and how accurately they attest. Polkadot’s Nomination 2.0 cut the minimum stake for pools from 85 DOT to just 1 DOT. That opened staking to millions more people. Enterprise adoption is surging. 63% of institutional crypto holders are now staking, according to Coinbase’s 2024 survey. Regulators are catching up too. The EU’s MiCA framework now requires staking providers to be licensed. The SEC has cracked down on unregistered services. And the biggest change? Decentralization is slipping. The top 10 Ethereum staking providers now control nearly half of all staked ETH. That’s a risk. The more centralized the network, the more vulnerable it is. That’s why diversification isn’t optional anymore-it’s essential.Final Checklist: Are You Ready to Stake?

Before you hit confirm, ask yourself:- Do I know the validator’s uptime history over the last 90 days?

- Is their self-bonded ratio above 10%?

- Are their fees between 5% and 15%?

- Do they communicate clearly during outages or upgrades?

- Am I spreading my stake across at least 4 different validators?

- Have I checked recent community feedback on Reddit or Trustpilot?

Staking is one of the safest ways to earn from crypto-but only if you choose wisely. Don’t chase the highest APR. Chase reliability.

What happens if my validator gets slashed?

If your validator gets slashed, you lose a portion of your staked tokens. The amount depends on the network: Ethereum can slash 0.5 ETH for minor issues or your full stake for double-signing. Polkadot can slash up to 70% of your stake. This penalty is automatic and irreversible. That’s why choosing a reliable validator with high uptime and a strong self-bonded ratio is critical.

Can I stake with less than 32 ETH on Ethereum?

Yes. You don’t need to run your own validator. You can delegate your ETH through staking pools like Lido, Coinbase, or Rocket Pool. These pools combine smaller stakes into full validator nodes. You’ll earn slightly lower rewards (around 3.5-4.2% APR) due to pool fees, but you can start with just 0.01 ETH. This is how most people stake on Ethereum today.

Why do some validators charge 0% commission?

They’re either scams or will raise fees later. Legitimate validators need to cover server costs, security audits, and staff salaries. A 0% fee is unsustainable. In 2024, multiple cases were documented where validators offered 0% fees to attract delegators, then suddenly increased them to 100%-stealing all rewards. Always assume a 0% fee is a trap.

How often should I check my validator’s performance?

Once a week is enough for most users. Use tools like Staking Rewards, ValidatorDB, or your wallet’s dashboard to check uptime, commission changes, and reward history. If you notice a sudden drop in uptime or a fee increase, move your stake immediately. Don’t wait for a slashing event.

Is staking safe in 2026?

Staking is safer than ever-but only if you do your homework. Regulatory frameworks like the EU’s MiCA and SEC enforcement actions have forced platforms to improve vetting. However, risks still exist: validator misbehavior, network upgrades, and centralization. The key is diversification, transparency, and avoiding high-risk validators. If you follow best practices, staking is one of the most secure ways to earn from crypto in 2026.