Regulated Crypto Platform: What It Means and Which Ones Actually Deliver

When you hear regulated crypto platform, a cryptocurrency exchange or service that operates under government oversight and follows legal financial rules. Also known as a compliant exchange, it’s supposed to keep your funds safer, prevent money laundering, and give you legal recourse if something goes wrong. But not all platforms that claim to be regulated actually are. Some just slap on a license from a weak jurisdiction and call it a day. True regulation means real oversight—like being registered with the SEC in the U.S., the FCA in the UK, or BaFin in Germany. It’s not a marketing buzzword. It’s a legal requirement with consequences for breaking it.

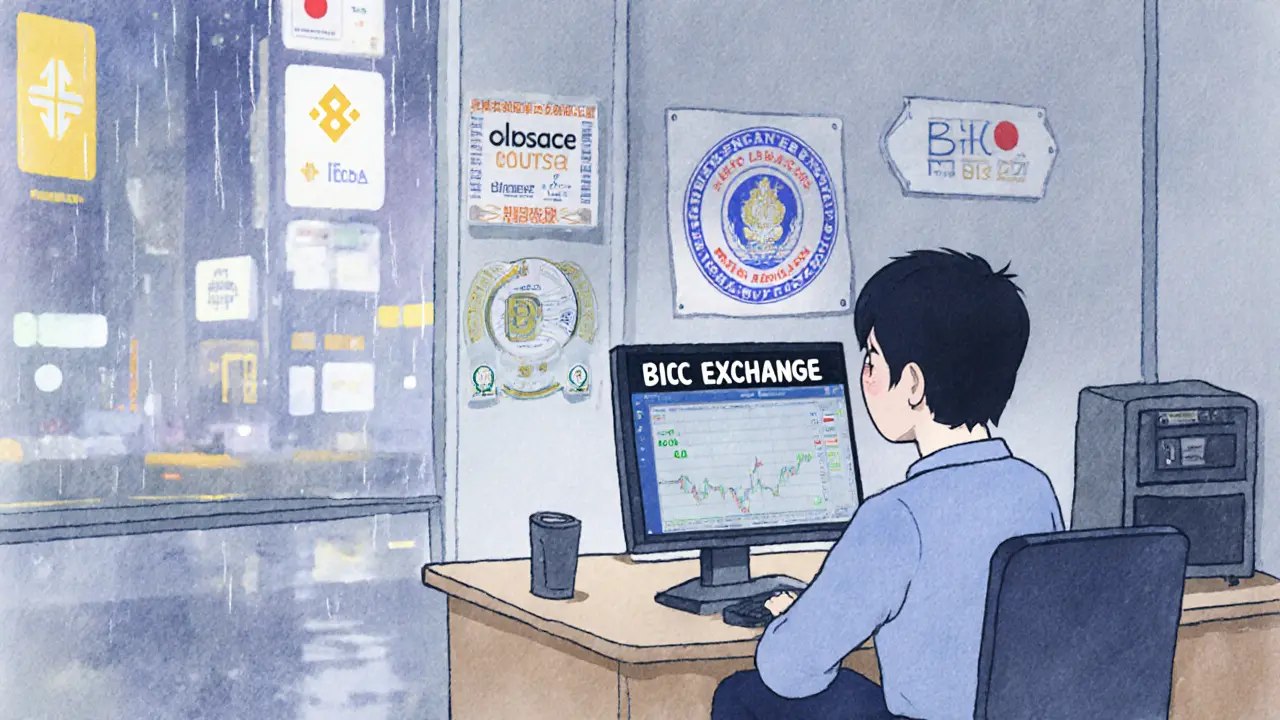

What does this look like in practice? A compliant exchange, a crypto trading platform that follows anti-money laundering and know-your-customer rules. Also known as regulated crypto platform, it must verify your identity, report suspicious activity, and keep financial records. That’s why platforms like Kraken or Coinbase in the U.S. ask for your ID and proof of address. It’s annoying, yes—but it’s also what stops criminals from using them. Compare that to shady DEXs like CRODEX or DerpDEX, where anyone can list a token with zero oversight. Those aren’t regulated. They’re wild west. And if your funds vanish? Good luck getting them back.

Regulation also affects how you’re taxed. In the UK, HMRC treats crypto as property, and a regulated platform will give you the transaction history you need to file correctly. In Mexico, the tax rules are still evolving, but if you’re using a regulated platform, you at least have clean data to work with. Meanwhile, platforms that avoid regulation often make it impossible to track your gains or losses—leaving you open to penalties. And let’s not forget privacy: crypto compliance, the process of following legal standards to prevent illicit use of digital assets. Also known as AML compliance, it doesn’t mean the government is spying on you. It means they’re stopping criminals from hiding stolen crypto, like the Lazarus Group using mixers to launder North Korean hacks. Regulation targets bad actors, not honest users.

Here’s the thing: regulation isn’t perfect. It’s slow, it’s expensive, and it sometimes stifles innovation. But if you’re holding real money in crypto, you want to know the platform you’re using has skin in the game. A regulated crypto platform can’t promise you 1000% returns, but it can promise you won’t wake up to a frozen account and zero support. The posts below dig into real examples—some platforms that got it right, others that pretended to, and the risks you face when you skip the basics. You’ll see what happens when regulation fails, how to spot fake compliance, and why your next move shouldn’t be based on hype alone.