BICC Exchange Fee Calculator

Estimate Your Fees

Based on industry standards for FSA-regulated exchanges in Japan

Estimated Fees

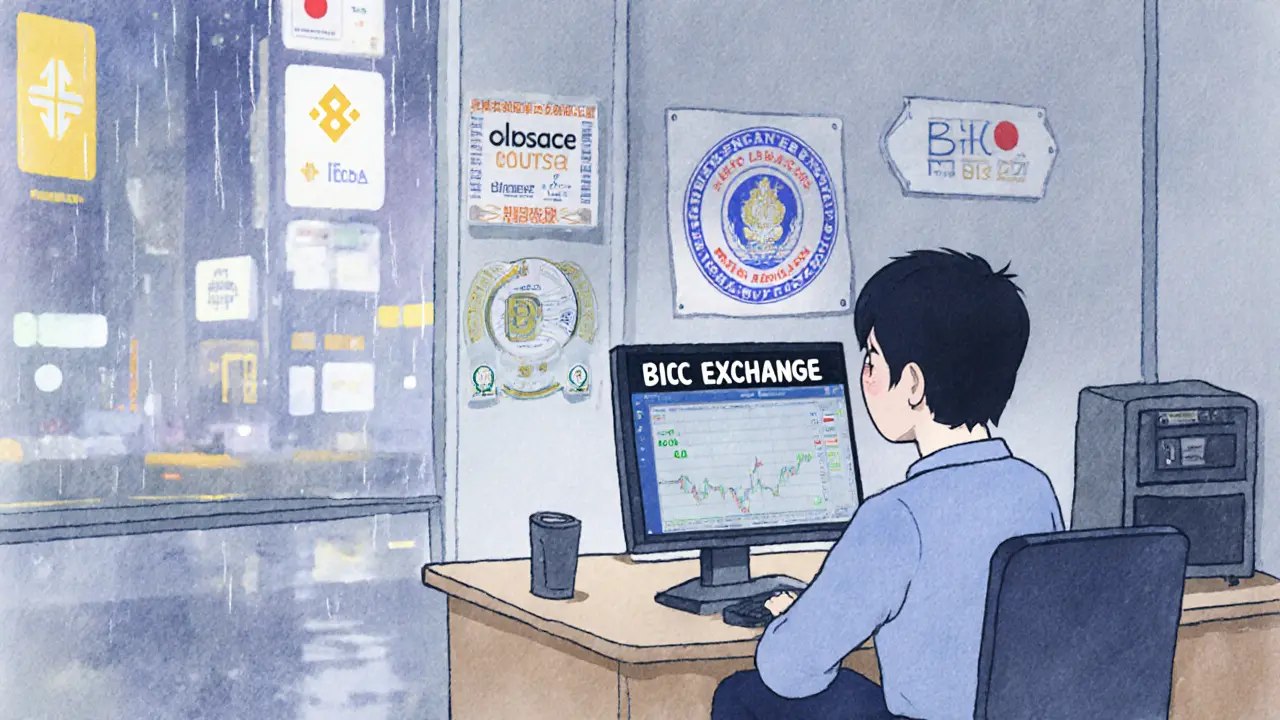

If you're looking for a crypto exchange based in Japan that's actually licensed by the government, BICC Exchange might be on your radar. But here’s the thing: you won’t find it on CoinGecko’s top 100 list. You won’t see it mentioned in most YouTube crypto roundups. And if you’re used to exchanges like Binance or Coinbase, BICC feels quiet - almost invisible. That doesn’t mean it’s a scam. It just means it plays by different rules.

What Is BICC Exchange?

BICC Exchange launched in 2018 and is registered under Japan’s Financial Services Agency (FSA). That’s a big deal. Japan was one of the first countries to crack down on unregulated crypto platforms after the Mt. Gox collapse. Since then, only exchanges that pass strict audits, keep user funds separate, and enforce KYC can legally operate. BICC is one of them.

Unlike global giants that chase international users, BICC focuses on the Japanese market. It supports trading in over 50 cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash. If you live in Japan and want to trade digital assets without stepping outside the law, BICC gives you a legal, regulated path.

How Does BICC Exchange Work?

BICC operates as a centralized exchange. That means they hold your crypto for you - not like a wallet where you control the keys. That’s standard for most exchanges, but it also means you trust them with your assets. So what’s their security like?

Every user must complete KYC. That’s not optional. You need to upload a government-issued ID - passport or driver’s license - and verify your email. Then you’re asked to turn on two-factor authentication (2FA). These steps aren’t just for show. They’re required by Japanese law. If you skip any of them, you can’t trade.

The signup process is straightforward:

- Go to the BICC website and click "Sign Up"

- Enter your name, email, and password

- Verify your email with the link they send

- Upload your ID for KYC

- Enable 2FA (Google Authenticator or Authy)

- Wait for approval - usually a few hours to a day

Once approved, you can deposit either cryptocurrency or Japanese Yen via bank transfer. Withdrawals work the same way. No credit cards, no PayPal, no third-party payment processors. Just direct bank transfers and blockchain deposits. It’s simple, but it’s also slow if you’re used to instant deposits on global platforms.

Trading Features and Asset Selection

BICC offers both spot trading and contract trading. Spot trading means buying and selling crypto at current market prices. Contract trading lets you speculate on price movements without owning the asset - think leverage, short positions, and futures. If you’re a beginner, stick to spot. If you’re experienced and understand the risks, contracts are available.

With over 50 coins listed, BICC has more options than some smaller Japanese exchanges. For example, BitFlyer USA only supports 11 cryptocurrencies. BICC gives you room to diversify beyond just BTC and ETH. You can trade lesser-known tokens like Chainlink, Solana, or Polygon - as long as they’re approved by Japan’s FSA.

But here’s the catch: liquidity matters. Even if a coin is listed, if no one’s trading it, you’ll struggle to buy or sell at a fair price. BICC doesn’t publish real-time volume data, and it’s not ranked on CoinMarketCap or CoinGecko. That’s a red flag for traders who need tight spreads and fast order fills.

How Does BICC Compare to Other Japanese Exchanges?

Japan has a few big players: BitFlyer, Coincheck, and GMO Coin. All are FSA-licensed. All have higher trading volumes. All appear on major exchange rankings.

BitFlyer has over 2 million users. Coincheck had $158 million in 24-hour volume as of October 2025. GMO Coin hit $125 million. BICC? No numbers are public. That’s not because it’s hiding - it’s because it doesn’t need to compete on volume. It’s not trying to be the biggest. It’s trying to be the safest.

Compared to these giants, BICC’s interface is simpler. Revain users describe it as "dynamic and user-friendly," but there aren’t many reviews. No detailed feedback on mobile apps, customer support response times, or fee structures. That’s unusual. Most exchanges, even small ones, have at least a few hundred user reviews. BICC has almost none.

That silence could mean one of two things: either users are happy and don’t feel the need to write reviews, or they’re not using it much. There’s no way to tell for sure.

Fees and Payment Methods

BICC doesn’t publish its fee schedule publicly. That’s a problem. If you’re comparing exchanges, you need to know the costs. Are deposits free? Are withdrawals charged per coin? Is there a spread markup?

Based on industry standards for FSA-regulated exchanges, you can expect:

- Free cryptocurrency deposits

- Small withdrawal fees (usually 0.0005 BTC for Bitcoin, 0.01 ETH for Ethereum)

- Trading fees around 0.1%-0.2% per trade, possibly lower for high-volume users

- Bank transfers for JPY deposits/withdrawals - likely free or low-cost

There are no sign-up bonuses, no referral programs, no cashback deals. BICC doesn’t lure users with promotions. That’s a good sign if you’re wary of exchanges that give away free crypto to attract scam targets. But it’s a downside if you’re looking for extra value.

Is BICC Exchange Safe?

Yes - but only if you’re in Japan.

BICC has never been flagged in any official scam database. California’s DFPI Crypto Scam Tracker doesn’t list it. No reports of hacks, frozen funds, or phishing scams tied to BICC. That’s rare. Most smaller exchanges get swallowed by fraud scandals within a few years. BICC has stayed clean for seven years.

Its FSA license is the strongest guarantee you’ll get. The agency requires exchanges to:

- Keep 95%+ of user funds in cold storage

- Submit monthly financial audits

- Separate customer assets from company funds

- Report suspicious activity to regulators

If BICC failed any of these, the FSA would shut it down immediately. That’s how strict Japan is.

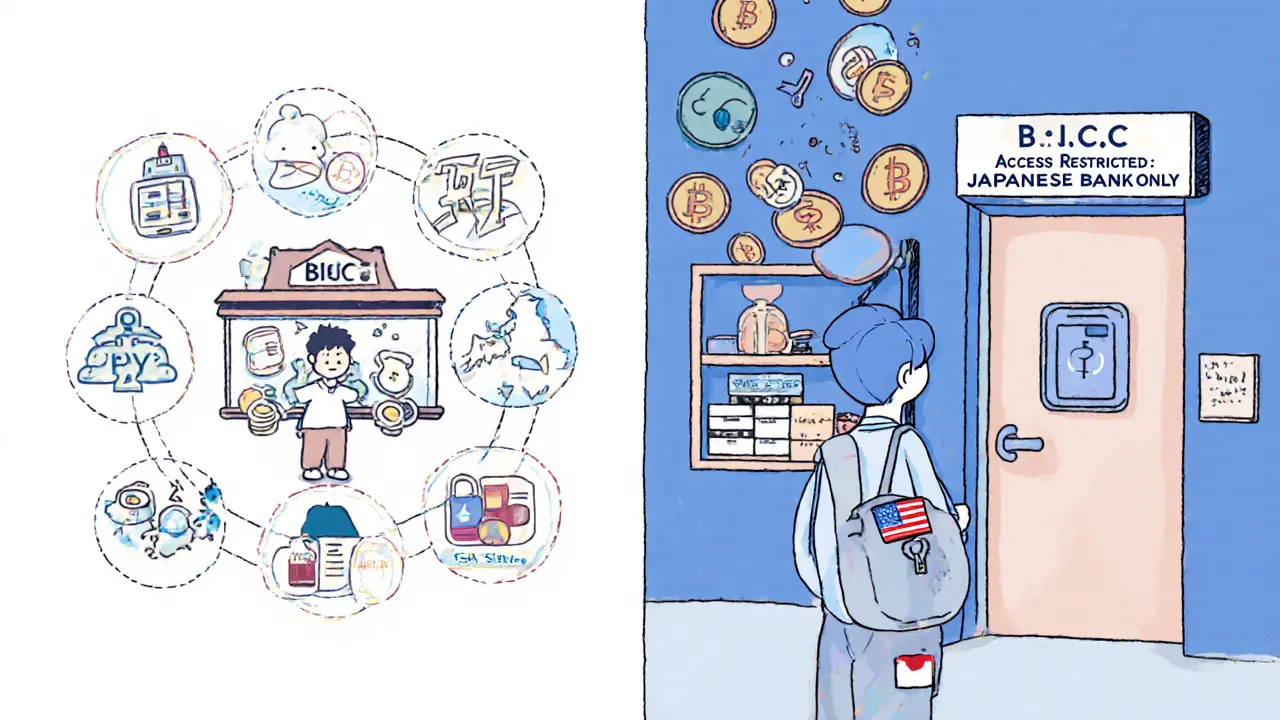

But safety doesn’t mean convenience. If you live outside Japan, you probably can’t open an account. The bank transfer option only works with Japanese banks. The KYC process asks for Japanese ID documents. The interface is mostly in Japanese. Even the customer support likely only responds in Japanese.

Who Is BICC Exchange For?

BICC isn’t for everyone. It’s not for Americans. Not for Europeans. Not for crypto traders who want to buy Dogecoin with a credit card or earn 10% APY on stablecoins.

BICC is for one group: Japanese residents who want to trade crypto legally, safely, and without risk of regulatory action. If you live in Tokyo, Osaka, or Fukuoka - and you want to hold Bitcoin without worrying about your exchange getting banned tomorrow - BICC is a valid option.

It’s not the fastest, not the cheapest, not the most popular. But it’s one of the few exchanges in Japan you can trust without doing a deep dive into its corporate structure.

The Bottom Line

BICC Exchange is a quiet, regulated, and safe platform - but only if you’re in Japan. It lacks the visibility, liquidity, and user feedback of bigger exchanges. It doesn’t offer bonuses, international support, or mobile apps that rival Coinbase or Kraken.

But if you care about legal compliance over flashy features, BICC delivers. It’s not trying to be the next Binance. It’s trying to be a reliable, long-term partner for Japanese investors. And in a market where so many exchanges have failed, that’s worth something.

For Japanese users: if you’ve done your research and want a platform that follows the rules, BICC is a solid choice. For everyone else: look elsewhere. There are better options with more features, more coins, and more support.

Is BICC Exchange regulated?

Yes. BICC Exchange is licensed and regulated by Japan’s Financial Services Agency (FSA). It has been operating under this license since 2018 and complies with Japan’s Payment Services Act, which requires strict KYC, cold storage of funds, and regular financial audits.

Can I use BICC Exchange if I live outside Japan?

Technically, you might be able to sign up, but it’s not practical. BICC requires Japanese bank transfers for fiat deposits and withdrawals, accepts only Japanese ID documents for KYC, and its interface and support are primarily in Japanese. Most international users will face blocked transactions and language barriers.

Does BICC Exchange have a mobile app?

There is no official mobile app for BICC Exchange as of October 2025. Users must trade via the website on desktop or mobile browsers. This is a disadvantage compared to competitors like Coincheck or BitFlyer, which offer dedicated iOS and Android apps with push notifications and faster access.

Why isn’t BICC on CoinGecko or CoinMarketCap?

BICC isn’t listed because it doesn’t meet the minimum trading volume or trust score thresholds required for inclusion. CoinGecko and CoinMarketCap prioritize exchanges with high liquidity and transparent volume data. BICC’s focus on the Japanese market means lower global volume, so it doesn’t rank - even though it’s fully regulated and legitimate.

Are there any known security issues with BICC Exchange?

No. BICC has never been reported in any official scam database, including California’s DFPI Crypto Scam Tracker. There are no public records of hacks, data breaches, or fund freezes linked to BICC. Its FSA license and seven-year operational history without incident suggest strong security practices.

What cryptocurrencies can I trade on BICC Exchange?

BICC supports over 50 cryptocurrencies, including major ones like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Bitcoin Cash (BCH), Chainlink (LINK), Solana (SOL), and Polygon (MATIC). All listed assets must comply with Japan’s regulatory standards, so you won’t find high-risk or meme coins like Dogecoin or Shiba Inu.

So let me get this straight - a crypto exchange that doesn’t show up on CoinGecko, has zero mobile app, and doesn’t publish fees is somehow ‘safe’? Cool. I’ll just stash my life savings in a shoebox labeled ‘FSA Approved’ then. 🤡

Honestly? I get why people are skeptical - but if you’re in Japan and want to avoid getting burned by some sketchy offshore platform, this is the kind of boring, slow, regulated stuff you actually want. No flash, no hype, just compliance. That’s crypto maturity right there.

Man, this feels like the crypto equivalent of a librarian who only speaks Japanese and refuses to use the internet. Beautiful. Quiet. Safe. But if you need a book - good luck finding it. The silence isn’t golden, it’s… hollow. Like a temple with no worshippers.

Think about it - we live in an age where every platform is screaming for attention, throwing free crypto like confetti, and treating users like dopamine addicts. BICC? It’s the quiet monk who meditates in the corner while the rest of the world burns down. It doesn’t need to be loud to be true. It doesn’t need to be popular to be pure. The market rewards noise - but history rewards patience. And safety. And regulation. This isn’t a platform. It’s a philosophy.

Yessss!! 🙌 Finally someone talks about safety over flash! If you’re in Japan, this is the *only* way to go. No scams, no rug pulls, no shady VCs - just clean, legal, FSA-backed trading. I’ve been using it for 2 years and zero issues. Trust > hype! 💪

It’s not that BICC is bad - it’s just that it’s not designed for you. If you’re not a Japanese resident, this is irrelevant. The fact that you’re even considering it from the US suggests you didn’t read the article. Read it again.

Oh please. ‘Safe’? Because it’s regulated? That’s like calling a prison safe because it has walls. What happens when the FSA gets bought out by a conglomerate? What happens when they change the rules tomorrow? You think regulation = safety? That’s the lie the banks sold us before 2008.

Agree with the point about liquidity. Even if it’s legit, if you can’t trade your tokens without waiting 3 days and paying $15 in fees, it’s not useful. Regulation doesn’t fix bad UX.

Wait, so BICC doesn't list DOGE or SHIB? That’s actually a feature, not a bug. Most of these meme coins are just pump-and-dumps. I’d rather trade SOL and LINK with a regulated exchange than gamble on Dogecoin with a random platform. Japan knows what it’s doing.

they say its safe but what if the fsa is corrupted what if its all a cover for the fed to track your crypto what if this is how they start freezing wallets next what if this is step one of the digital dollar takeover

So the exchange is quiet because it’s not a scam? That’s the best defense they got? No reviews? No volume? No app? Sounds like a ghost town with a fancy license.

For Japanese users this is gold. For everyone else? It’s a nice thought experiment. I wish more places had this level of regulation - but you can’t force it on people who don’t live there. It’s like bringing a snowboard to the desert.

really appreciate this breakdown. i was worried about using any exchange outside usa but if its legit in japan and clean for 7 years? that’s rare. maybe i’ll move there just to use this lol

One must admire the discipline of an institution that forgoes marketing, liquidity metrics, and global expansion in favor of regulatory integrity. In an era of performative finance, BICC represents a quiet form of resistance - not against technology, but against commodification.

if you’re in japan and you want to trade crypto without stressing about getting raided by the cops - this is your guy. simple, clean, no nonsense. i’ve used it for 3 years. no complaints. not flashy but not sketchy either.

Wow. A crypto exchange that doesn’t have a mobile app? Doesn’t list Shiba Inu? Doesn’t even publish fees? This isn’t a platform - it’s a time capsule from 2013. The fact that people are calling this ‘safe’ just proves how desperate we are for anything that isn’t a scam.

This isn’t an exchange - it’s a cautionary tale dressed in compliance paperwork. The silence isn’t golden. It’s the sound of a company that doesn’t want attention because it doesn’t have enough users to matter. Regulated? Sure. Relevant? Absolutely not.

the fact that this place doesn’t have a mobile app is kinda refreshing honestly. no notifications, no FOMO, no push alerts telling you to ‘buy now!’ just you, your bank transfer, and your crypto. it’s like digital minimalism.

i think the real issue is that people expect exchanges to be like amazon or netflix but crypto is different. if you want speed and hype go to binance if you want safety and silence go to bicc. its not broken its just not built for you. also the kyc is kinda annoying but hey its japan

they say 'no hacks' but what if the fsa is just hiding it? what if they're all in on this? what if this is the first step to a crypto surveillance state? i've seen this movie before... it always ends with them taking your money and calling it 'regulation'.