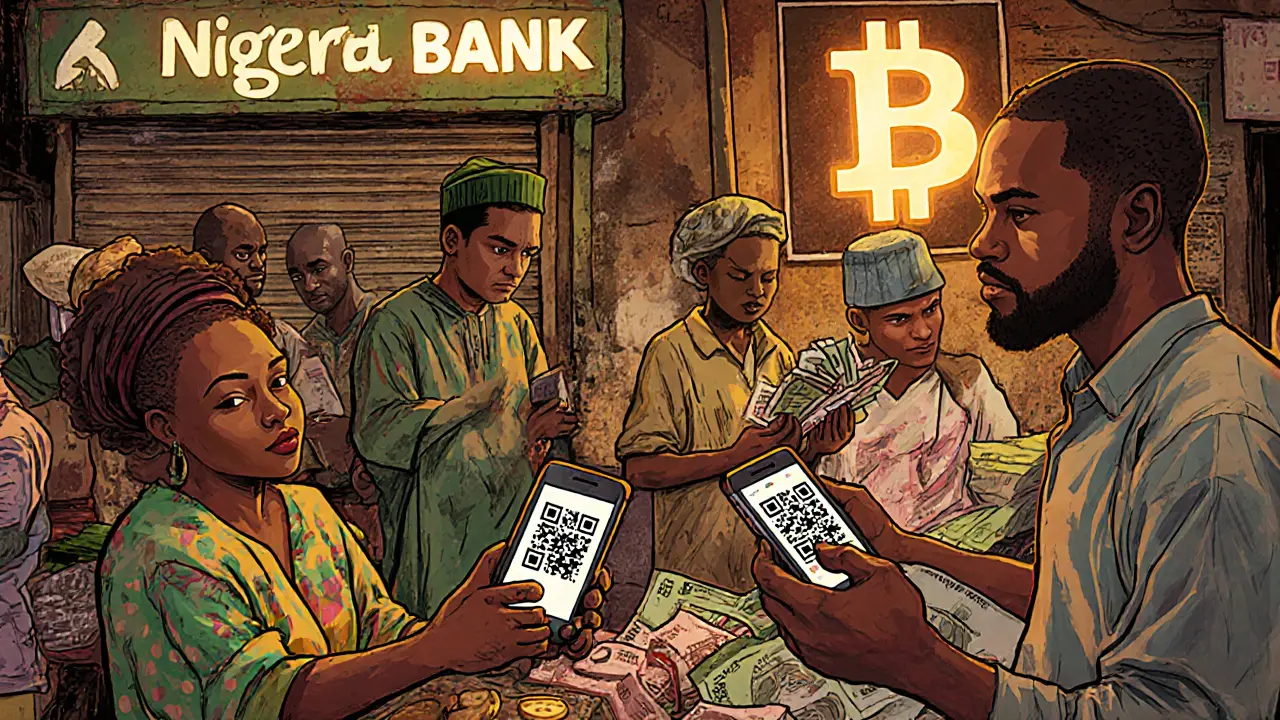

Naira Inflation Crypto: How Nigerians Use Crypto to Beat Currency Collapse

When the Naira, the official currency of Nigeria, has lost over 70% of its value against the US dollar since 2023. Also known as Nigerian naira, it's no longer a reliable store of value—just a medium for daily transactions before it drops again. That’s why thousands of Nigerians are turning to crypto, digital assets like Bitcoin and stablecoins that operate outside government control. Also known as cryptocurrency, it’s not speculation here—it’s survival. People aren’t buying Bitcoin to get rich overnight. They’re using stablecoins, crypto tokens pegged to the US dollar, like USDT and USDC, to protect their savings from sudden devaluation. Also known as digital dollars, they’re the closest thing to cash that can’t be seized or devalued by the Central Bank.

The Naira’s collapse isn’t just about prices rising. It’s about access. Banks limit withdrawals. Foreign exchange is rationed. Paying for imports, sending money abroad, or even buying medicine can take weeks. Crypto bypasses all that. P2P platforms like Paxful and LocalBitcoins let Nigerians trade Naira for USDT in minutes. No bank approval. No delays. No middlemen. This isn’t a trend. It’s a response to systemic failure. And it’s working. A 2024 Chainalysis report showed Nigeria ranked #2 globally in crypto adoption—behind only Vietnam—not because people love tech, but because they had no other choice.

It’s not perfect. Scammers target newcomers. Some exchanges freeze accounts. But the core truth remains: when your currency loses value daily, crypto isn’t risky—it’s the safer option. The posts below show how real people are using crypto to protect their income, send remittances, and avoid the worst of Nigeria’s economic chaos. You’ll find guides on stablecoin swaps, P2P safety tips, and real stories from traders who turned crypto into a lifeline. No fluff. No hype. Just what’s working on the ground.