Naira to USDT Value Converter

Protect Your Savings from Inflation

Nigeria's naira loses value daily. Convert naira to USDT stablecoin to see how much your savings would hold their value. Used by 22 million Nigerians to protect their wealth from inflation.

Current Context: Naira has lost over 75% value since 2016. Inflation hit 24% in 2023. USDT (pegged to USD) provides stable value when naira fluctuates.

Current exchange rate: USDT = ₦1,025.50 (Updated: 2025-03-22)

Your Savings Value

Naira amount

₦0.00

0.00 USDT

USDT maintains stable value while naira loses 10% weekly

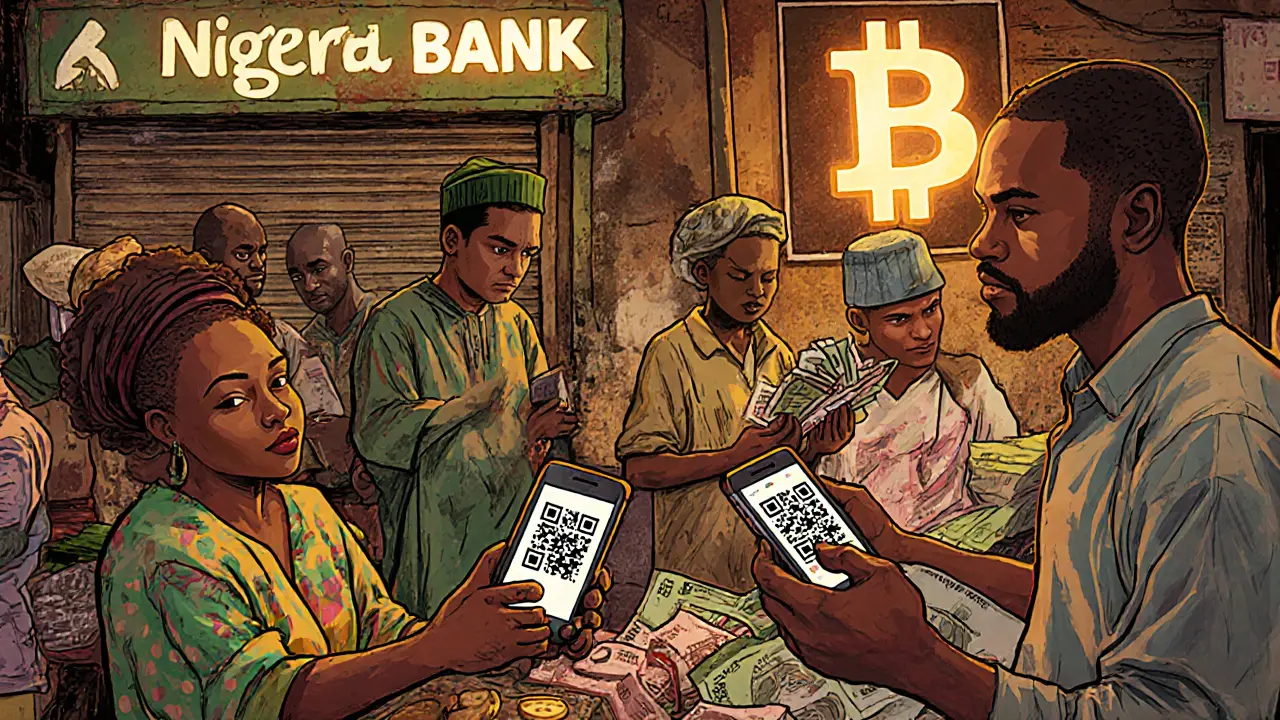

Why Nigerians Are Turning to Crypto in Record Numbers

Over 22 million Nigerians-more than 10% of the population-now own cryptocurrency. That’s not a trend. It’s a survival strategy. While governments and banks struggle to keep the naira stable, ordinary people are using Bitcoin, USDT, and other digital assets to protect their savings, pay for goods, and receive money from abroad. This isn’t happening because crypto is trendy. It’s happening because the naira has lost over 75% of its value since 2016, inflation hit 24% in 2023, and banks won’t let most people access their own money.

The Ban That Was Lifted-And Why It Changed Everything

In 2021, the Central Bank of Nigeria (CBN) told banks to cut off services to crypto exchanges. The message was clear: don’t touch this. But people didn’t stop. They just moved to peer-to-peer (P2P) platforms like Binance P2P, where traders bought and sold crypto directly using bank transfers, mobile money, or even cash. The ban didn’t kill crypto-it forced it underground, where it grew faster.

Then, in late 2023, the CBN reversed course. Licensed exchanges could now operate openly. Banks were told to resume services. Why? Because the crackdown had failed. People were still trading. The economy was still bleeding. And crypto was the only thing keeping remittances flowing. By 2025, Nigeria saw over $59 billion in crypto transactions in just one year. That’s not speculation-it’s data from Chainalysis and the World Bank.

How Crypto Is Beating the Banking System

One in three Nigerian adults is unbanked. That means they don’t have access to savings accounts, loans, or even basic digital payments. Traditional banks are concentrated in cities. Rural areas? Forget it. Crypto fills that gap. All you need is a smartphone and internet. No ID? No problem. Many P2P platforms let you trade with just a phone number and a profile photo.

For freelancers and remote workers, crypto is the only way to get paid. Sending $1,000 through Western Union or MoneyGram used to cost up to $80 in fees. Now, with USDT, the fee is under $1-and the money arrives in minutes. Nigerians on Upwork, Fiverr, and remote jobs in Europe and the U.S. are switching to crypto wallets because it’s faster, cheaper, and reliable.

The Inflation Hedge That Actually Works

When the naira drops 10% in a week, people panic. They rush to buy dollars. But dollars are hard to get. The official exchange rate is useless. The black market rate is risky. So they buy Bitcoin or USDT instead. Stablecoins like USDT are pegged to the U.S. dollar. They don’t swing wildly like Bitcoin. They’re digital cash that holds value.

Reddit threads in Nigeria are full of stories: “I saved ₦500,000 in my bank account. After inflation, it was worth ₦300,000 in real terms. I moved it to USDT. Now it’s worth what it was.” That’s not anecdotal. It’s happening every day. A March 2025 currency devaluation triggered a $25 billion monthly spike in crypto transactions across Sub-Saharan Africa-mostly from Nigeria. While other countries saw crypto activity drop, Nigeria surged. People weren’t gambling. They were protecting their livelihoods.

Who’s Using Crypto-and How

Nigeria’s crypto users aren’t just tech bros in Lagos. They’re market traders in Kano, students in Ibadan, drivers in Port Harcourt, and nurses in Enugu. Most start with Binance P2P or Quidax. They buy small amounts-₦5,000, ₦10,000-just to test it. Within two to four weeks, they learn how to send, receive, and store crypto. No coding. No fancy tools. Just a phone and a WhatsApp group.

Telegram and WhatsApp are the real classrooms. Experienced users share tips: “Don’t keep your crypto on the exchange. Use a wallet.” “Use Binance P2P, not local exchanges-better rates.” “Always check the seller’s trade history.” These aren’t forums. They’re survival networks.

Even small transactions matter. Over 8% of all crypto value sent in Sub-Saharan Africa is under $10,000. That’s retail use-people buying food, paying school fees, sending money to relatives. In the U.S. or Europe, crypto is for investors. In Nigeria, it’s for daily life.

The Rise of Local Fintech Giants

Nigeria isn’t just adopting crypto-it’s building its own ecosystem. Moniepoint, a digital payment platform that lets small businesses accept payments via phone, became a unicorn in 2025 with a $1 billion valuation. Google invested in it. Why? Because Moniepoint integrates crypto payouts. Farmers, tailors, and mechanics can now get paid in crypto and convert it to naira instantly.

Then there’s NIBSS, Nigeria’s national payment processor. In 2025, it partnered with Zone’s blockchain network to make interbank transfers faster and fraud-proof. This isn’t about replacing banks. It’s about upgrading them. The government isn’t fighting crypto anymore. It’s trying to ride it.

What’s Still Broken

Adoption isn’t perfect. Exchange platforms still crash during price spikes. Some local apps shut down without warning. Customer support on international exchanges like Binance can take days to respond. And while the CBN lifted its ban, the rules are still vague. Are you taxed on crypto gains? Can you use crypto to pay for imports? No clear answers.

Security is another worry. Scammers pose as support agents. Fake wallets steal private keys. Many users still don’t understand how to store crypto safely. A 2025 survey found that 40% of new users kept their crypto on exchanges-where it’s vulnerable to hacks.

And then there’s the risk of policy reversal. If global pressure grows-or if inflation drops-the government could clamp down again. That’s the shadow hanging over every crypto user in Nigeria.

The Future Is Already Here

Nigeria is now the second-most crypto-adoption country in the world, behind only India. It’s not because of marketing. It’s because the system failed, and people built something better. The next phase? Institutional use. Banks are starting to offer crypto-linked savings accounts. Pension funds are exploring blockchain for transparency. The Central Bank is testing its own digital currency, the eNaira-but so far, it’s not catching on. Why? Because it’s still tied to the naira.

Crypto in Nigeria isn’t a fad. It’s infrastructure. It’s the new ATM. The new bank. The new remittance network. And it’s growing because the old systems won’t fix themselves.

Is crypto legal in Nigeria?

Yes, crypto is legal to own and trade in Nigeria. The Central Bank of Nigeria lifted its 2021 ban on banks serving crypto businesses in late 2023. Licensed exchanges like Binance, Quidax, and Yellow Card now operate openly. However, the government hasn’t passed full crypto laws yet, so regulation remains unclear in areas like taxation and business use.

Can I use crypto to pay for things in Nigeria?

Yes, but not everywhere. Major online retailers, freelancing platforms, and some tech startups accept crypto. A growing number of physical stores in Lagos, Abuja, and Port Harcourt accept Bitcoin or USDT for goods and services. Most people still convert crypto to naira first using P2P platforms. Direct crypto payments are rising but still niche.

Which crypto is most popular in Nigeria?

Bitcoin is the most traded, but USDT (Tether) is the most used. USDT is a stablecoin pegged to the U.S. dollar, so it holds its value even when the naira crashes. People use it to store savings, send money abroad, and pay for imports. Ethereum and Solana are growing for DeFi, but most users stick to Bitcoin and USDT.

How do I start using crypto in Nigeria?

Download the Binance app, go to P2P trading, and buy USDT with your bank account or mobile money. Start small-₦5,000 or ₦10,000. Join a Nigerian crypto Telegram group for help. Once you’re comfortable, move your crypto to a non-custodial wallet like Trust Wallet or MetaMask for safety. Never keep large amounts on exchanges.

Is crypto safer than saving in naira?

For most Nigerians, yes. The naira loses value every day due to inflation. Crypto, especially stablecoins like USDT, holds value better. But crypto isn’t risk-free-exchanges can fail, scams exist, and prices can swing. The key is to use crypto as a tool to protect wealth, not as a gamble. Store it securely, use it for real needs, and never invest more than you can afford to lose.

Oh wow, so Nigeria’s just bypassed the entire global financial system because the naira is trash? Cool. Next they’ll be using Bitcoin to pay for their next military coup. I bet the IMF is just sobbing into their gold bars right now. 🤡

this is actually so cool to see. people just figuring out how to survive when the system fails them. no gov, no bank, just a phone and some trust. kinda beautiful in a messed up way. i wish more places had this kind of grassroots innovation.

Let me get this straight-people are using crypto not because they believe in decentralization, but because their government is incompetent and their banks are closed? That’s not a revolution. That’s a cry for help wrapped in a blockchain. And yet… I can’t help but admire the ingenuity. Who needs a central bank when you’ve got a WhatsApp group and a phone number?

i’ve seen this first hand from my cousins in lagos. they started with 5k naira on binance p2p, just to test. now they’re sending money to their siblings in the uk without waiting 3 days or paying 15% fees. it’s not about getting rich-it’s about not losing everything every week. the real win? they’re teaching each other. no degrees needed, just real talk in group chats. this is how change happens.

The data’s solid but the narrative’s soft. People aren’t adopting crypto they’re escaping collapse. And let’s be real-USDT isn’t magic. It’s just dollar proxy with higher risk. If the peg breaks, so does their entire financial safety net. Still. Better than naira inflation.

What’s fascinating isn’t the tech-it’s the social infrastructure. The WhatsApp groups, the Telegram tutorials, the unspoken rules passed from one person to another. This isn’t Silicon Valley. This is grassroots financial literacy, built by people who have nothing to lose and everything to gain. The banks didn’t fail them. They just stopped trying.

I’ve been following this for a while. The real story isn’t the $59 billion in volume-it’s the 8% of transactions under $10k. That’s not speculation. That’s grocery money. School fees. Rent. People treating crypto like cash, not a lottery ticket. It’s quiet, practical, and incredibly human.

Nigeria? You call that adoption? You’re just using crypto because you can’t print money without it turning into toilet paper. Meanwhile, real economies have central banks that work. This isn’t innovation-it’s desperation dressed up in whitepaper jargon. And don’t even get me started on USDT being ‘stable’. Ha.

One must consider the geopolitical implications. The Central Bank of Nigeria’s reversal is not a capitulation to innovation-it is a coerced adaptation under the weight of mass civil disobedience. The fact that $25 billion in monthly transactions emerged from a state of enforced financial isolation suggests not merely adoption, but systemic rebellion. The digital currency regime, in this context, is not a tool-it is a weapon of the disenfranchised.

It’s amazing how something so simple-a phone, a wallet, a friend who knows how it works-can rebuild a financial lifeline. No one’s asking for permission. No one’s waiting for a law. They’re just doing it. And honestly? That’s the most powerful kind of progress.

Let’s be honest-Nigeria’s crypto boom is just a symptom of a failed state. You don’t build an economy on P2P trades and WhatsApp tutorials. You build it on institutions. This isn’t progress-it’s a house of cards held together by desperation and poor regulation. And when the CBN comes back with teeth, it’ll all collapse like a bad ICO.

I mean… I get it. But like… why not just get a VPN and use PayPal? 😴

my friend in abuja just paid her kid’s school fees in usdt last week. the school converted it to naira the same day. no drama, no delays. she said it felt like magic at first. now she just calls it ‘normal’. that’s the real win. not the headlines. not the numbers. just someone who finally doesn’t have to choose between feeding her family or watching her savings vanish.

This is not financial innovation. This is a third-world workaround. Real economies have central banks, legal frameworks, and stable currencies. Nigeria’s situation is tragic, but it does not mean crypto is the solution. It is merely a temporary bandage on a severed artery. The government must fix the naira, not encourage digital chaos.