Inflationary Tokens: What They Are and Why They Matter in Crypto

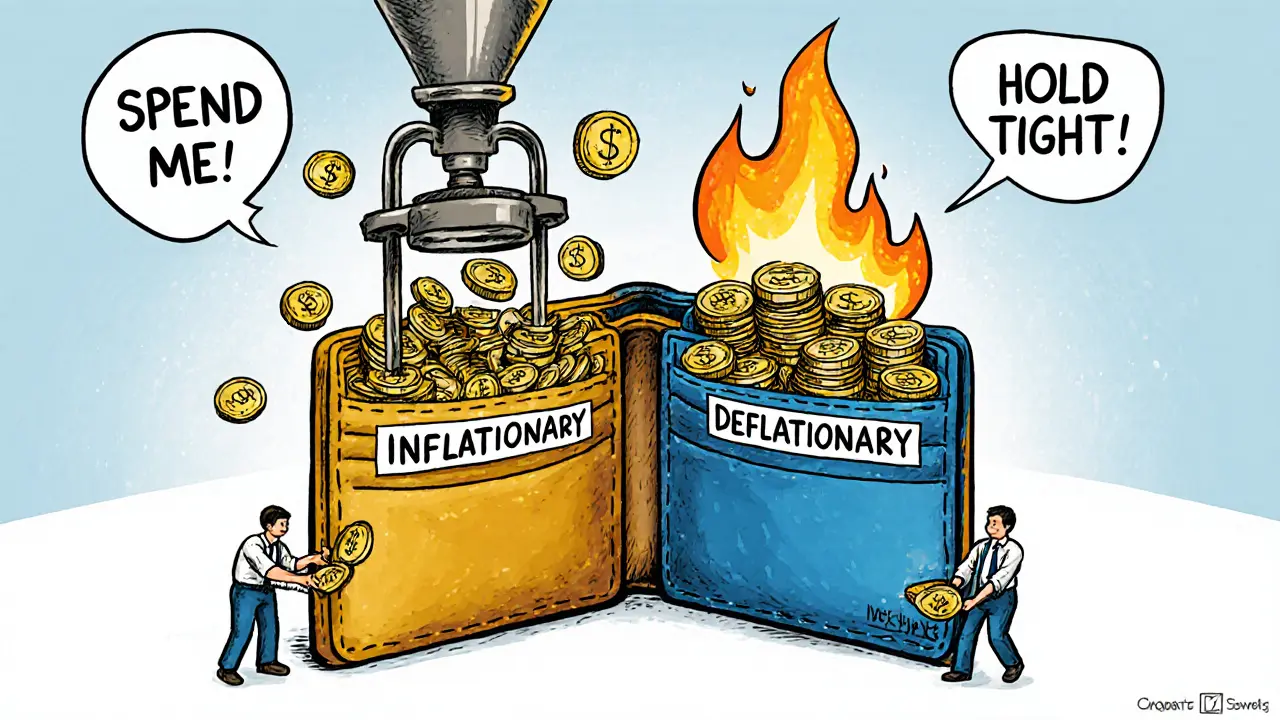

When you hear inflationary tokens, cryptocurrencies with a continuously increasing supply that can dilute value over time. Also known as floating supply coins, they’re designed to reward stakers, fund development, or encourage spending—unlike deflationary coins that burn tokens to create scarcity. Most people think all crypto is like Bitcoin, where there’s a hard cap of 21 million. But that’s not true. Many newer projects intentionally keep printing new coins, and that changes everything about how you judge their long-term value.

Tokenomics, the economic design behind a cryptocurrency’s supply, distribution, and usage is where the real story lies. Some inflationary tokens, like those used in GameFi or DeFi platforms, need constant new supply to keep rewards flowing to users. Others, like meme coins with no real utility, use inflation as a way to keep trading volume high—even if it means your holdings lose purchasing power. Compare that to deflationary tokens, coins that reduce total supply over time through burning mechanisms, which aim to increase scarcity and, ideally, value. The difference isn’t just technical—it’s financial. If you hold a token that adds 5% more coins every year, your share of the pie gets smaller unless the price rises faster than inflation.

Look at the posts below. You’ll see examples like inflationary tokens hiding in plain sight: projects that promise rewards but never explain where the new coins come from, or exchanges that list tokens with infinite supply and zero audits. Some, like CHEEPEPE or AINN, started with hype and kept printing tokens to fuel short-term trading. Others, like RACA or SHARDS, used token inflation as part of their airdrop mechanics to distribute rewards widely. But here’s the catch: if you don’t know how many new coins are being added each month, you’re guessing at your real returns. This collection breaks down which tokens are truly inflationary, which ones pretend to be deflationary, and how to spot the ones that could wipe out your gains over time.