Digital Yuan: What It Is, How It Works, and Why It Matters

When you hear digital yuan, China's official central bank digital currency launched by the People's Bank of China. Also known as e-CNY, it's not just another cryptocurrency—it's the first major nation-state to roll out a fully controlled digital version of its fiat money. Unlike Bitcoin or Ethereum, the digital yuan isn’t decentralized. It’s designed to replace cash, track spending, and give the Chinese government direct control over how money flows through its economy.

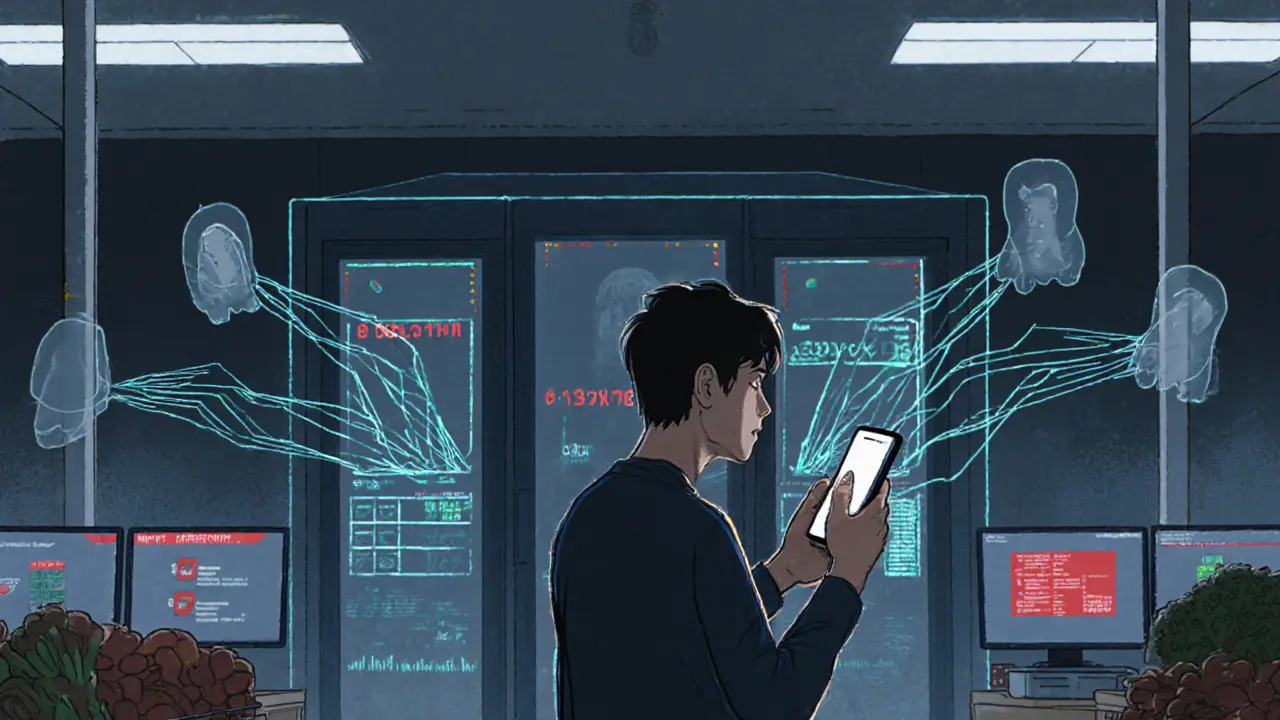

This isn’t theoretical—it’s already in use. Over 260 million people have tried the digital yuan wallet, and it’s accepted in everything from street markets to subway stations across dozens of cities. The government uses it to distribute subsidies, pay public workers, and even enforce spending rules—like limiting how much you can spend on luxury goods. It’s also being tested internationally, with pilot programs in places like Thailand and the UAE, where Chinese tourists can pay using e-CNY without exchanging currency. That’s a quiet but powerful move to challenge the dollar’s global dominance.

The CBDC, central bank digital currency, a digital form of a country’s official money issued and regulated by its central bank is the broader category the digital yuan belongs to. While the U.S. and Europe are still studying the idea, China is already running live trials with real money. That puts pressure on other nations to respond—not because they want to copy it, but because they fear being left behind in a world where payment systems are no longer neutral.

What makes the digital yuan different from apps like Alipay or WeChat Pay? Those are private platforms that still rely on bank accounts and traditional currency. The digital yuan is money itself—issued by the central bank, stored in a government-controlled wallet, and settled instantly without banks in between. That means the government can freeze transactions, set expiration dates on funds, or even program rules like ‘this money can only be spent on groceries.’

It’s not just about payments. The blockchain finance, the use of distributed ledger technology to improve transparency, speed, and control in financial systems behind the digital yuan isn’t public like Bitcoin’s. It’s a private, permissioned ledger, meaning only approved nodes can validate transactions. This gives China speed and control, not openness. And that’s the point: it’s finance as a tool of state policy, not financial freedom.

What you’ll find in the posts below aren’t hype pieces or speculative takes. These are real breakdowns of how digital currencies like the yuan are reshaping global finance, what governments are doing behind the scenes, and how everyday people are affected. You’ll see how China’s move connects to tokenized assets, regulatory shifts, and even how other countries are responding. No fluff. No guesses. Just what’s actually happening as the world’s money system changes under our feet.