Digital Euro: What It Is, Why It Matters, and How It Changes Crypto

When you hear digital euro, a central bank digital currency (CBDC) issued by the European Central Bank to replace physical cash in digital form. Also known as e-euro, it’s not a cryptocurrency—it’s a state-backed digital version of the euro, designed to be used just like cash but on your phone or card. Unlike Bitcoin or Dogecoin, it won’t be mined or traded on decentralized exchanges. It’s controlled, tracked, and issued by governments. And that’s exactly why it’s shaking up the crypto world.

The European Central Bank, the governing body responsible for monetary policy in the Eurozone, including the development and rollout of the digital euro has been testing the digital euro since 2021. By 2025, they’re close to launching a pilot. This isn’t just about convenience. It’s about control. Governments want to reduce reliance on private payment systems like PayPal or crypto wallets, and they want to track every euro spent. That’s why the digital euro will likely have built-in limits—maybe caps on daily spending, or restrictions on anonymous transfers. It’s not about freedom. It’s about compliance.

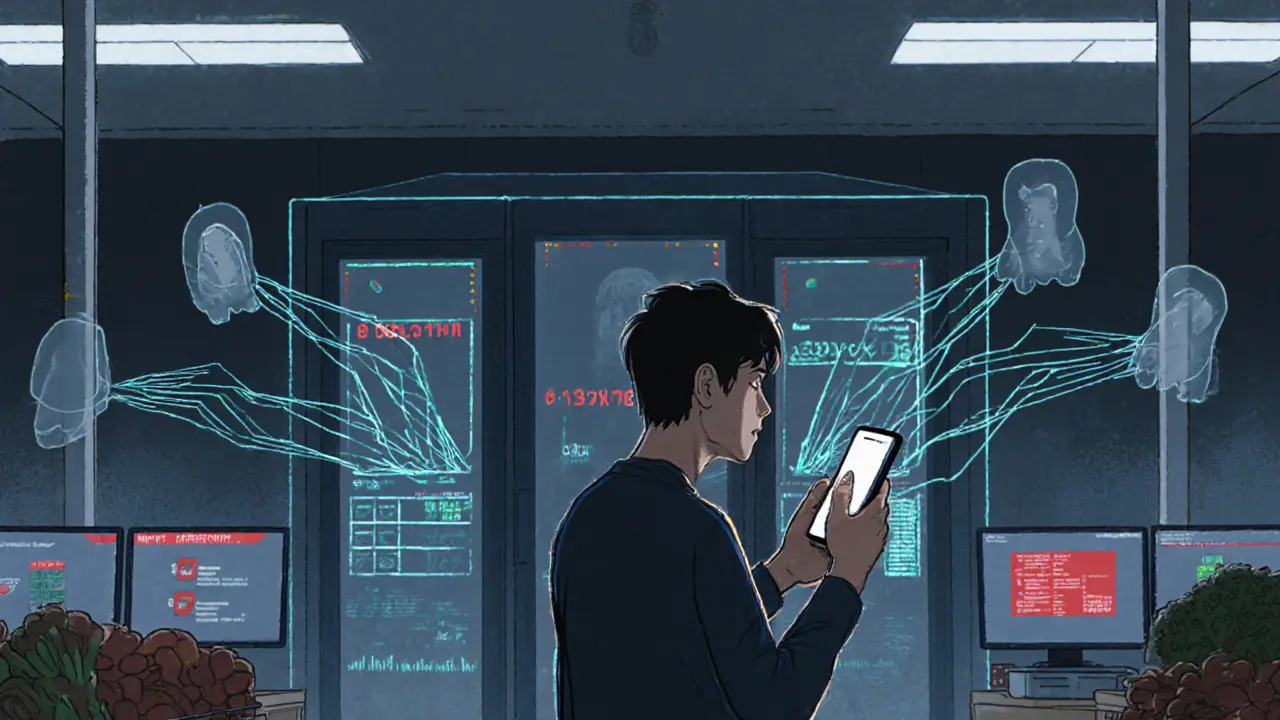

This directly impacts how you use CBDC, a government-issued digital currency backed by a central bank, designed to coexist with cash and private digital payments in your portfolio. If the digital euro becomes the default way Europeans pay for groceries, rent, or bills, stablecoins like USDT or USDC could lose ground. Why hold a crypto token pegged to the euro when the euro itself is now digital, instant, and backed by the state? Some DeFi platforms might even start accepting the digital euro directly—bypassing traditional banks entirely. But here’s the catch: you won’t be able to send it to a wallet you control like you can with Bitcoin. The digital euro will live in apps approved by the ECB. No self-custody. No anonymity.

That’s why the digital euro isn’t just a payment upgrade—it’s a power shift. It changes who owns your financial data, who controls your money flow, and what role crypto plays in everyday life. In countries like Nigeria or Argentina, crypto is a lifeline against inflation. In Europe, the digital euro could be the new lifeline—controlled by the state, not the market. And that’s why the posts below matter. You’ll find reviews of exchanges that might soon support it, deep dives into how CBDCs affect privacy, and breakdowns of how governments are using blockchain to track money—not to empower users, but to manage them. This isn’t speculation. It’s happening now. And if you’re holding crypto in Europe, you need to know what’s coming.