Deflationary Tokens: How Scarce Crypto Coins Drive Value

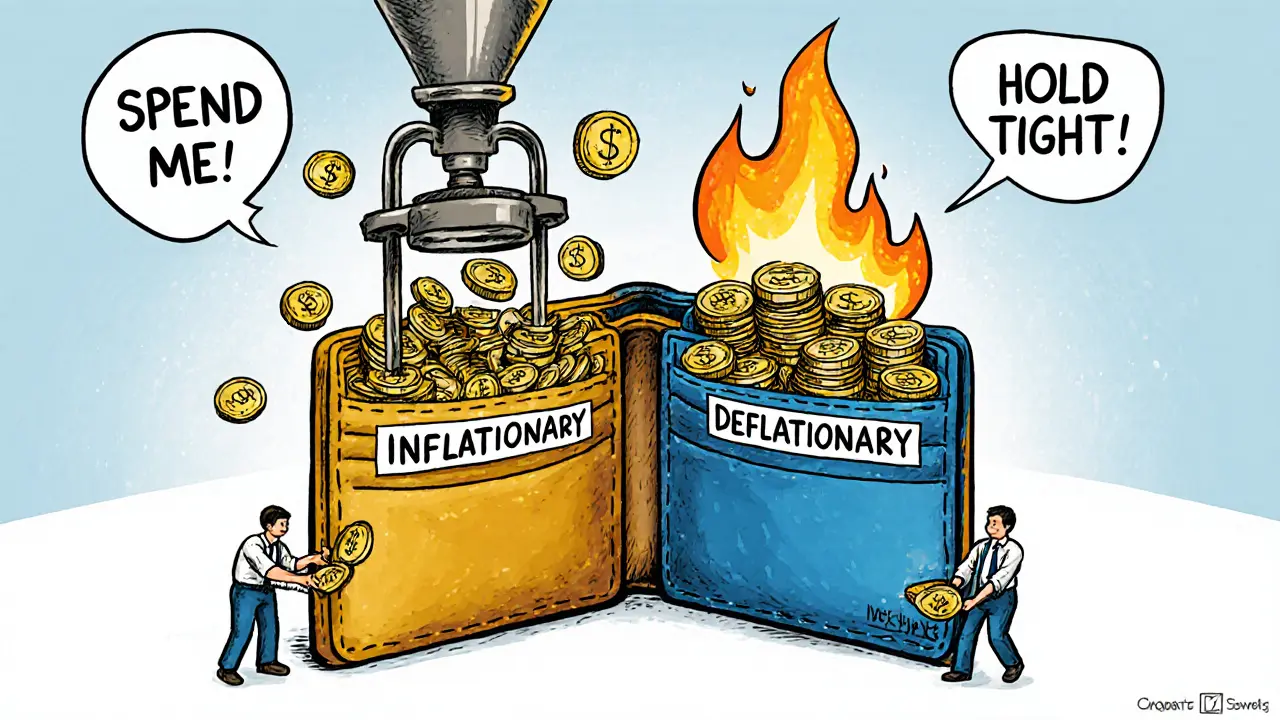

When you buy a deflationary token, a cryptocurrency with a fixed or shrinking total supply that reduces over time through burning mechanisms. Also known as burnable tokens, it works differently from most coins that just print more forever. This scarcity is built into the code—not just a marketing claim—and it changes how people think about value, holding, and long-term use. Unlike inflationary coins where new tokens keep being created, deflationary tokens make each remaining unit more valuable simply because fewer exist. Think of it like gold versus paper money: one gets harder to find, the other keeps getting printed.

Deflationary tokens often burn a percentage of every transaction, lock up supply in dead wallets, or cap the maximum supply at launch. Bitcoin is the original example—only 21 million will ever exist. But newer tokens like Binance Coin (BNB), a token that regularly burns tokens quarterly to reduce supply and increase scarcity, take this further by actively removing coins from circulation. Others, like SHIB, a meme coin that burned over 90% of its supply to create artificial scarcity, use burning as a way to signal commitment—even if their utility is weak. The real winners aren’t just the ones that burn tokens, but the ones that combine scarcity with real demand.

Not every token that says "deflationary" actually delivers. Some just lock up supply without any real use case. Others burn coins but still have infinite minting rules hidden in the code. That’s why you need to look past the label. Check the contract, see how much has been burned, and ask: does anyone actually use this coin? The posts below dig into real examples—some that worked, others that collapsed—and show you how to tell the difference between a smart design and a flashy lie. You’ll find reviews of exchanges where these tokens trade, deep dives into tokenomics, and breakdowns of airdrops tied to deflationary models. No fluff. Just what matters when your money’s on the line.