Cryptocurrency Supply: What It Means and Why It Matters

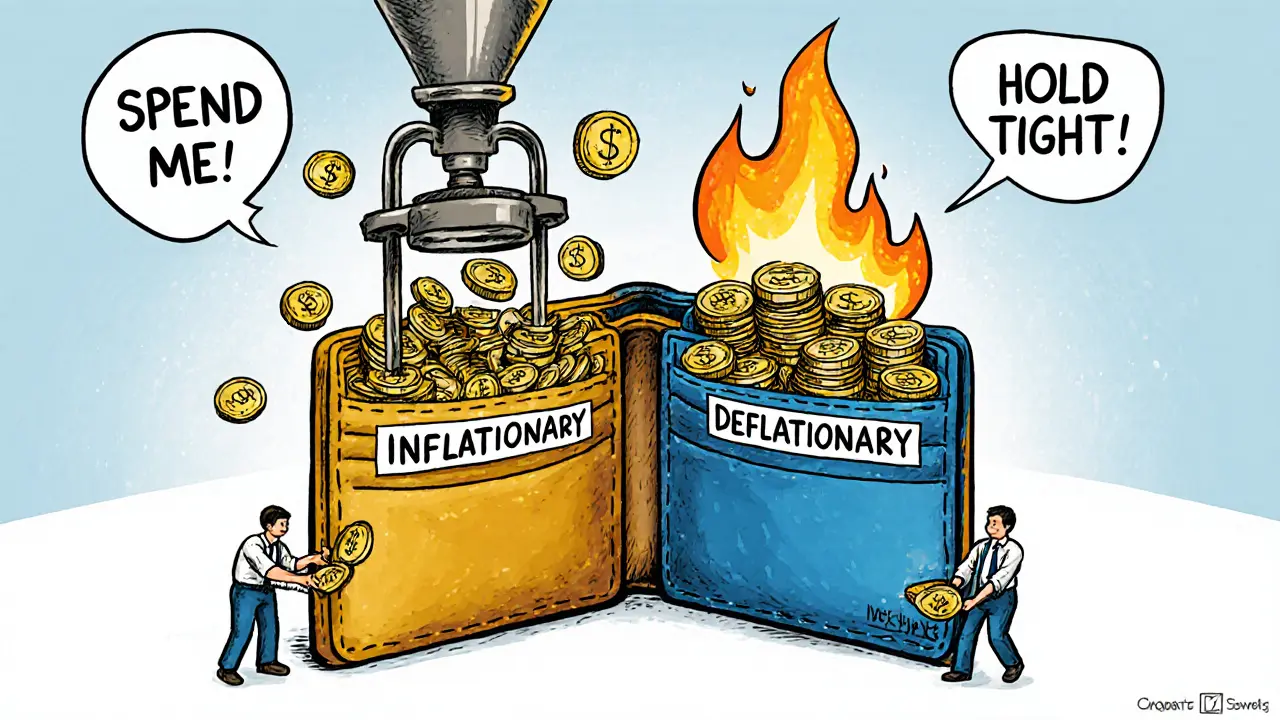

When you hear cryptocurrency supply, the total amount of a coin or token that exists or will ever exist, including what’s locked, burned, or in circulation. Also known as token supply, it’s one of the most overlooked but powerful factors behind a crypto’s price behavior. It’s not just about how many coins are out there—it’s about who controls them, when they’re released, and whether the supply is fixed or endless.

There are three key types you need to know: circulating supply, the number of coins actively available to the public and trading on exchanges, total supply, all coins that have been created, including those locked in wallets or reserved for future use, and max supply, the absolute cap on how many coins will ever exist. Bitcoin, for example, has a max supply of 21 million—no more, no less. That’s why people call it digital gold. But many newer tokens have no cap, or the cap is so high it doesn’t matter. That changes everything.

Projects with low circulating supply and high demand often see big price spikes—think of early Dogecoin or Shiba Inu. But if a project dumps a huge chunk of tokens all at once, the price crashes. That’s why you need to check not just how many coins exist, but how they’re distributed. A few wallets holding 80% of the supply? That’s a red flag. A well-distributed supply with gradual unlocks? That’s more sustainable. You’ll see this play out in real projects like USDT.a, which has a stable supply backed by reserves, or BTC2.0, which has infinite supply and zero real value behind it. The difference isn’t technical—it’s about trust.

Supply isn’t just a number on a chart. It’s tied to incentives. Airdrops like the RACA x BSC GameFi Expo II or the WorldShards SHARDS drop rely on controlled supply to reward early users without flooding the market. Staking rewards on platforms like MultiversX or Fluence depend on how new tokens are released over time. Even scams like EvmoSwap or CHEEPEPE hide behind fake supply numbers to look legit. If a token has no clear supply schedule, no audits, and no transparency—don’t trust it.

Below, you’ll find real-world breakdowns of how supply shapes everything—from stablecoins like USDT.a to meme coins like CHAR and AINN. You’ll see which projects have real limits, which ones are printing forever, and how supply changes after airdrops, burns, or token unlocks. This isn’t theory. It’s what separates smart investors from those who lose money chasing hype.