Cryptocurrency in Nigeria: How Nigerians Use Crypto to Beat Inflation and Bypass Banks

When cryptocurrency Nigeria, the widespread use of digital currencies by Nigerians to bypass economic controls and protect wealth from hyperinflation. Also known as crypto adoption in Nigeria, it’s not a trend — it’s a response to a broken system. In a country where the naira lost over 60% of its value against the dollar between 2021 and 2025, and banks routinely limit withdrawals or freeze accounts, crypto isn’t about getting rich. It’s about staying solvent.

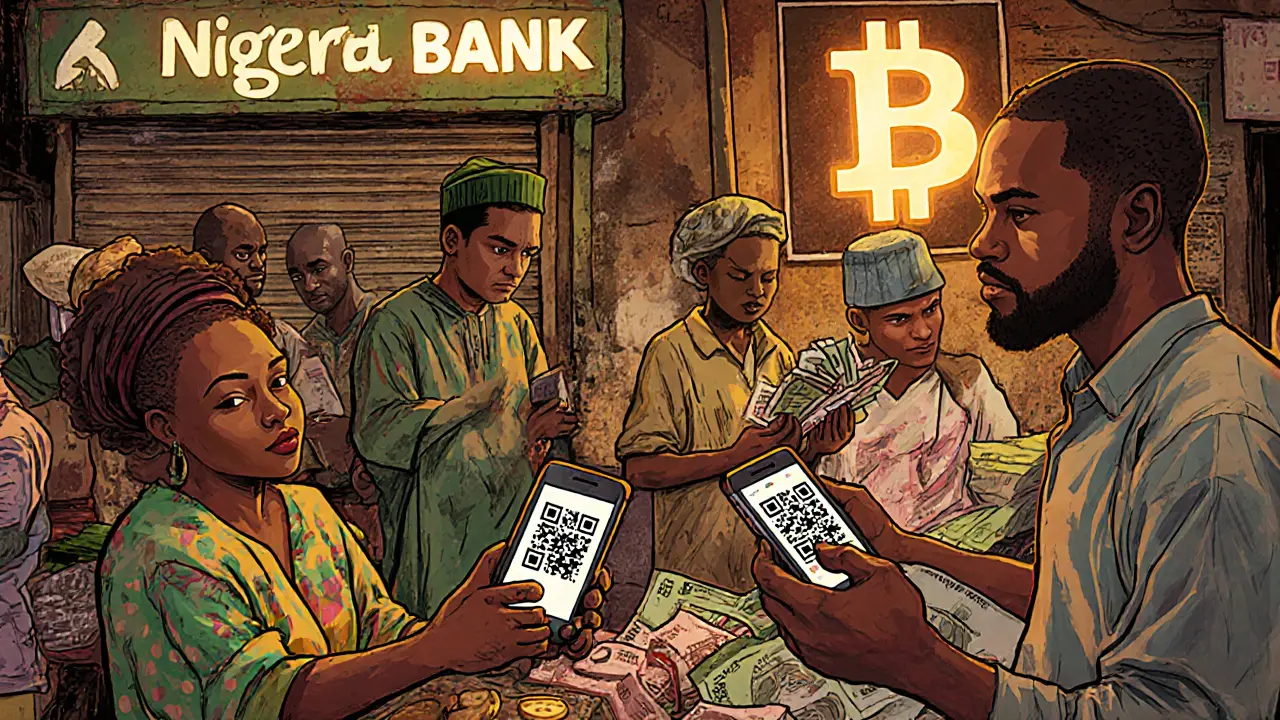

People in Lagos, Abuja, and Port Harcourt aren’t just trading Bitcoin or Ethereum — they’re using stablecoins, digital currencies pegged to the U.S. dollar to preserve value. Also known as USDT and USDC, they let Nigerians store money without fear of sudden devaluation. They use P2P platforms like Paxful and Binance P2P to buy USDT with local cash, then send it abroad for family support or business payments — all without going through banks that charge high fees or demand impossible paperwork. Even small traders, market vendors, and students rely on crypto to pay for imports, school fees, or medical bills when traditional finance fails them.

Regulators in Nigeria have tried to shut this down. The Central Bank banned banks from processing crypto transactions in 2021, then lifted it in 2023 — but the damage was done. People already moved. Now, over 33 million Nigerians own or actively use crypto, according to Chainalysis. That’s more than the population of most European countries. And it’s not just Bitcoin. People are trading local tokens, using DeFi apps for loans, and even mining crypto in homes with solar panels because the grid is unreliable. The real story isn’t about hype or speculation — it’s about crypto regulation Nigeria, the messy, evolving legal gray zone where citizens outpace policymakers. Also known as crypto compliance Nigeria, it reflects a global pattern: when institutions fail, people build alternatives.

What you’ll find in this collection aren’t generic crypto guides. These are real stories from the Nigerian crypto frontlines: how traders avoid scams, why some airdrops vanished overnight, which exchanges locals actually trust, and how mixing services are being used — both for privacy and for illegal purposes. You’ll see how a Nigerian teen uses DerpDEX to trade meme coins for rent money, how a Lagos freelancer gets paid in USDC, and why a crypto exchange called BICC is irrelevant here — while others like CRODEX and ShadowSwap quietly serve niche communities. This isn’t theory. It’s life on the ground, where crypto isn’t optional. It’s the only tool that works.