Crypto Regulation Nigeria: What You Need to Know About Trading and Compliance

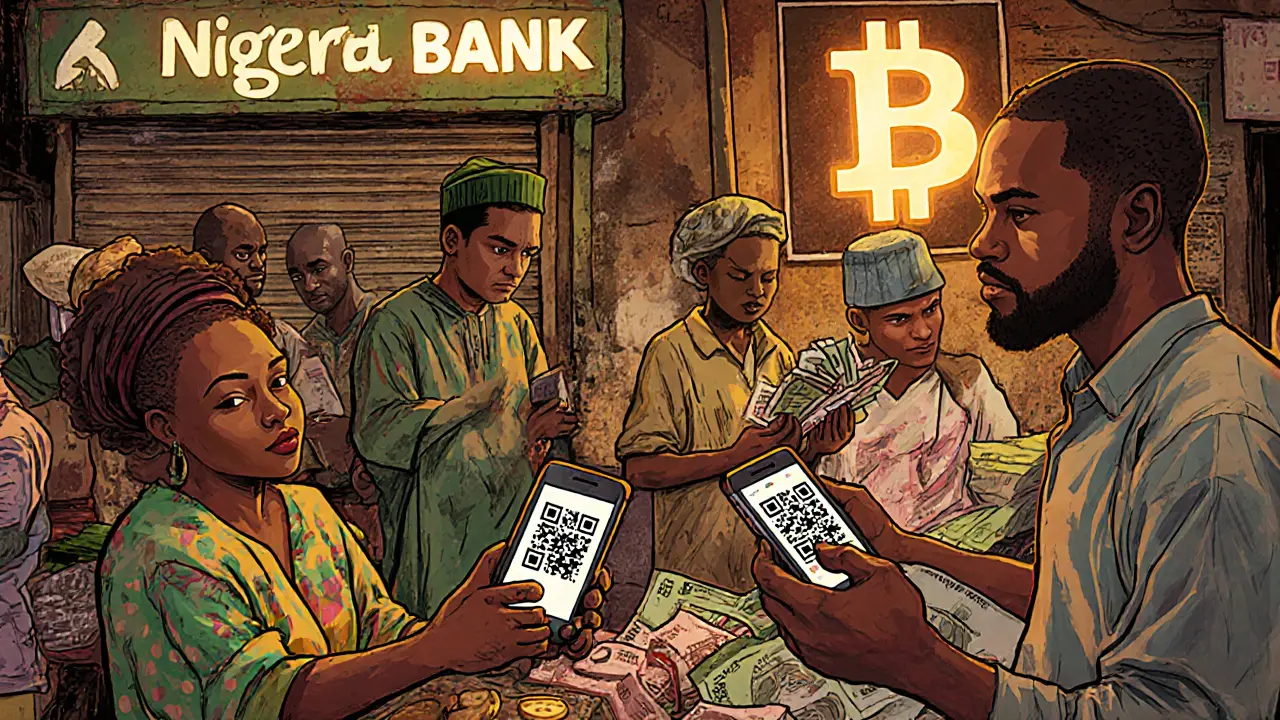

When it comes to crypto regulation Nigeria, the set of legal rules and enforcement actions that govern how cryptocurrencies are bought, sold, taxed, and used within Nigeria. Also known as Nigerian cryptocurrency laws, it’s not just about bans or permits—it’s about who controls your money and how the government sees digital assets. In 2021, the Central Bank of Nigeria (CBN) ordered banks to cut off services to crypto exchanges. That didn’t stop millions from trading. It just pushed them underground—onto P2P platforms, offshore apps, and stablecoins like USDT. Today, the rules are still messy. There’s no outright ban, but there’s no clear legal framework either. The SEC has started registering crypto firms, and the government is exploring a digital naira. But for regular users? It’s a gray zone where you trade, but you’re not protected.

Nigerian crypto laws, the evolving legal environment that determines whether crypto activities are permitted, restricted, or penalized under Nigerian jurisdiction. Also known as crypto compliance Nigeria, it’s shaped by two forces: fear of capital flight and pressure from youth who see crypto as a way out of inflation and unemployment. The CBN’s 2021 directive targeted banks, but it didn’t make owning Bitcoin illegal. What’s illegal? Using banks to fund crypto trades. That’s why so many Nigerians use P2P marketplaces like Paxful and Binance P2P. They pay cash, get USDT, and send it abroad. The government sees this as a threat to the naira. But they also see the tax revenue they’re missing. In 2024, the Federal Inland Revenue Service (FIRS) started asking for crypto transaction records. If you made gains, you owe tax. No one’s auditing everyone—but if you’re trading regularly, you’re on their radar.

Binance Nigeria, the Nigerian-facing arm of the world’s largest crypto exchange, which was forced to shut down local fiat on-ramps but still operates as a P2P hub for millions of Nigerian traders. Also known as Binance NG, it’s the closest thing Nigeria has to a crypto lifeline. Even after the CBN’s order, Binance stayed open for trading and withdrawals. It just stopped direct bank deposits. That didn’t matter. Users found workarounds. Today, over 30 million Nigerians use crypto, and Binance P2P handles billions in monthly volume. It’s not perfect—scams happen, disputes take weeks, and there’s no buyer protection. But for many, it’s the only way to save money when inflation hits 30%. And while the government talks about regulating exchanges, they haven’t shut down P2P. Why? Because they can’t.

What you’ll find below are real stories and breakdowns of what’s actually happening on the ground. Not theory. Not press releases. Real cases: how people avoid bank blocks, what happens when the tax man comes knocking, why some exchanges disappeared overnight, and how stablecoins became Nigeria’s unofficial savings account. These aren’t guides for beginners. These are war stories from the front lines of crypto in Nigeria.