Crypto Exchange Japan: What You Need to Know About Trading Crypto in Japan

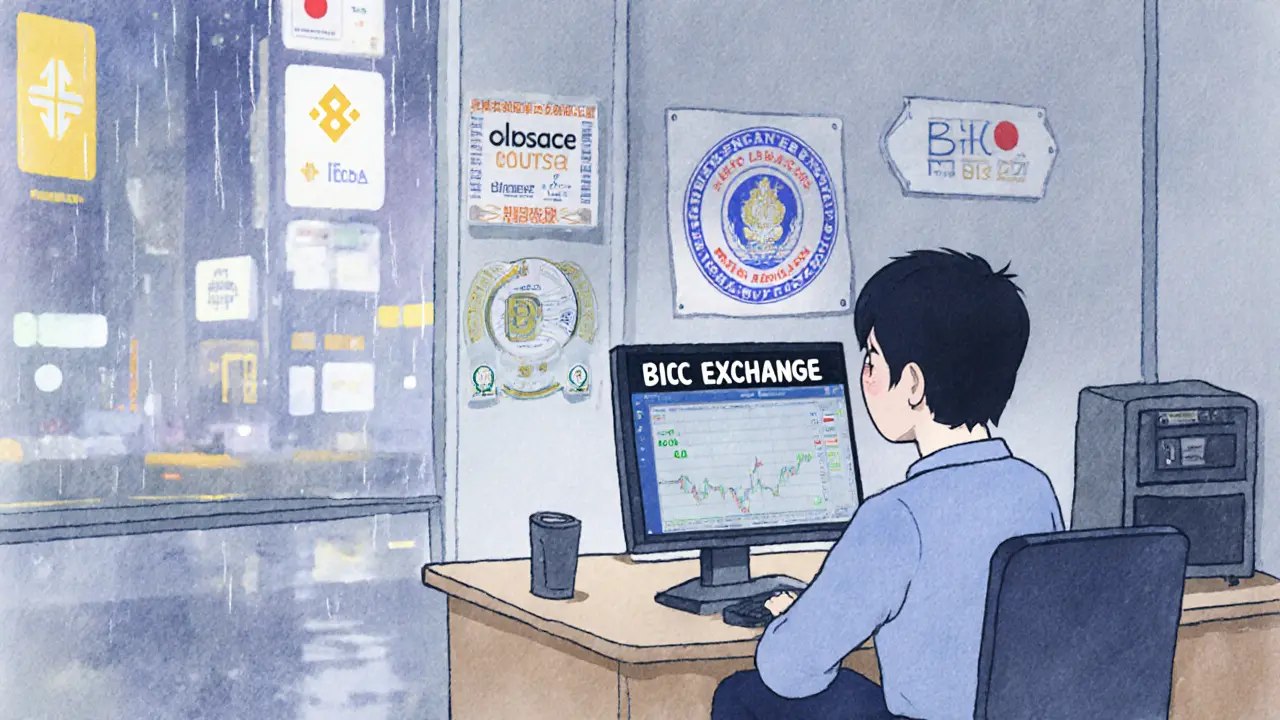

When you're trading crypto in Crypto Exchange Japan, a regulated, well-established market where exchanges must be licensed by Japan's Financial Services Agency. Also known as Japanese crypto platforms, these exchanges are among the most trusted in the world because they follow strict rules on user funds, KYC, and security. Unlike places where crypto operates in the gray zone, Japan made it legal early — back in 2017 — and has kept a tight grip on who can operate and how.

That means if you're using a crypto exchange in Japan, you're likely dealing with one of the big licensed names like Binance Japan, BitFlyer, or Coincheck. These aren’t shady DeFi platforms — they’re registered financial institutions. You’ll need to verify your identity, link a bank account, and follow Japan’s anti-money laundering rules. The government even requires exchanges to keep 95% of user funds in cold storage. That’s not just good practice — it’s the law.

But it’s not all smooth sailing. Japan has some of the strictest crypto tax Japan, rules that treat cryptocurrency as property, not currency, meaning every trade, swap, or airdrop can trigger a taxable event. Also known as Japanese crypto taxation, this system catches many traders off guard. If you swap BTC for ETH, you owe tax on the gain. If you get an airdrop, it’s income. If you sell for yen, it’s a capital gain. There’s no allowance, no exemptions — just clear, harsh math. And while Japan lets you trade Bitcoin and Ethereum freely, it has banned or restricted dozens of tokens deemed too risky or unregulated. That’s why you won’t find obscure meme coins or low-volume DEXs on major Japanese exchanges.

Why does this matter? Because Japan is one of the few countries where crypto isn’t just tolerated — it’s institutionalized. Banks work with exchanges. ATMs accept crypto. Retailers accept Bitcoin. But all of it happens under a heavy regulatory umbrella. If you’re coming from a country where crypto is wild west, Japan feels like a museum: everything is clean, labeled, and controlled. It’s safe, but it’s not free.

That’s why the posts below focus on what actually works in Japan’s unique environment. You’ll find reviews of exchanges that are legal and active here, breakdowns of how taxes hit your wallet, and real stories from traders who’ve navigated the rules. There’s no fluff about DeFi yield farms or unlicensed DEXs — because in Japan, those don’t survive long. What you’ll find instead is practical, grounded advice from people who’ve been through the system. Whether you’re a local trader or someone looking to operate here, this collection cuts through the noise and shows you what’s real.