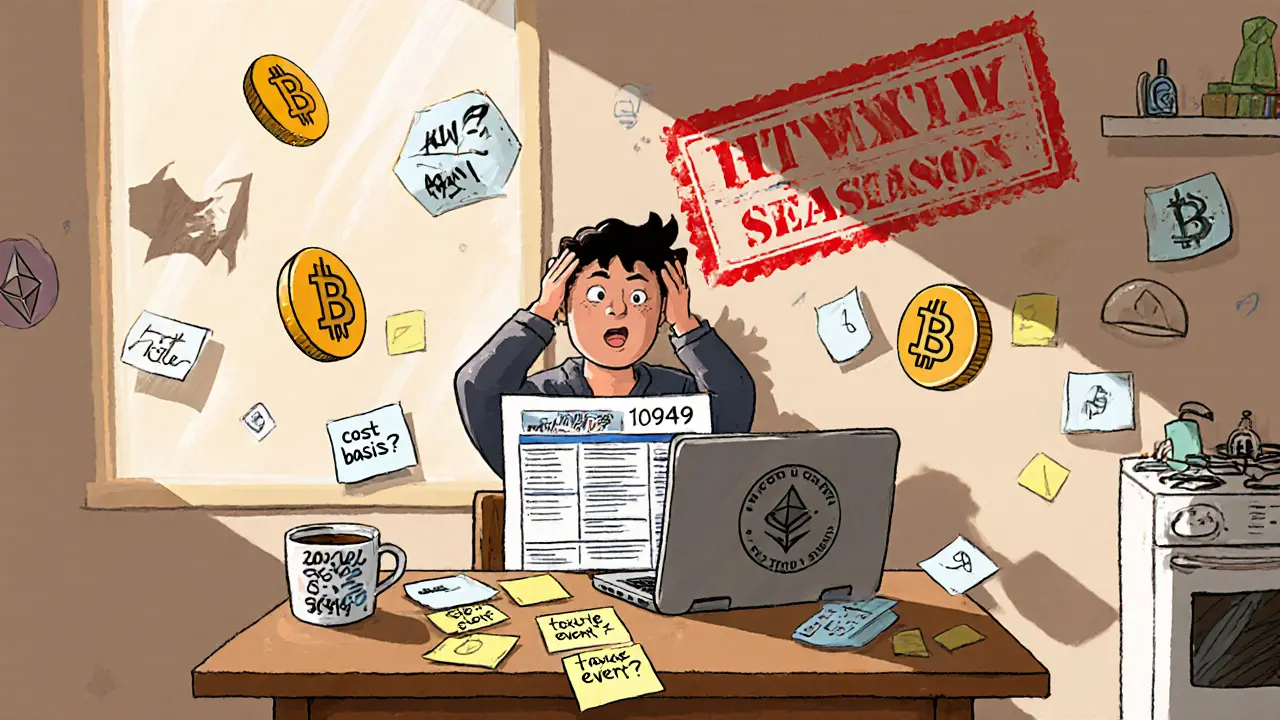

Crypto Capital Gains: How to Track, Report, and Minimize Taxes on Your Crypto Profits

When you sell Bitcoin, trade Ethereum for Solana, or even swap one meme coin for another, you might have triggered a crypto capital gain, a taxable profit from selling or trading cryptocurrency at a higher value than you bought it. Also known as cryptocurrency capital gain, it’s not just a buzzword—it’s a legal obligation in most countries. The IRS, HMRC, and other tax agencies treat crypto like property, not cash. That means every trade, every swap, every cash-out could create a tax event—even if you didn’t touch fiat.

Most people think they only owe taxes when they cash crypto into dollars. That’s wrong. Buying a pizza with Bitcoin? If that Bitcoin rose in value since you bought it, you just had a capital gain. Selling your Dogecoin to buy a new DeFi token? Another taxable event. Even airdrops and staking rewards can count as income, which then becomes part of your cost basis. The real problem? Most wallets and exchanges don’t automatically track this for you. You’re on your own to log every transaction, date, price, and wallet address. Without good records, you’re guessing your tax bill—and that’s how audits start.

That’s why the posts below focus on real crypto situations that directly tie into crypto capital gains. You’ll find breakdowns of exchanges like VirgoCX and COEXSTAR that help with reporting, scams like Wavelength that could wipe out your gains overnight, and tools like Merkle Trees that underpin how blockchain records are verified—critical if you ever need to prove your transaction history to a tax authority. You’ll also see how countries like Pakistan and Kazakhstan handle crypto differently, and why regulation changes can suddenly turn a profit into a liability. These aren’t theory pieces. They’re real-world examples of what happens when crypto meets taxes, regulation, and reality.

By the time you finish reading, you’ll know exactly when you owe taxes, how to avoid overpaying, and what tools or platforms actually help you stay compliant—not just survive the next audit.