Crypto Ban Cambodia: What Happened and How It Changed the Region

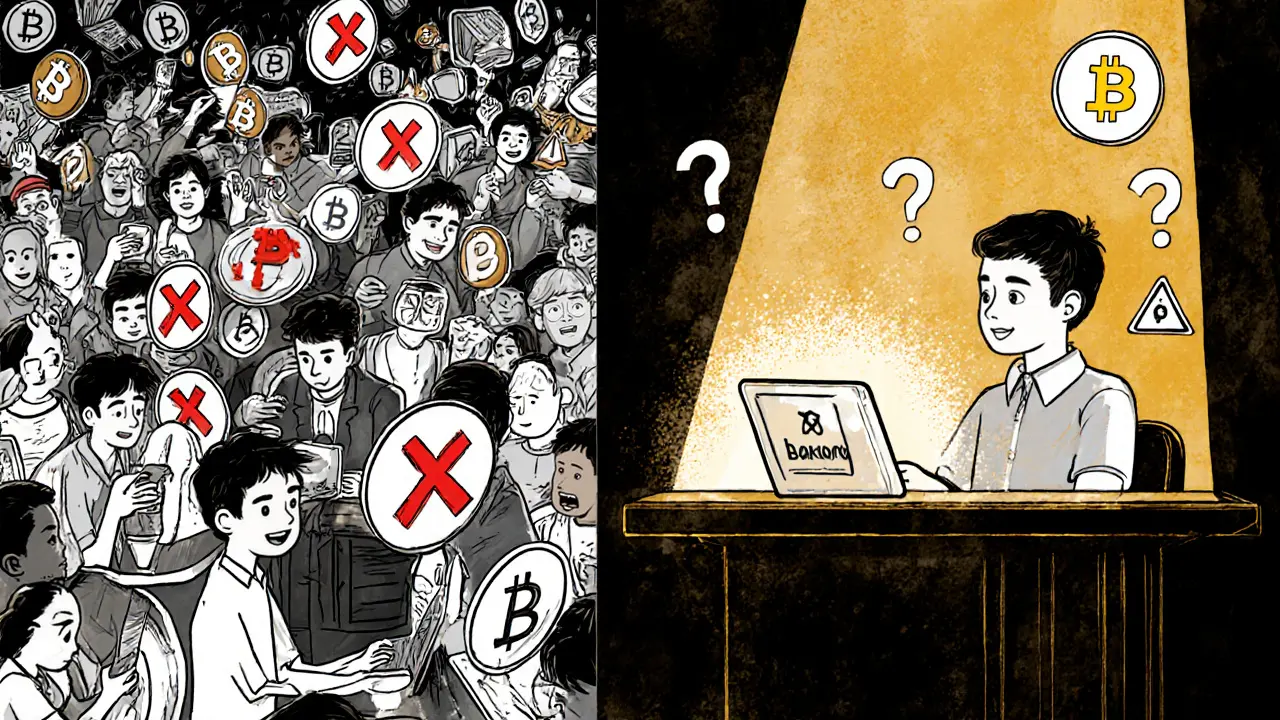

When Cambodia, a Southeast Asian nation that briefly tried to ban all cryptocurrency transactions in 2023 made headlines for outlawing crypto, the world assumed it was a win for regulators. But the truth was stranger: the ban didn’t stop trading—it just pushed it underground. People kept using Bitcoin and USDT through peer-to-peer apps, local money changers, and hidden WhatsApp groups. The government thought it was shutting down finance. Instead, it made crypto more personal, more local, and harder to control.

Cryptocurrency regulation, the set of rules governments impose on digital assets to control money flow and prevent fraud in Cambodia was never about protecting citizens. It was about protecting the banking elite. The central bank feared losing control over cash flows, especially as remittances and informal trade moved to blockchain. But when people realized crypto was their only way to send money abroad without fees or delays, compliance dropped. Crypto mining ban, a policy often used to reduce energy use or prevent unregulated financial activity wasn’t even part of the story—Cambodia had almost no mining. This was about payments, not proof-of-work. Meanwhile, neighboring countries like Thailand and Vietnam watched closely. They saw how a ban backfired and chose a different path: licensing exchanges, taxing gains, and letting people use crypto as long as they paid up.

What happened in Cambodia isn’t just a cautionary tale. It’s a blueprint for how crypto survives when governments try to kill it. The people didn’t need permission to use Bitcoin—they needed access. And when banks refused to serve them, crypto stepped in. The crypto ban Cambodia didn’t work because it ignored one simple truth: if money moves, people will find a way to move it. Below, you’ll find real stories from the ground, breakdowns of similar crackdowns, and deep dives into how digital finance keeps growing even when it’s labeled illegal.