Crypto Adoption in Nigeria: How Real People Are Using Crypto Beyond Speculation

When you hear crypto adoption in Nigeria, the widespread use of digital currencies by everyday Nigerians to bypass financial restrictions and protect savings from inflation. Also known as Nigerian crypto usage, it’s not a trend—it’s a response to years of economic instability, currency controls, and unreliable banking. Unlike places where people buy Bitcoin as a bet on the future, in Nigeria, crypto is used today—to pay for food, send money home, or save wages that inflation could erase overnight.

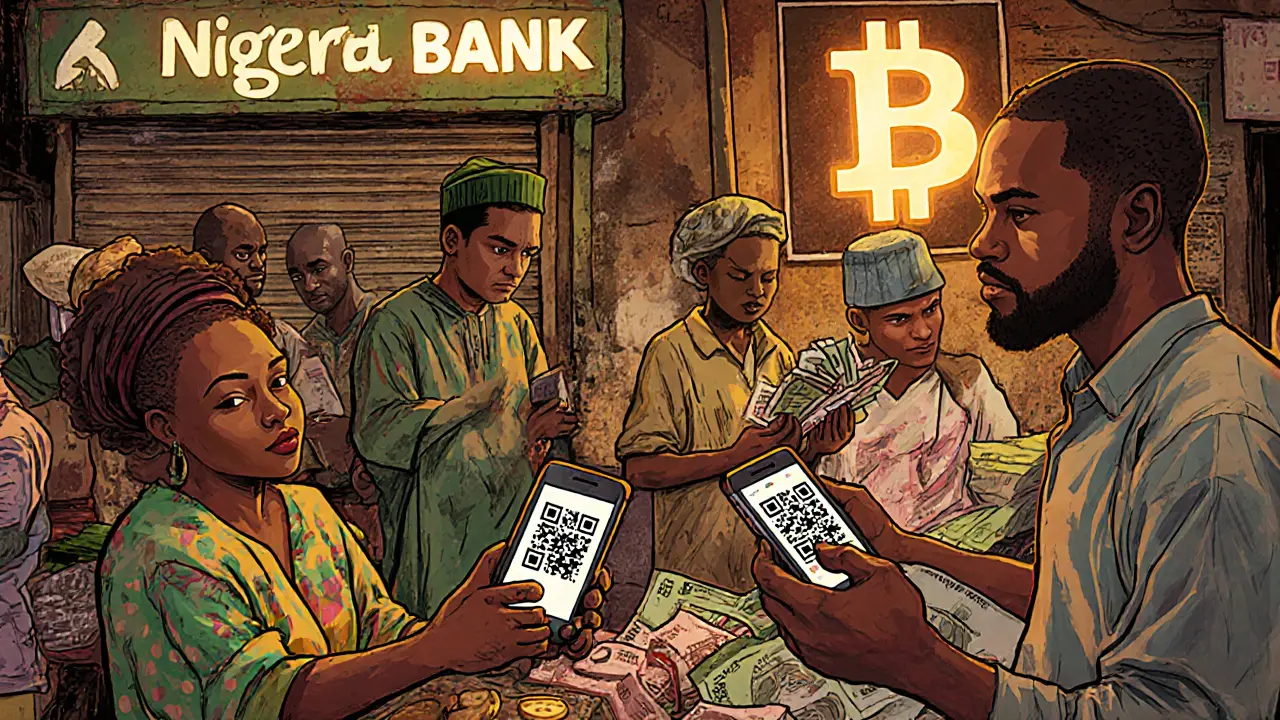

At the heart of this movement are stablecoins, digital tokens pegged to the U.S. dollar that hold their value even as the naira crashes. Also known as USDT and USDC, these coins let Nigerians store value without waiting for bank approval or risking seizure. Then there’s P2P crypto, peer-to-peer trading platforms where users buy and sell crypto directly with cash or bank transfers. Also known as local crypto markets, they’ve become the unofficial backbone of Nigeria’s financial system—bypassing banks entirely. And while global media talks about crypto as a speculative asset, Nigerians treat it like cash: necessary, immediate, and non-negotiable.

The rise of crypto adoption in Nigeria didn’t happen because of flashy apps or influencer hype. It happened because the system failed. When the government blocked access to foreign currency, people turned to crypto. When banks froze accounts during protests, people used Bitcoin. When inflation hit 30%, stablecoins became the only reliable way to preserve savings. This isn’t about trading altcoins or chasing airdrops—it’s about survival. The posts below show you exactly how this plays out: from how Nigerians use P2P platforms to buy USDT with cash at local markets, to how they send money to family abroad without Western Union fees, to why even small traders avoid centralized exchanges entirely. You’ll see real stories, real risks, and real solutions—not theory, not speculation, just what’s working on the ground right now.