Concentrated Liquidity: How It Works and Why It Matters in Crypto Exchanges

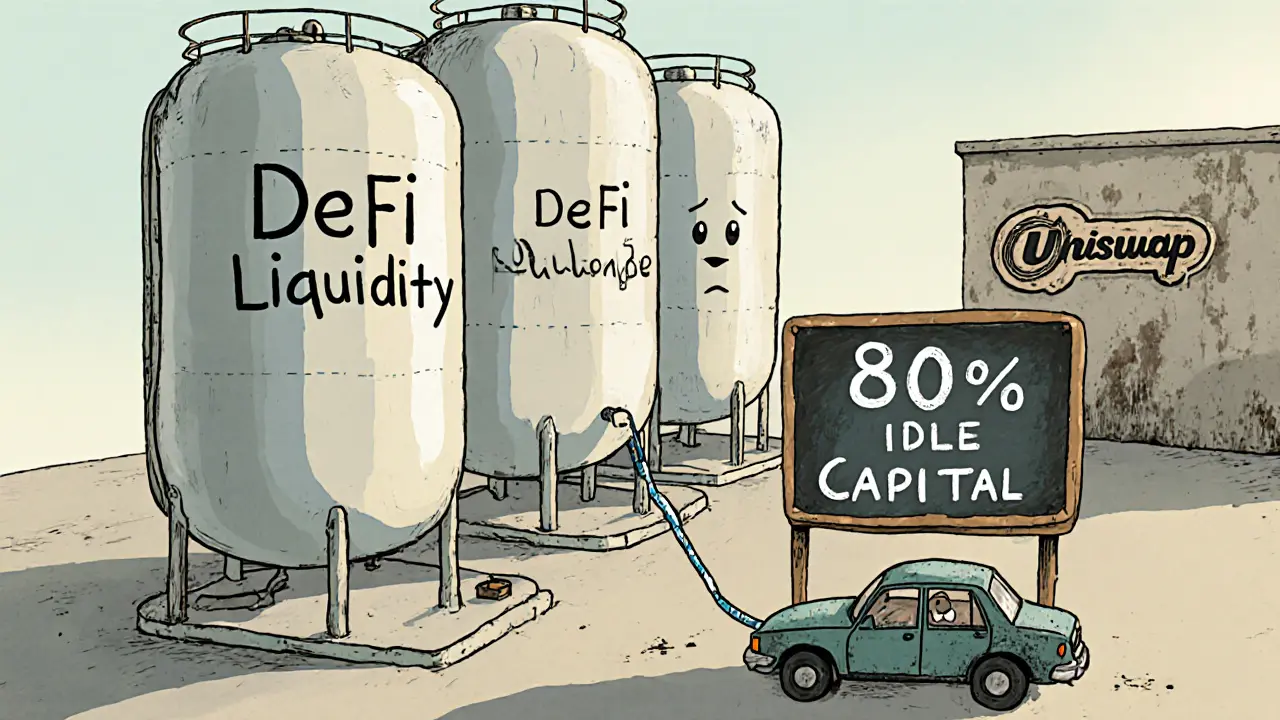

When you hear concentrated liquidity, a strategy where liquidity providers pin their funds to narrow price ranges instead of spreading them across the whole curve. Also known as smart liquidity, it's what makes modern decentralized exchanges like Camelot V3 and Lifinity more efficient than older ones. Before concentrated liquidity, DEXs like Uniswap V2 forced traders to spread their tokens across every possible price—from $1 to $100,000—even if the market only moved between $10 and $15. That meant your capital sat idle 90% of the time. Now, with concentrated liquidity, you pick the range where you think the price will trade. If you're right, you earn way more fees. If you're wrong, you get pulled out of the position faster. It’s like renting a storefront only during rush hour instead of paying for it 24/7.

This shift changed how AMM, Automated Market Makers that power most DEXs by using math instead of order books work. Traditional AMMs had constant product formulas that diluted returns. Concentrated liquidity AMMs, like the ones in Camelot V3, a zero-fee DEX built for Arbitrum that uses concentrated liquidity to boost rewards for traders and providers, let providers choose their own price ranges. This means less slippage, better yields, and tighter spreads. It’s not magic—it’s math optimized for real market behavior. And it’s why platforms like Lifinity and Marswap are trying to copy it. But not all of them do it well. Some still have low volume, fake liquidity, or no audits. That’s why you need to know which ones actually use it right.

Concentrated liquidity isn’t just for pros. Even if you’re new to crypto, understanding it helps you pick better DEXs, avoid scams, and spot real opportunities. You’ll see it in action in reviews of exchanges like Camelot V3, where the whole model revolves around this feature. You’ll also see it in how airdrops tie into liquidity mining—projects reward users who provide liquidity in smart ranges. But beware: if a platform claims to offer concentrated liquidity but has zero trading volume or no public code, it’s probably vaporware. The real ones have clear ranges, real users, and transparent fee structures.