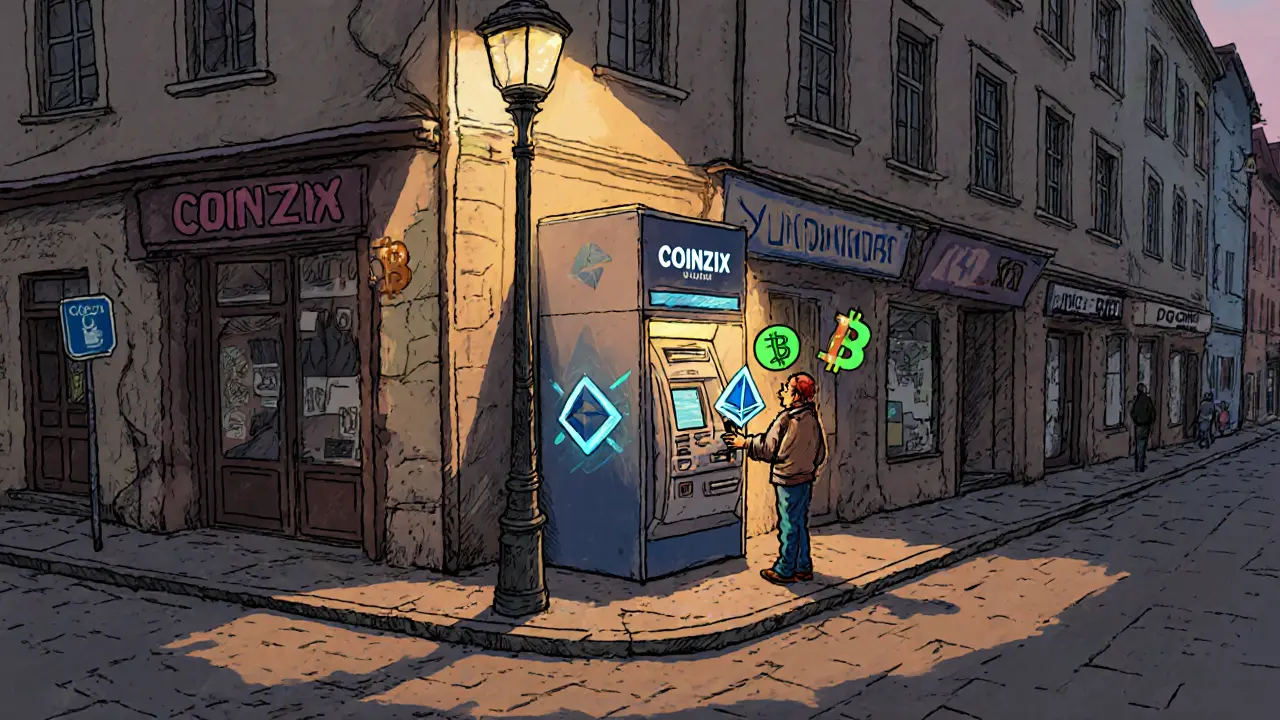

COINZIX Review: Is This Crypto Exchange Legit or a Scam?

When you hear COINZIX, a crypto exchange that claims to offer fast trades and low fees. Also known as CoinZix, it pops up in Telegram groups and social media ads promising easy profits. But here’s the problem: there’s no official website, no regulatory license, and zero verified user reviews from trusted sources like CoinGecko or Trustpilot. If a platform doesn’t show up on major crypto directories, doesn’t list its team, and has no public audit, it’s not a platform—it’s a gamble.

Real crypto exchanges like VirgoCX, a regulated Canadian exchange with free e-Transfers and strong security, or COEXSTAR, a licensed Philippine exchange with transparent fees and KYC, don’t hide. They publish their licenses, support pages, and customer service contacts. They don’t rely on influencers to push their name. They earn trust through transparency. COINZIX does the opposite. No domain history. No customer support email. No withdrawal records. That’s not a startup—it’s a ghost.

Scammers love to copy names like COINZIX because they sound official. They use fake testimonials, screenshots of fake profits, and pressure tactics: "Limited spots!" or "Only 24 hours to join!" But real exchanges don’t rush you. They give you time to research. They let you test small deposits. They don’t vanish after you send funds. If you’re looking for a safe place to trade, you don’t need hype—you need proof. And COINZIX has none.

Below, you’ll find real reviews of crypto exchanges that actually exist—some that made it, some that collapsed, and others that turned out to be outright frauds. You’ll learn what to look for before you send your first dollar. You’ll see how exchanges like AlphaX and Wavelength disappeared overnight. You’ll find out why some platforms, like Coinfloor, shut down after years of operation. And you’ll learn how to spot the next COINZIX before it steals your crypto.